June 2022

The global autonomous data platform market is expanding at a robust CAGR of 22.9%. This growth is driven by rising demand for AI-driven data management and real-time analytics across industries.

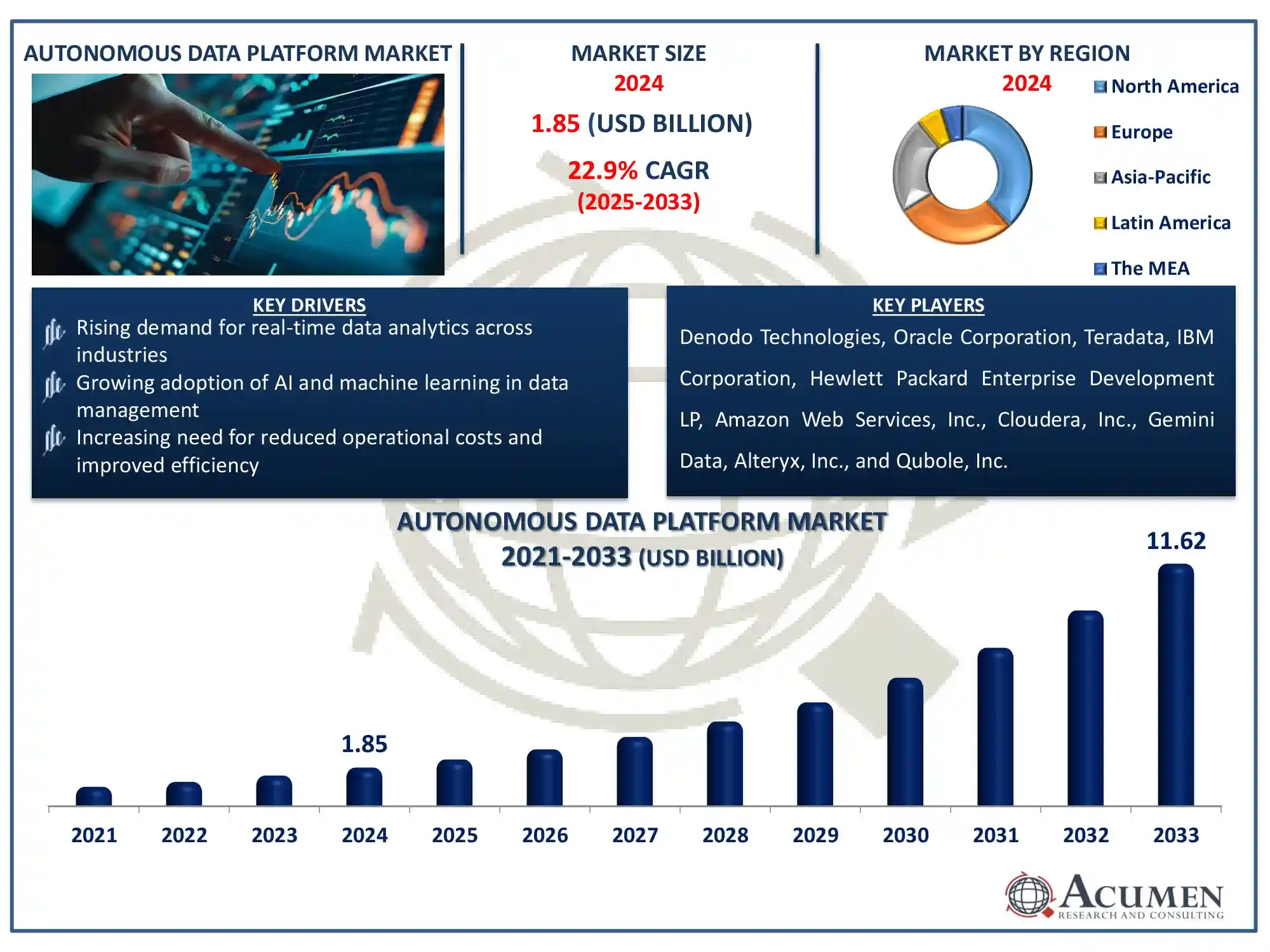

The global autonomous data platform market size accounted for USD 1.85 billion in 2024 and is estimated to exceed USD 11.62 billion by 2033 growing at a CAGR of 22.9% from 2025 to 2033. An autonomous data platform (ADP) is a data management solution that leverages artificial intelligence (AI) and machine learning (ML) to self-manage, self-secure, and self-repair. It automates critical functions such as data integration, storage, governance, and analytics, significantly reducing human intervention and operational complexity. Designed to handle large volumes of data with high efficiency, ADPs maintain data quality, security, and compliance while enabling real-time insights and data-driven decision-making. This makes them essential in today’s fast-paced digital economy, where agility and intelligence are competitive advantages.

