December 2022

Battery Energy Storage System (BESS) Market (By Battery Type: Lithium-ion Battery, Advanced Lead-acid Battery, Flow Battery, Sodium-ion Battery; By Connection Type: On-grid, Off-grid; By Ownership: Customer Owned, Third-party Owned, Utility Owned; By Energy Capacity: Below 30 kWh, Between 30 kWh to 10 MWh, Above 10 MWh; By Application: Residential, Commercial & Industrial, Utility) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2034

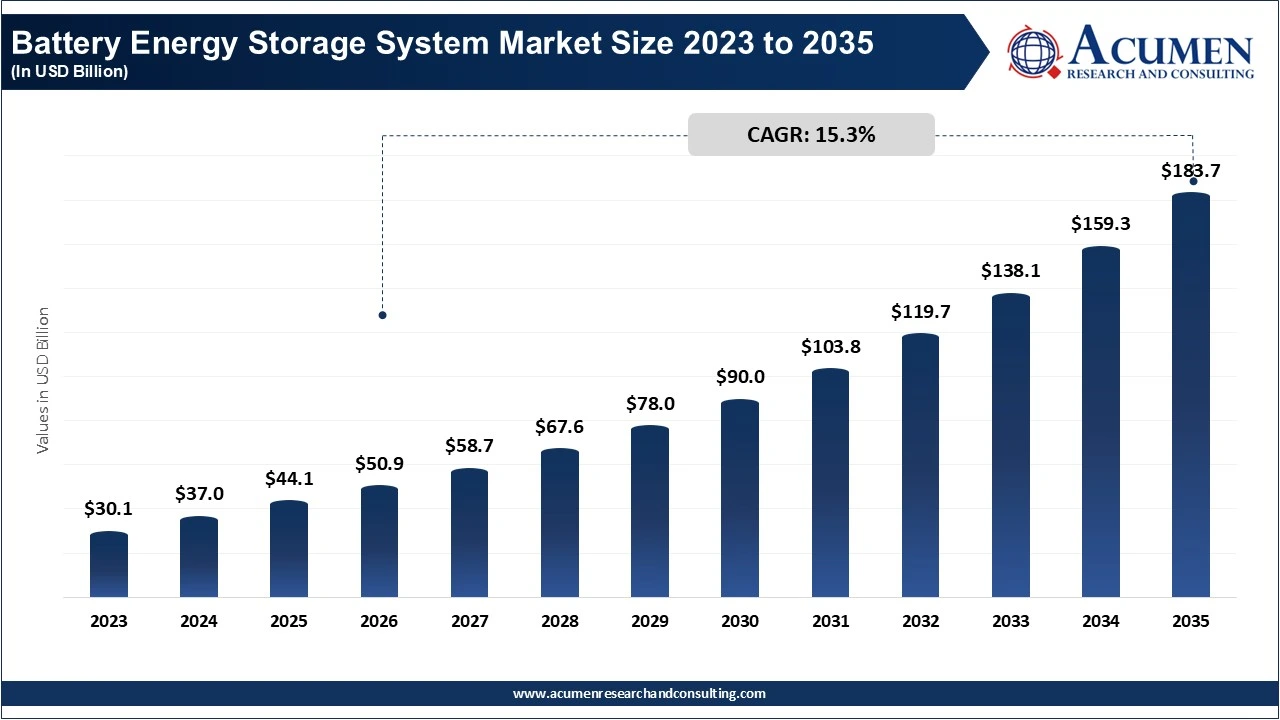

The global battery energy storage system (BESS) market size accounted for USD 44.12 billion in 2025 and is estimated to record around USD 183.70 billion by 2035 growing at a CAGR of 15.3% from 2026 to 2035. The global transition to renewable energy and decarbonization goals are major propellers of the BESS market. Solar and wind generation are intermittent which has resulted in utilities and grid operators increasingly relying on energy storage to facilitate fluctuations in power output, peak load management, and grid reliability. Government policies, incentives and regulations aimed at reducing carbon emission are pushing investments in energy storage projects around the world. Additionally, a rise in power outages and the requirement of resiliency for energy infrastructure in both developed and emerging economies have increased the demand for large-scale and distributed BESS solutions.

Another major factor for growth is the continued rapid decline in battery prices and progress in energy storage technology, notably in lithium-ion batteries. Improvements to the energy density, safety, and battery lifespan make BESS commercially competitive across a variety of utility-scale, commercial and residential applications. Growing production of electric vehicles (EV) is also strengthening the battery supply chain and helping to further drive down costs. Additionally, growing energy needs, urbanization and increasingly decentralized energy systems (microgrids and virtual power plants) are creating new opportunities globally for BESS.

