December 2020

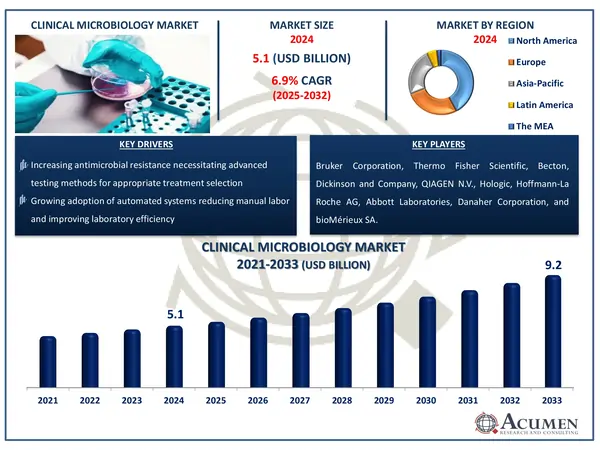

The Global Clinical Microbiology Market Size accounted for USD 5.1 Billion in 2024 and is estimated to achieve a market size of USD 9.2 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

The Global Clinical Microbiology Market Size accounted for USD 5.1 Billion in 2024 and is estimated to achieve a market size of USD 9.2 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

Clinical microbiology is concerned with the detection and characterization of pathogenic microorganisms in clinical specimens obtained from patients suspected of having an infection. Culture methods, microscopy, biochemical assays, and molecular diagnostic approaches such as PCR and DNA sequencing are all examples of laboratory techniques. Microbiologists work closely with infectious disease specialists to recommend effective antibiotic therapy and infection control methods. The area is also concerned with tracking antibiotic resistance patterns, developing quick diagnostic tests, and conducting surveillance systems to avoid healthcare-associated illnesses and track new pathogens in community settings.

|

Market |

Clinical Microbiology Market |

|

Clinical Microbiology Market Size 2024 |

USD 5.1 Billion |

|

Clinical Microbiology Market Forecast 2033 |

USD 9.2 Billion |

|

Clinical Microbiology Market CAGR During 2025 - 2033 |

6.9% |

|

Clinical Microbiology Market Analysis Period |

2021 - 2033 |

|

Clinical Microbiology Market Base Year |

2024 |

|

Clinical Microbiology Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Disease, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Bruker Corporation, Thermo Fisher Scientific, Becton, Dickinson and Company, QIAGEN N.V., Hologic, Bio-Rad Laboratories, Hoffmann-La Roche AG, Abbott Laboratories, Danaher Corporation, and bioMérieux SA. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Clinical microbiology market growth is being driven by technical breakthroughs in disease diagnosis, an increase in the frequency of infectious diseases, and epidemic outbreaks. According to the CDC, nearly one in every 31 hospital patients in the United States contracts at least one healthcare-associated infection on a daily basis, underlining the critical need for accurate diagnostic methods. Rapid advances in molecular diagnostics and automation are improving accuracy and turnaround time for results. Furthermore, substantial support from the public and private sectors continues to drive growth. For example, the National Institutes of Health (NIH) has set aside more than $1.5 billion in 2023 for infectious illness research. Furthermore, expanding public-private collaborations and incentives are boosting product development and laboratory capacity.

However, the market experienced significant disruption during the COVID-19 pandemic, which affected manufacturing and global supply chains, delaying product delivery to end-users. Despite these challenges, expanding healthcare infrastructure in emerging economies is anticipated to provide lucrative growth opportunities from 2020 to 2027. According to World Bank data, countries such as India increased their healthcare spending to 3.01% of GDP in 2021, aiming to improve access and capacity.

On the downside, limited reimbursement policies for microbiology testing procedures are expected to restrict market growth to an extent, particularly throughout the forecast period from 2025 to 2033, affecting affordability and adoption rates.

The worldwide market for clinical microbiology is split based on product, disease, application, end user, and geography.

According to clinical microbiology industry analysis, as of 2024, the reagents category was the largest in the market. Pathogen detection relies heavily on reagents, which aid in processes such as staining, culture, and molecular diagnostics like PCR. Their dominance arises from their widespread and repeated use in testing, as well as the increased requirement for high-sensitivity diagnostics in infectious disease detection. According to NIH data, increased expenditure in infectious disease research and innovation is expanding the scope and accuracy of reagents. With a rising global infection load and increased testing volumes, particularly in hospitals and diagnostic labs, the need for reagents is stable, ensuring their market leadership.