| Area of Focus | Details |

| Autonomous Data Platform Market Size 2024 | USD 1.85 Billion |

| Autonomous Data Platform Market Forecast 2033 | USD 11.62 Billion |

| Autonomous Data Platform Market CAGR During 2025 - 2033 | 22.9% |

| Segments Covered | By Component, By Deployment, By Enterprise Size, By Application, By End Use, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Denodo Technologies, Oracle Corporation, Teradata, IBM Corporation, Hewlett Packard Enterprise Development LP, Amazon Web Services, Inc., Cloudera, Inc., Gemini Data, Alteryx, Inc., and Qubole, Inc. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

One of the key drivers of the ADP market is the growing demand for real-time data analytics across industries. Certifications from the Data Science Council of America (DASCA) highlight how real-time analytics is transforming sectors by delivering actionable insights for agile decision-making and predictive trend analysis. This empowers dynamic pricing and personalized services in retail and e-commerce, enhances patient care through real-time monitoring in healthcare, and enables fraud detection, algorithmic trading, and predictive maintenance in finance and manufacturing—ultimately driving efficiency and reducing operational risks.

The core strength of autonomous data platforms lies in their AI and ML capabilities, which reduce manual workloads and improve accuracy through automated decision logic. India’s National Strategy for Artificial Intelligence (NSAI), released by NITI Aayog, emphasizes the critical role of AI and ML in enhancing data infrastructure across sectors. It also underscores the importance of a robust data ecosystem through initiatives such as AIRAWAT (AI Research, Analytics and Knowledge Assimilation Platform) to foster scalable and responsible AI-driven analytics.

Despite their advantages, deploying ADPs often requires significant upfront investment in infrastructure, integration, and software, making it challenging for small and mid-sized enterprises (SMEs). However, this barrier is being mitigated by cloud-based solutions, which offer scalable, cost-effective alternatives.

For instance, in February 2024, Veeam launched Veeam Data Cloud, an integrated solution for cloud backup, storage, and ransomware recovery for Microsoft Azure and Microsoft 365. Built on Azure and powered by Cirrus Backup-as-a-Service (BaaS) technology, it enhances data resilience with AI-powered automation, ransomware protection, and cloud-native BaaS capabilities. This reflects the growing enterprise demand for secure, scalable, and autonomous data platforms.

The worldwide market for autonomous data platform is split based on component, deployment, enterprise size, application, end use, and geography.

The platform components dominate sector because they play a critical role in automating data lifecycle operations. It includes fundamental functionalities including data ingestion, integration, governance, and analytics powered by AI and machine learning. Companies rely significantly on these platforms to eliminate manual intervention and increase data-driven decision-making. As the demand for real-time, scalable, and intelligent data operations increases, the platform segment remains the market leader.

According to the deployment segment, on-premises deployment dominates the business due to the high demand for data security, control, and compliance, particularly in regulated sectors like as BFSI and healthcare. Enterprises prefer on-premise systems to preserve complete control over critical data and ensure unique configurations. It also enables improved performance tweaking for complicated and large-scale applications. Despite the proliferation of cloud alternatives, data-sensitive sectors continue to prefer on-premises options.

Large organizations dominate the autonomous data platform industry due to their larger demand for enhanced data management and analytics capabilities. They generate massive amounts of data on a regular basis, necessitating scalable and intelligent platforms for efficient processing and analysis. Large firms are better positioned to invest in autonomous solutions due to their larger budgets and IT infrastructure. Their emphasis on digital transformation and operational efficiency accelerates adoption in this market.

By application, data analytics is likely to be the most popular application in the autonomous data platform market as firms prioritize data-driven decision-making. These platforms give firms advanced analytics tools that provide real-time insights and prediction capabilities. They drastically cut the time to insight by automating data preparation and analysis. As rivalry grows across industries, harnessing analytics becomes vital for achieving a competitive advantage.

The BFSI sector dominates the autonomous data platform market due to its huge data volumes and vital requirement for real-time analytics, fraud detection, and regulatory compliance. Financial institutions rely on self-contained platforms to streamline operations, improve customer experience, and assure data security. These tools enable to automate data governance and risk management activities. As digital banking and fintech services become more prevalent, the BFSI industry's reliance on autonomous data solutions increases.