A battery energy storage system (BESS) is a form of technology in which electrical energy is stored in rechargeable batteries and supplied back when required, allowing the capacity to balance electricity supply and demand, enhance the stability of the electric grid, and facilitate the integration of renewable energy such solar and wind energy sources.

Growing Renewable Energy Integration

Government Policies and Supportive Regulations

High Initial Investment Cost

Battery Degradation and Limited Lifespan

Rising Demand for Electric Vehicles (EVs)

Development of Microgrids and Smart Grids

| Area of Focus | Details |

| BESS Market Size 2025 | USD 44.1 Billion |

| BESS Market Forecast 2035 | USD 183.7 Billion |

| BESS Market CAGR During 2026 - 2035 | 15.3% |

| BESS Market Analysis Period | 2021 - 2035 |

| BESS Market Base Year | 2025 |

| BESS Market Forecast Data | 2026 - 2035 |

| Segments Covered | By Battery Type, By Connection Type, By Ownership, By Energy Capacity, By Application, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Tesla, CATL (Contemporary Amperex Technology Co.), BYD, LG Energy Solution, Samsung SDI, Fluence Energy, Siemens Energy, ABB, General Electric (GE), Panasonic, Saft Groupe, and Narada Power. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

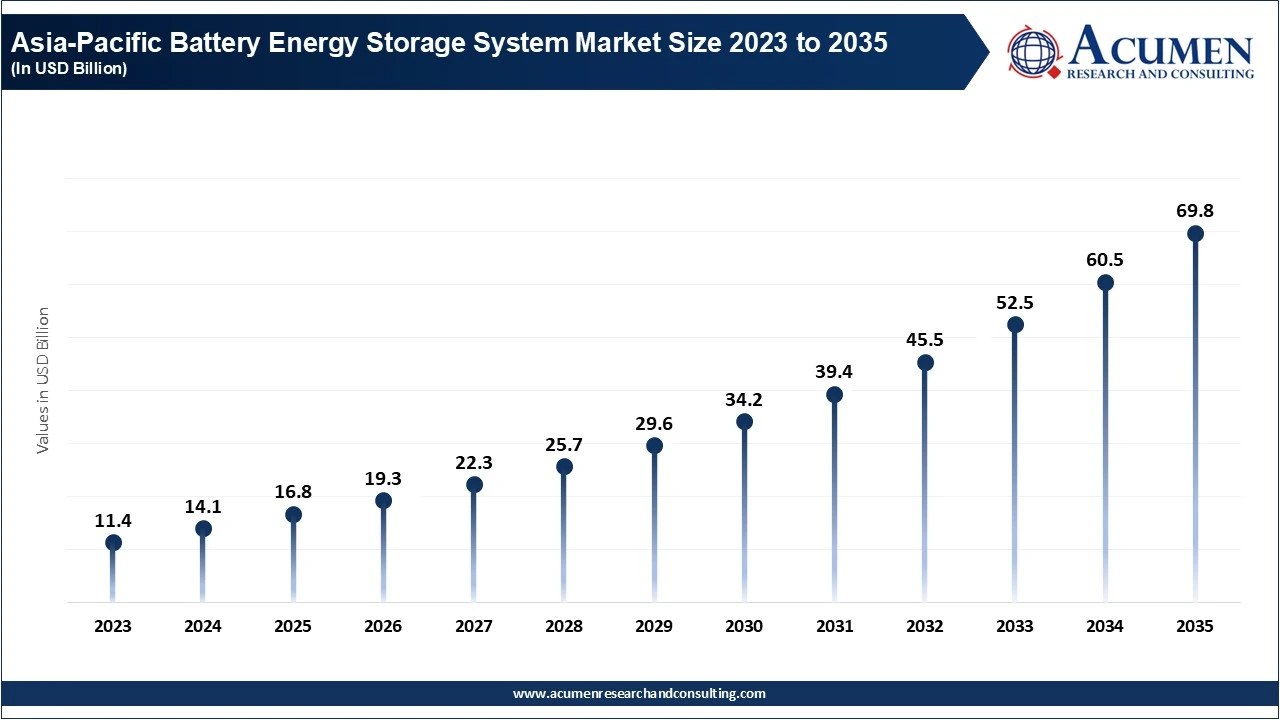

The Asia-Pacific region has the largest share of the global BESS market, primarily driven by China, Japan, and South Korea. China maintains its leading position with its large amounts of capital being invested in renewable energy, vast expansion of grid infrastructure, and a strong domestic battery manufacturing community. Additionally, government support through favorable policies, targets for renewable energy integration, and national energy storage deployment plans has supported substantive installations of BESS. Furthermore, the presence of substantial battery manufacturers in the region and overall strength in supply chains has reduced system costs, speeding up adoption of both utility-scale and commercial applications. Likewise, the rapid expansion of solar and wind capacity across India, Southeast Asia, and Australia further supports the continued dominance of Asia-Pacific as a regional market.

