June 2022

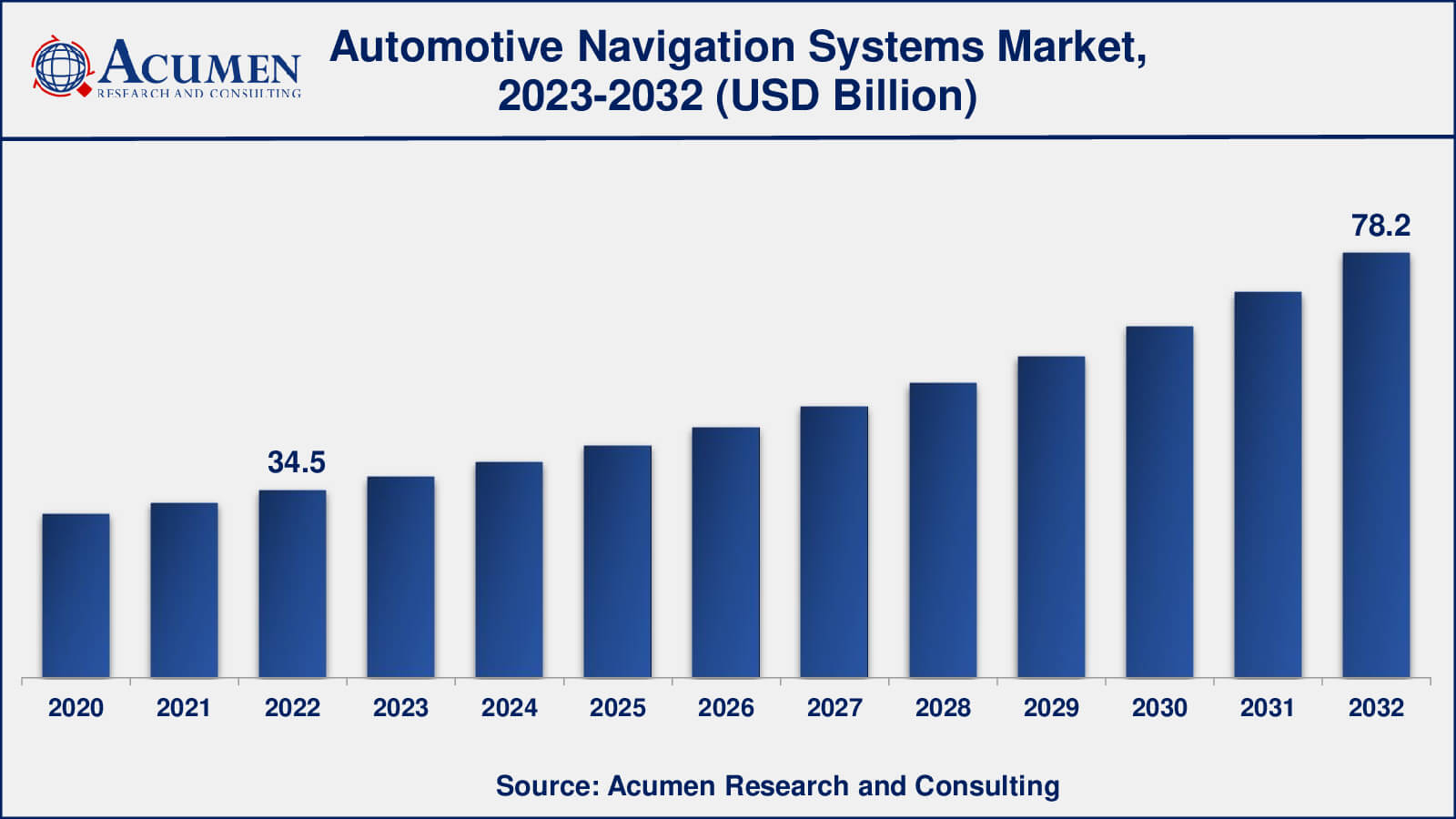

Automotive Navigation Systems Market Size accounted for USD 34.5 Billion in 2022 and is estimated to achieve a market size of USD 78.2 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

