March 2023

Coin Cell Battery Market (By Type: LR (Alkaline), CR (Lithium), SR (Silver Oxide), ZnAir, Others; By Application: Consumer Electronics, Industrial Devices, Medical Devices, Others) - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2035

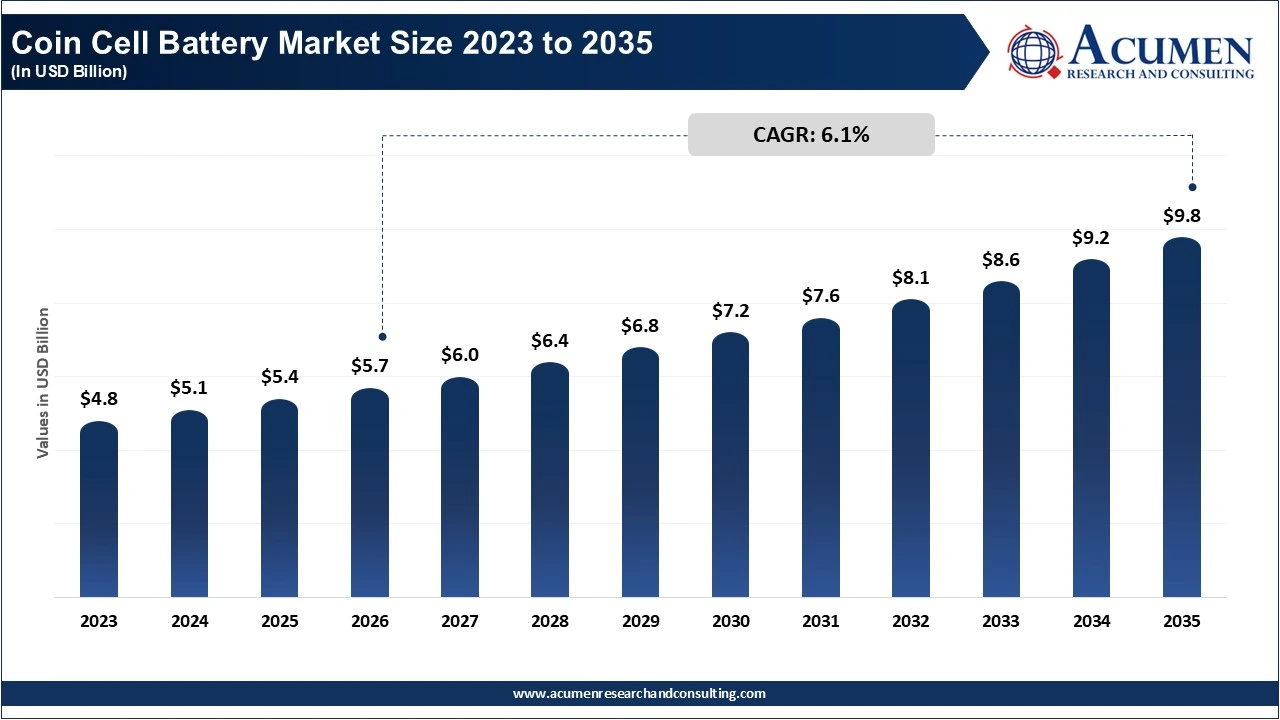

The global coin cell battery market size was estimated at USD 5.4 billion in 2025 and is projected to reach around USD 9.8 billion by 2035, growing at a CAGR of 6.1% from 2026 to 2035. The coin cell battery market is experiencing steady growth due to increasing demand for small, energy efficient power sources for consumer electronic devices, healthcare devices, and Internet of Things (IoT) applications. Continued adoption of wearable technology and portable medical devices, along with improvements in battery chemistry and miniaturization, will support the growth of the market around the world.