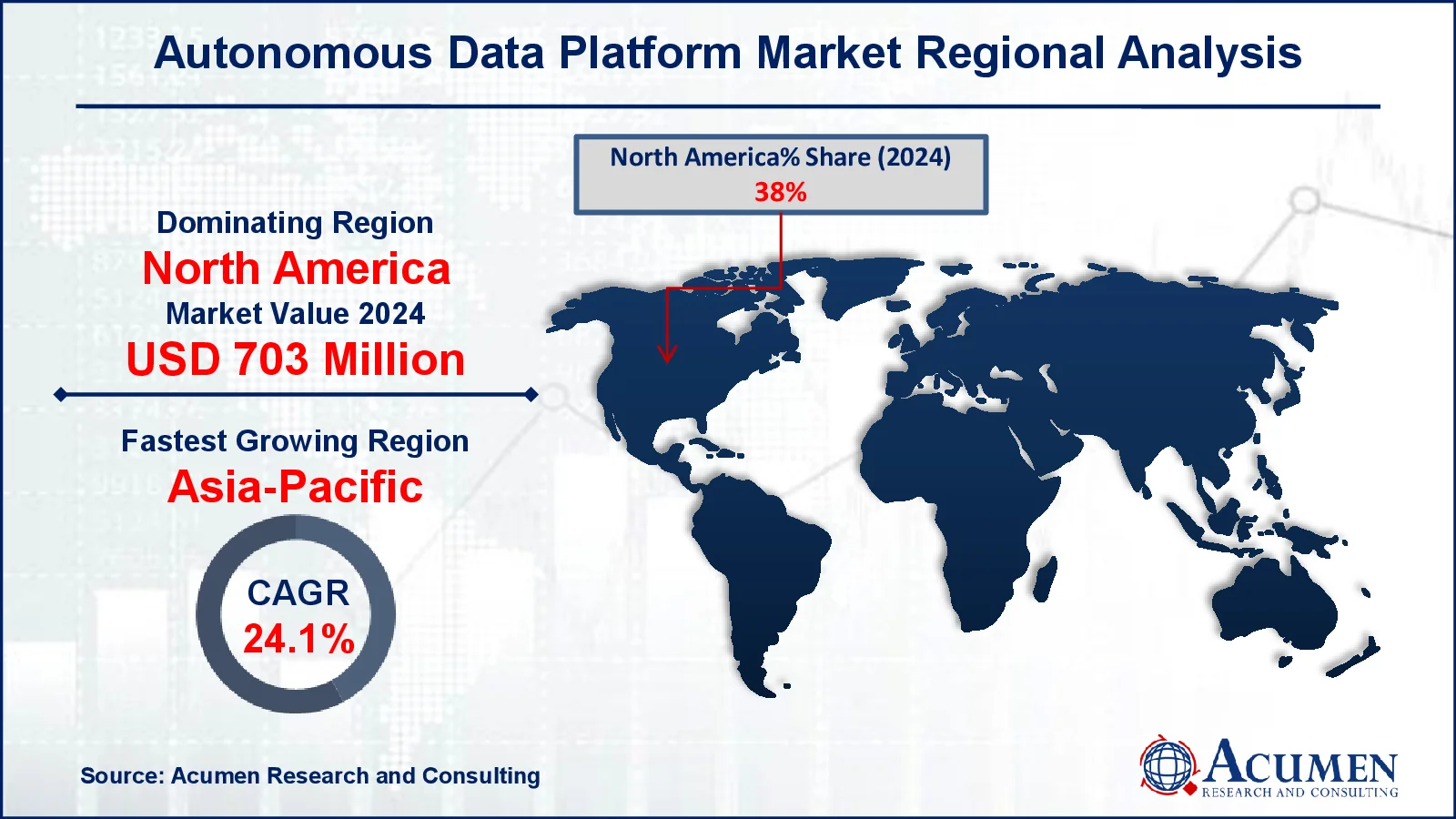

North America remains the leading region in the autonomous data platform (ADP) market, driven by the early adoption of advanced technologies, a strong presence of key industry players, and significant investments in AI and data-centric infrastructure. The region’s robust IT ecosystem and focus on digital transformation have enabled widespread deployment of autonomous platforms across sectors such as banking, financial services, and insurance (BFSI), healthcare, and retail.

For instance, on April 29, 2024, the Federal Permitting Improvement Steering Council (Permitting Council) announced over $30 million in funding to improve permitting efficiency across the U.S. federal government. As part of President Biden’s Investing in America agenda, this funding aims to modernize vital IT systems and integrate cutting-edge technologies to accelerate infrastructure project approvals. Such strategic initiatives are expected to further boost the adoption of autonomous data platforms, particularly in government and public sector applications, by enhancing the need for intelligent, automated systems capable of managing and analyzing complex permitting data.

Asia-Pacific is rapidly emerging as the fastest-growing region in the autonomous data platform market, fueled by accelerated digital transformation, government-led tech initiatives, and rising enterprise adoption of AI-driven data solutions. According to IndiaAI, India alone is projected to witness an estimated $100 billion investment in AI-powered data centers by 2027, signaling strong demand for scalable, autonomous platforms.

Countries like China, India, and those in Southeast Asia are making substantial investments in cloud infrastructure, smart city development, and enterprise digitalization. This evolving digital landscape positions the Asia-Pacific region as a vital growth frontier for autonomous data platforms, particularly in sectors such as manufacturing, telecommunications, and public services, where data-driven automation is becoming essential.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Some of the top autonomous data platform companies offered in our report include Denodo Technologies, Oracle Corporation, Teradata, IBM Corporation, Hewlett Packard Enterprise Development LP, Amazon Web Services, Inc., Cloudera, Inc., Gemini Data, Alteryx, Inc., and Qubole, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2022

September 2022

March 2024

October 2024