The Global Automotive Navigation Systems Market Size accounted for USD 34.5 Billion in 2022 and is estimated to achieve a market size of USD 78.2 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

Automotive Navigation Systems Market Highlights

The automotive navigation system stands as a pivotal component within modern vehicles, acting as an indispensable guide for drivers. This sophisticated system not only orchestrates vehicle movements but also furnishes a wealth of invaluable information, including nearby hotels, gas stations, route alternatives, public transportation options, popular destinations, and estimated travel durations. Facilitated by Bluetooth and Wi-Fi connectivity, the navigation system seamlessly interfaces with a variety of devices, affording drivers access to an array of features such as audio playback, hands-free calling, and messaging capabilities.

Whether integrated within the vehicle itself or accessible through mobile devices, this electronic marvel provides users with a real-time visual representation of their precise location and delivers step-by-step directions to their chosen destination. This technologically advanced system is commonly referred to as GPS, harnessing signals from satellite-based global positioning systems to ensure accuracy and reliability in navigation.

Global Automotive Navigation Systems Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Automotive Navigation Systems Market Report Coverage

| Market | Automotive Navigation Systems Market |

| Automotive Navigation Systems Market Size 2022 | USD 34.5 Billion |

| Automotive Navigation Systems Market Forecast 2032 | USD 78.2 Billion |

| Automotive Navigation Systems Market CAGR During 2023 - 2032 | 8.7% |

| Automotive Navigation Systems Market Analysis Period | 2020 - 2032 |

| Automotive Navigation Systems Market Base Year |

2022 |

| Automotive Navigation Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Sales Channel, By Vehicle Type, By Device, By Propulsion, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alpine Electronics Inc., Harman International Industries Inc., Denso Corporation, Clarion Co. Ltd., Continental AG, Aisin AW Co. Ltd., TomTom International BV, JVC Kenwood Corporation, Panasonic Corporation, and Mitsubishi Electric Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Navigation Systems Market Insights

The automotive sector is currently experiencing rapid technological advancements globally. Developing government regulations related to passenger and vehicle safety, coupled with the deployment of advanced navigation systems by manufacturers, are factors expected to drive the growth of the global market. There is a gradual increase in passenger vehicle sales in developing countries, prompting manufacturers to focus on deploying advanced features in vehicles for a better driving experience, including the deployment of advanced navigation systems for real-time traffic updates and safe parking assistance.

The rising logistics activities in developed and developing countries, along with the demand for advanced navigation systems in the transportation sector to facilitate ease of travel and accurate monitoring of operations, are other factors expected to support the growth of the target market. Logistics activities are increasing globally, leading to a higher demand for advanced navigation systems that enhance operational efficiency.

Major players are concentrating on product development with significant investments and the introduction of new user-friendly products with wider screens for better map and direction clarity. Additionally, partnerships and agreements aimed at increasing revenue share and customer base are expected to further boost the growth of the car GPS navigation system market.

For example, in 2020, Subaru partnered with TomTom, the location technology specialist, to supply Subaru's all-new infotainment platform with TomTom Maps and navigation for commercial vehicles, along with a new navigation user interface.

Furthermore, the trend towards collaborative work for product development and innovative product offerings is supporting global market growth. Players in the car GPS navigation system market are collaborating on product development activities, which are expected to help them expand their customer base and increase profitability. In 2020, Hitachi Automotive Systems Americas, Inc. and TomTom collaborated on the development of a new real-time hazard service for navigation and Advanced Driver Assistance Systems (ADAS). Through this collaboration, the companies aim to provide real-time updates on the location of road hazards detected by Hitachi Automotive Systems.

However, factors such as the high cost of the product and the availability of alternative cost-effective solutions are expected to hamper the growth of the global market. Consumer preferences for smartphone navigation systems and portable GPS systems, available at lower prices, are increasing. Additionally, rising concerns about data security are expected to further challenge the adoption, posing limitations to the growth of the target market. High investments in technological advancements and innovative product offerings are factors expected to create new opportunities for the car navigation market over the forecast period.

