September 2020

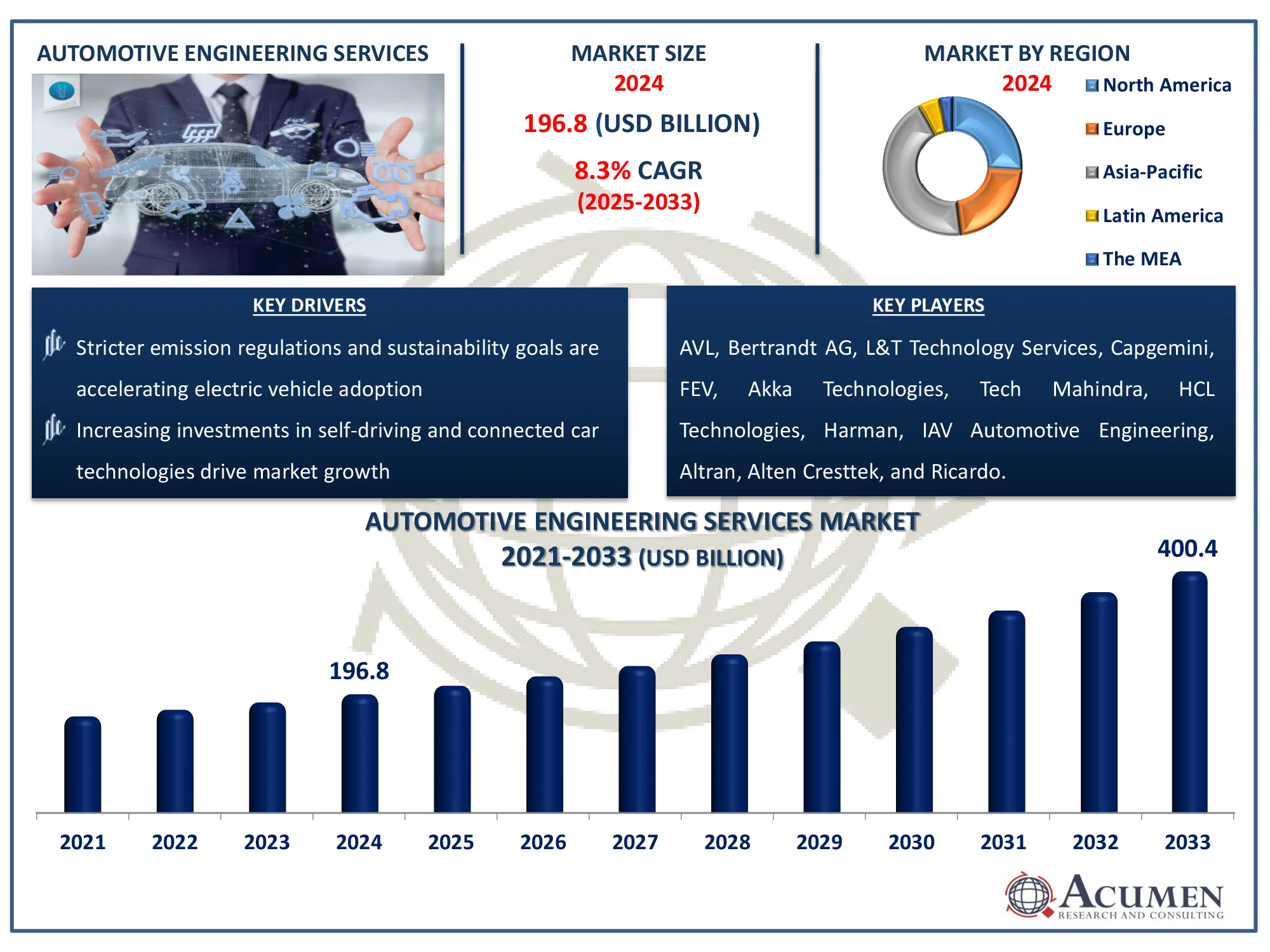

The Global Automotive Engineering Services Market Size accounted for USD 196.8 Billion in 2024 and is estimated to achieve a market size of USD 400.4 Billion by 2033 growing at a CAGR of 8.3% from 2025 to 2033.

The Global Automotive Engineering Services Market Size accounted for USD 196.8 Billion in 2024 and is estimated to achieve a market size of USD 400.4 Billion by 2033 growing at a CAGR of 8.3% from 2025 to 2033.

Automotive engineering is the design and manufacturing of automobiles, which incorporates mechanical, electrical, electronic, software, and safety engineering. Automotive engineering services include the design and testing of numerous vehicle components such as brake systems, engines, safety features, fuel technologies, and gearboxes. Furthermore, the automotive engineering services market is segmented by service type, application, location, vehicle type, and region. The service component covers concept/research, designing, prototyping, system integration, and testing.

|

Market |

Automotive Engineering Services Market |

|

Automotive Engineering Services Market Size 2024 |

USD 196.8 Billion |

|

Automotive Engineering Services Market Forecast 2033 |

USD 400.4 Billion |

|

Automotive Engineering Services Market CAGR During 2025 - 2033 |

8.3% |

|

Automotive Engineering Services Market Analysis Period |

2021 - 2033 |

|

Automotive Engineering Services Market Base Year |

2024 |

|

Automotive Engineering Services Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Service Type, By Location, By Vehicle Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

AVL, Bertrandt AG, L&T Technology Services, Capgemini, FEV, Akka Technologies, Tech Mahindra, HCL Technologies, Harman, IAV Automotive Engineering, Altran, Alten Cresttek, and Ricardo. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The global automotive engineering industry is expanding rapidly, driven mostly by increased demand for improved connection solutions. Increasing carbon emissions and environmental concerns have expedited the adoption of electric cars (EVs) and shared mobility, resulting in market growth. Furthermore, rising collaborations between automotive OEMs and suppliers, as well as increased R&D investments from global firms, are accelerating growth. For example, in July 2023, HCLTech purchased Germany-based automotive engineering company ASAP Group for EUR 251 million (USD 273.25 million), obtaining a 100% stake to strengthen its position in autonomous driving, e-mobility, and networking.