North America is the fastest-growing region of the BESS market, augmented by strong renewable energy adoption rates, increasing modernization of grid efforts, and supportive government policies, particularly in the United States. The U.S. is experiencing the most rapid growth in the BESS market largely because of favorable tax incentives, state-based energy storage mandates (e.g., California and New York) as well as growing investment rates into utility-scale storage projects. An increase in the frequency of power outages and extreme weather events has also increased demand for energy resilience solutions. The expansion of electric vehicle infrastructure combined with the functionality of data centers in North America is creating new demand for battery storage in the commercial and industrial sectors; creating North America to grow fastest in total BESS market share, globally.

BESS Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 27% |

| Europe | 23% |

| Asia-Pacific | 38% |

| Latin America | 8% |

| MEA | 4% |

The worldwide market for battery energy storage system (BESS) is split based on battery type, connection type, ownership, energy capacity, application, and geography.

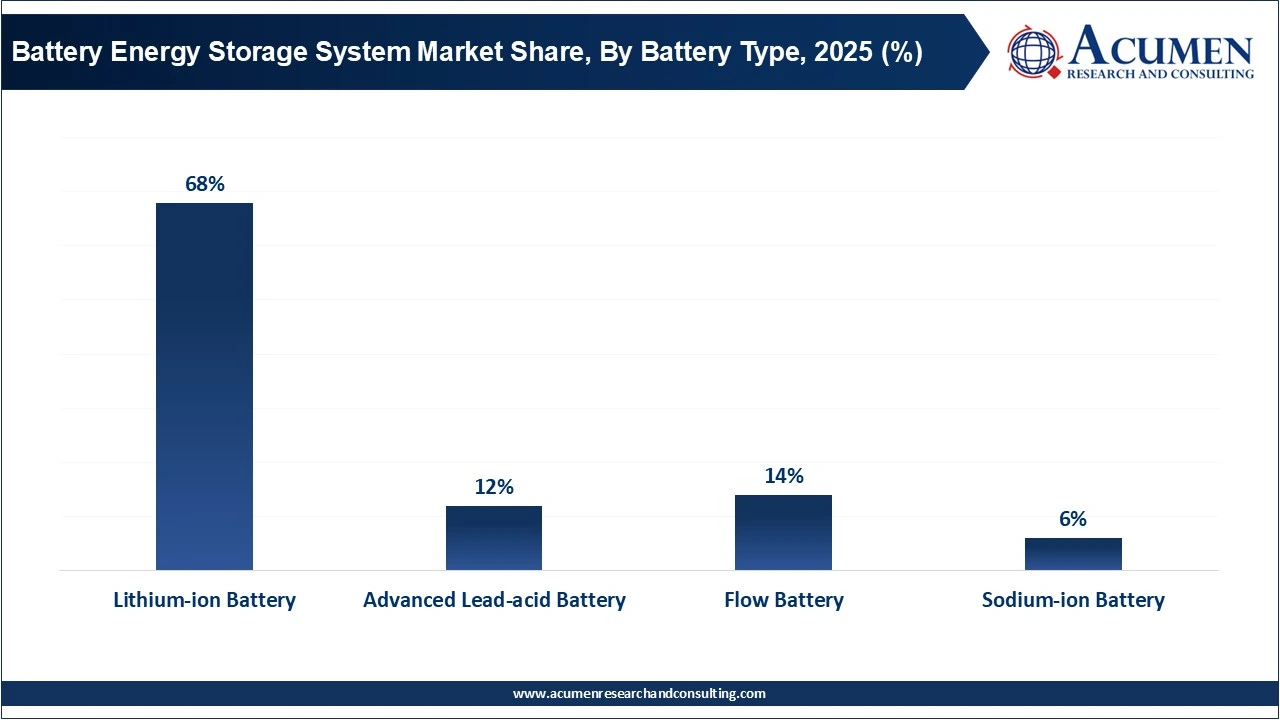

Lithium-ion batteries are currently the leading technology in the BESS market due to their better energy density, response time, and efficiency over alternative battery solutions. Lithium-ion batteries are also leveraging their extensive use in electric vehicles, which has improved cost reduction through scale production of factory components. Lithium-ion batteries are used in residential, commercial, and utility-scale applications, making it the overwhelming solution for short- to medium-duration energy storage projects around the globe.