Automotive Navigation Systems Market Segmentation

The worldwide market for automotive navigation systems is split based on sales channel, vehicle type, device, propulsion, and geography.

Automotive Navigation Systems Sales Channel

The global automotive navigation system market classifies products into two segments based on the sales channel: OEM (Original Equipment Manufacturer) and aftermarket. The aftermarket segment is expected to experience steady revenue growth. Aftermarket navigation systems, also known as portable navigation systems, find use in older vehicles that lack factory-installed navigation systems.

E-commerce enterprises are facing increasing pressure to ensure timely product delivery due to the growth of the e-commerce sector. Current logistics suppliers are forming agreements with various e-commerce enterprises for efficient product distribution. To meet this demand, logistics companies are expanding their services by adding more vehicles to their fleets, equipping them with satellite navigation systems to enhance customer service.

OEM navigation systems, on the other hand, offer larger screens, higher quality, and faster processor speeds compared to portable navigation systems. OEMs are concentrating on developing immersive and technologically advanced systems capable of performing multiple functions within a single unit.

Automotive Navigation Systems Vehicle Type

The automotive navigation system market is categorized into passenger cars, heavy commercial vehicles, and light commercial vehicles. Among these, the passenger car segment holds the largest market share, primarily due to the significant increase in automobile production. The global demand for navigation systems is on the rise, driven by the growing production of passenger cars.

The dominance of the passenger car segment in the automotive navigation system market can be attributed to the increasing global production of passenger cars. In recent years, there has been a substantial increase in the production of passenger cars, leading to a significant surge in the global demand for navigation systems.

Automotive Navigation Systems Device

The dash navigation system is characterized by its user-friendly interface, high accuracy, and real-time traffic updates, making it a significant influencer in the market. This system is seamlessly integrated into the car's dashboard, providing drivers with a convenient and reliable navigation experience. Dash navigation systems often feature 3D maps and are competitively priced, with improved options available from original equipment manufacturers (OEMs).

Furthermore, in-dash navigation systems can be installed either as an aftermarket option or as a factory-installed feature by the car manufacturer. On the other hand, portable navigation devices (PNDs) are handheld gadgets that utilize GPS signals to determine location. PNDs are commonly used in cars to provide turn-by-turn directions and location-based services.

Automotive Navigation Systems Propulsions

According to the automotive navigation systems market forecast, the electric vehicle segment has established dominance in the market share and is poised to maintain its leadership from 2023 to 2032. This sustained dominance is attributable to the rapid global demand for electric vehicles, bolstered by government initiatives aimed at mitigating rising carbon emissions. These initiatives play a pivotal role in promoting the adoption of electric vehicles worldwide.

Automotive Navigation Systems Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Automotive Navigation Systems Market Regional Analysis

The North American market is poised to capture a significant share of revenue, primarily due to the presence of major industry players within the country. Additionally, the region boasts advanced infrastructure that facilitates the adoption of cutting-edge technologies, further bolstered by manufacturers' innovative product offerings. These factors collectively contribute to the robust growth of the North American market.

In contrast, the Asia Pacific region is expected to experience rapid growth in the near future. This growth can be attributed to the surging sales of passenger vehicles and the development of government regulations aimed at fostering technological advancements. Moreover, the presence of major automotive manufacturers in this region, coupled with increasing merger and acquisition activities geared toward expanding market presence and enhancing profit margins, plays a pivotal role in driving the regional market's expansion.

Automotive Navigation Systems Market Players

Some of the top automotive navigation systems companies offered in our report includes Alpine Electronics Inc., Harman International Industries Inc., Denso Corporation, Clarion Co. Ltd., Continental AG, Aisin AW Co. Ltd., TomTom International BV, JVC Kenwood Corporation, Panasonic Corporation, and Mitsubishi Electric Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2022

August 2020

February 2023

April 2021