Governments throughout the world are enforcing strict emission norms and regulations for ICE vehicles, which is a primary driver of market growth. The International Energy Agency (IEA) reports that fuel economy standards, ZEV mandates, fiscal controls, purchasing incentives, and ICE bans are encouraging automakers to speed EV research. This, in turn, drives up demand for engineering services in battery technology, powertrain electrification, and vehicle integration. Furthermore, telecom and software companies are making significant investments in autonomous and connected car technology, accelerating industry growth.

However, issues such as intellectual property (IP) limits and changing business models may limit industry expansion. On the other hand, the standardization of safety features and the growing demand for self-driving vehicles are projected to open up new prospects. For example, DiDi said in April 2023 that it will introduce self-driving taxis as part of its ride-hailing business by 2025. The company also unveiled autonomous driving gear, such as the DiDi Beiyao Beta LiDAR, which was developed in collaboration with Chinese technology firm Benewake. Furthermore, the increasing emphasis on autonomous vehicles and the expanding trend of outsourcing automotive engineering services are likely to fuel market demand in the approaching years.

Automotive Engineering Services Market Segmentation

Automotive Engineering Services Market SegmentationThe worldwide market for automotive engineering services is split based on service type, location, vehicle type, application, and geography.

According to automotive engineering services industry analysis, prototyping leads the market because it plays an important role in vehicle development, allowing manufacturers to test designs before mass production. It aids in cost reduction, efficiency improvement, and the early detection of possible difficulties. With the rise of electric and self-driving vehicles, there is a greater demand for quick prototyping to speed up innovation. This sub-segment's prominence is due to developments in 3D printing and simulation technologies, as well as the desire for faster time-to-market.

According to automotive engineering services industry analysis, in-house automotive engineering services depending on location are predicted to experience the greatest growth during the projection period. The segment is predicted to increase positively as original equipment manufacturers (OEM) increasingly favor in-house development of complex procedures such as engine design, powertrain design, and transmission systems. Furthermore, the designs and optimization of automobile parts vary from one OEM to the next; for the same concern, it is preferable to be done in-house for better outcomes. These are a few of the variables expected to boost demand during the predicted period.

According to automotive engineering services industry analysis, on the basis of vehicle type, passenger cars are expected to expand the fastest during the projection period. According to the India Brand Equity Foundation (IBEF), passenger cars, three-wheelers, two-wheelers, and quadricycles were produced in total of 23, 58,041 units in April 2024. The increasing demand for autonomous vehicles and concurrently rising concern for environmental conditions such as air pollution and global warming are propelling the segment's growth over the predicted period.

According to automotive engineering services market forecast, by application, connection services are expected to be the fastest-growing market over the forecast period. Increased autonomous vehicle testing techniques, together with developments in AI technology and the arrival of 5G connection in automotive, are further driving segment growth. Some of the features associated with connectivity services include vehicle diagnostics, parking assistance, smart infotainment, and diagnostics, which are likely to increase market share during the projection period.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Automotive Engineering Services Market Regional Analysis

Automotive Engineering Services Market Regional AnalysisIn terms of regional segments, Asia-Pacific region dominates the automotive engineering services market, led by major automobile production hubs such as China, India, and Japan. Strong government backing for electric mobility, rising urbanization, and greater R&D investments in next-generation car technology all contribute to its leadership position. For example, in April 2024, Ricardo and Caepro joined up to offer high-end, cost-effective engineering services in India, leveraging expertise in powertrains, electrification, and simulation for both automotive and commercial vehicles.

North America is likely to see significant market expansion, driven by tough pollution laws, increased demand for electric and autonomous vehicles, and significant investments in new automotive technology by key businesses such as Tesla, GM, and Ford. According to the US Department of Energy, transportation consumes 30% of total energy and 70% of petroleum. The shift to energy-efficient vehicles, together with developments in battery technology, powertrain optimization, and lightweight materials, is likely to stimulate demand for automotive engineering services.

Europe is expected to increase rapidly during the projection period, owing to rising demand for refined and low-emission automobiles. The aim to cut greenhouse gas emissions by 80-95% by 2050 bolsters market growth. Furthermore, increased R&D investments by global automotive manufacturers in the region are likely to boost market value, boosting innovation in the sector.

Some of the top automotive engineering services companies offered in our report include AVL, Bertrandt AG, L&T Technology Services, Capgemini, FEV, Akka Technologies, Tech Mahindra, HCL Technologies, Harman, IAV Automotive Engineering, Altran, Alten Cresttek, and Ricardo.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2020

November 2022

October 2023

April 2020