The respiratory diseases segment is projected to lead the clinical microbiology market, driven by India's significant burden of respiratory illnesses. According to the Global Burden of Disease Study, India accounted for 32% of global disability-adjusted life years (DALYs) due to chronic respiratory diseases, despite comprising only 18% of the world's population. Chronic obstructive pulmonary disease (COPD) and asthma were the most significant causes, accounting for 75.6% and 20.0% of these DALYs respectively.

Furthermore, tuberculosis (TB) is still a major public health concern in India. The Ministry of Health and Family Welfare's National TB Prevalence Survey found that the prevalence of all kinds of TB was 312 per 100,000 people. Acute respiratory infections are also serious issues. According to an Indian Council of Medical Research (ICMR) report, 50% of respiratory infection patients admitted to hospitals in the previous two months were caused by H3N2 influenza.

The clinical applications category is likely to lead the clinical microbiology market, owing to the increased demand for precise diagnoses in healthcare settings. As the prevalence of infectious diseases and hospital-acquired infections (HAIs) has increased, so has the demand for clinical microbiology services. According to the World Health Organization (WHO), HAIs affect hundreds of millions of individuals globally each year, resulting in a high demand for microbiological tests. Furthermore, the global increase in antibiotic resistance has underlined the need for precise diagnostic procedures to guide appropriate medication. As healthcare organizations increase their investment in diagnostic infrastructure, the clinical applications segment is likely to remain the largest, driven by the need for faster and more accurate pathogen detection.

According to clinical microbiology market forecast, hospitals and diagnostic centers by end user accounted for the maximum revenue share in 2024. The high incidences of diseases like tuberculosis, HIV-AIDS, malaria, and epidemic diseases and the necessity to treat these diseases in the hospitals and diagnostic centers are supporting the segmental market growth. The availability of advance products and trained professionals to operate the instruments for the treatment of infectious diseases are supporting the regional market growth.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

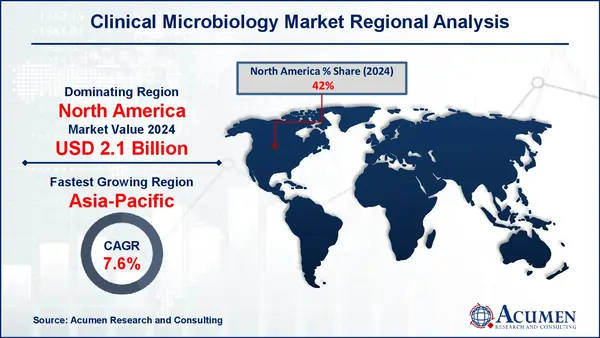

Clinical Microbiology Market Regional Analysis

North America along with its major economies including the US and Canada is leading the clinical microbiology market. The advanced healthcare infrastructure and the presence of major players in the region are supporting the highest market value. The high penetration of clinical microbiology technologies among key end-users in the region and well-established distribution channels for clinical microbiology product manufacturers and suppliers are accelerating the regional market value. The ongoing investment in the healthcare sector by the major players for the development of advancements in the healthcare sector is further propelling the supporting the regional market growth. Moreover, the region is also projected to maintain its dominance throughout the clinical microbiology market forecast period from 2025 to 2033.

In contrast, Asia-Pacific is developing as the fastest-growing market for clinical microbiology. Demand is being driven by rapid improvements in healthcare infrastructure, increased government spending on public health, and an increasingly infected population. Countries such as China, India, and Japan are investing considerably in diagnostics. According to the World Bank, healthcare spending as a proportion of GDP is continuously increasing in Asia-Pacific, with India expanding its health budget by over 13% by 2023. Furthermore, the increasing prevalence of antibiotic resistance, as well as the demand for faster, more accurate disease identification, are driving the implementation of microbiological testing in regional clinical settings.

Clinical Microbiology Market Players

Some of the top clinical microbiology companies offered in our report include Bruker Corporation, Thermo Fisher Scientific, Becton, Dickinson and Company, QIAGEN N.V., Hologic, Bio-Rad Laboratories, Hoffmann-La Roche AG, Abbott Laboratories, Danaher Corporation, and bioMérieux SA.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2020

February 2025

October 2023

May 2021