|

Battery Type |

Market Share (%) |

Key Highlights |

|

Lithium-ion Battery |

68% |

Dominant due to high energy density, fast response time, falling costs, and widespread use across residential, commercial, and utility-scale storage. |

|

Advanced Lead-acid Battery |

12% |

Used for cost-sensitive and backup applications, especially in remote and small-scale systems, but limited by lower lifecycle and efficiency. |

|

Flow Battery |

14% |

Gaining popularity in utility-scale and long-duration storage due to long lifespan and scalability, particularly for renewable integration. |

|

Sodium-ion Battery |

6% |

Emerging alternative due to lower material costs and reduced dependency on lithium, mainly in pilot and early deployment stages. |

Flow batteries are the fastest growing segment of battery energy storage systems, due to their ability to accommodate long durations of energy storage, as well as grid applications. They will outlast lithium ion batteries by years, and the technology can achieve greater depths of discharge without performance degradation. Due to demand for renewables and intermittency concerns, the market has started to deploy flow batteries in large-scale utility projects, specifically targeting renewable smoothing and load shifting applications.

On-grid systems dominate the global BESS market as governments and utilities within power grids are heavily focused on modernizing existing grids to accommodate renewable energy. Grid-scale energy storage is being heavily invested in to provide a capacity for frequency regulation, peak shaving, and renewable power balancing. Urbanization and growing demand for electricity in both developed and developing economies will sustain this market dominance.

| Connection Type | Market Share (%) | Key Highlights |

| On-grid | 75% | Dominates due to large-scale grid stabilization projects, renewable integration, and utility investments. |

| Off-grid | 25% | Growing rapidly in remote and rural electrification, island grids, and solar+storage microgrid applications. |

Off-grid BESS systems are the fastest-growing segment, owing to electrification in rural and remote regions and rising acceptance of solar-plus-storage. Many developing regions (e.g., Africa, Southeast Asia, and Latin America) are now installing off-grid systems to provide reliable power supply in regions where existing grid infrastructure is underdeveloped or non-existent. In addition, heightened demand for energy security and resilience is further fueling growth in this segment.

Utility-owned BESS constitutes the largest segment of the market due to the expansion of large-scale grid storage projects throughout the world. Utilities are investing heavily to support the integration of renewables, provide ancillary services for grid performance improvements, and to replace fossil fuel-based peaker plants for energy generation. The BESS systems operate at a large capacity and comprise a substantial portion of the market value of BESS and installed capacity.

| Ownership Type | Market Share (%) | Key Highlights |

| Utility Owned | 52% | Largest share due to deployment of grid-scale projects by governments and power utilities for grid stability and load balancing. |

| Customer Owned | 28% | Common in residential and commercial sectors for backup power and energy bill optimization. |

| Third-party Owned | 20% | Fast-growing model due to energy-as-a-service, leasing, and reduced upfront cost for end users. |

The third-party ownership segment is the fastest-growing segment due to the increasing acceptance of energy-as-a-service and leasing frameworks that help minimize the financial burden to a business or residential user by avoiding the upfront cost implications. The adoption of the role of energy storage service providers and financial options for energy storage usage is making third party ownership attractive for residential users, especially in the commercial and industrial market segments.

Utility players continue to lead the market due to the large capital invested in energy storage capabilities that can meet large utility-scale applications. Utilities are increasingly investing in battery energy storage systems (BESS) for frequency regulation and responsively managing peak load, and accommodating renewable variables. These initiatives involve utility threshold deployments that will drive significant market revenues and total energy storage capacity.

| Application | Market Share, (%) | Key Highlights |

| Utility | 55% | Largest segment due to increasing deployment of grid-scale storage projects for renewable integration and frequency regulation. |

| Commercial & Industrial | 27% | Growing strongly due to energy cost optimization, peak load management, and power reliability needs. |

| Residential | 18% | Driven by rooftop solar adoption, backup power needs, and increasing electrification of homes. |

The commercial and industrial segment is the fastest-growing sector as electricity prices continue to climb and industries increasingly seek demand and reliability of energy. Businesses use BESS in order to mitigate energy costs by reducing peak demand charges, optimize energy usage and ensure uninterrupted power supply. Adoption of BESS in this market segment is expected to be accelerated by growth in data centers, manufacturing centers, and commercial complexes.

By Battery Type

By Connection Type

By Ownership

By Energy Capacity

By Application

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2022

August 2020

September 2020

March 2025