A coin cell battery is a small, round, flat battery commonly used to power small electronic devices such as watches, calculators, hearing aids, remote controls, and medical instruments. Coin cell batteries are typically manufactured as lithium, silver oxide, or alkaline chemistry cells; they can produce voltage for a long period of time. As a result, they are well suited to low drain, long life end products.

| Attributes | Details |

| Coin Cell Battery Market Size 2025 | USD 5.4 Billion |

| Coin Cell Battery Market Forecast 2035 | USD 9.8 Billion |

| Projected CAGR During 2026 - 2035 | 6.1% |

| Analysis Period | 2023 - 2035 |

| Base Year | 2025 |

| Forecast Data | 2026 - 2035 |

| Segments Covered | By Type, By Application, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Panasonic Corporation, Golden Power Group Holdings Ltd., TOSHIBA CORPORATION, HARDING ENERGY INC., Renata SA, Sony Group Corporation, BeStar Electronics Co. Ltd, Maxell Holdings Ltd., Duracell Inc., Camelion Batteries GmbH, EVE Energy Co. Ltd., and Koninklijke Philips N.V. |

The coin cell battery market is growing steadily as the demand for compact, durable, and efficient power sources continues to rise across industries. These round batteries are used for consumer electronics such as watches, hearing aids, remote controls, fitness trackers, and medical and IoT devices. Demand is especially fueled by growing popularity of wearable technology and growing use of connected, portable organized. Advances in lithium based and solid-state coin cells have increased energy density, lifespan, and overall performance for modern electronics applications. Manufacturers are also emphasizing sustainability and innovation by using environmentally friendly materials and creating efficiencies in manufacturing. The Asia-Pacific region continues to drive demand due to its leading electronics base, customer demand, as well as rapid adoption of smart devices and healthcare technologies.

While the coin battery market has an auspicious growth trajectory, it also has some headwinds that can impact market growth. Rising raw materials prices, especially lithium and silver, and waste concerns about recycling and/or disposal of the batteries, present powerful headwinds for manufacturers. However, the challenges begin research and development into more sustainable, rechargeable, and many batteries expected to last longer, and waste less, and more efficient. It is expected that new chances in automotive electronics, smart home devices, and advanced medical implants will increase strength in the market in the next few years. With ongoing innovation and a world shift towards smaller, energy-efficient devices, the coin cell battery market is expected to change rapidly this decade as it combines technology and an increasing emphasis on being earth conscious and long lasting.

The worldwide market for coin cell battery is split based on type, application, and geography.

By type, the segment CR (Lithium) holds the largest market share for coin cell batteries, as they exhibit high energy density, long shelf life, and stable performance. Compared to alkaline or silver oxide, these batteries are much better at efficiency and reliability, good for timepieces and medical devices and some IoT devices. CR lithium coin cells are also broadly available and compatible with modern electronic devices. The increasing demand for compact power solutions used in wearable and portable devices also fuels demand for CR lithium coin cells globally.

| Type | Market Share (%) | Key Highlights |

| CR (Lithium) | 45% | Dominant segment due to high energy density, long shelf life, and wide use in watches, remote controls, and IoT devices. |

| SR (Silver Oxide) | 22% | Popular in precision electronics and medical devices for stable voltage and compact design. Commonly used in hearing aids and calculators. |

| LR (Alkaline) | 18% | Cost-effective option for low-drain devices such as toys and small household gadgets. Widely available and environmentally safer compared to silver oxide. |

| ZnAir | 10% | Primarily used in hearing aids and medical applications. Also, offers high energy output but limited shelf life once activated. |

| Others | 5% | Includes specialty chemistries such as manganese dioxide or hybrid cells developed for specific industrial or experimental uses. |

By application, the consumer electronics segment holds the largest share of the market for coin cell batteries on account of the wide usage of the batteries in devices such as watches, calculators, remote controllers, and fitness trackers. The demand for lightweight and portable electronic gadg that require reliable and long-lasting power continues to drive the market. Moreover, the consumer electronics segment is continuing its dominance in the global market given the juggernaut of smart wearables and connected devices.

| Application | Market Share (%) | Key Highlights |

| Consumer Electronics | 39% | Largest segment driven by demand for remote controls, wristwatches, car key fobs, and wearables. Rising disposable income and digital lifestyle boost adoption. |

| Medical Devices | 25% | Increasing use in hearing aids, glucose monitors, and portable diagnostic tools. Focus on miniaturization and reliability supports segment growth. |

| Industrial Devices | 21% | Growing adoption in sensors, control modules, and backup systems for industrial automation and IoT infrastructure. |

| Others | 15% | Includes applications in automotive systems, smart cards, and defense equipment, contributing to niche but steady demand. |

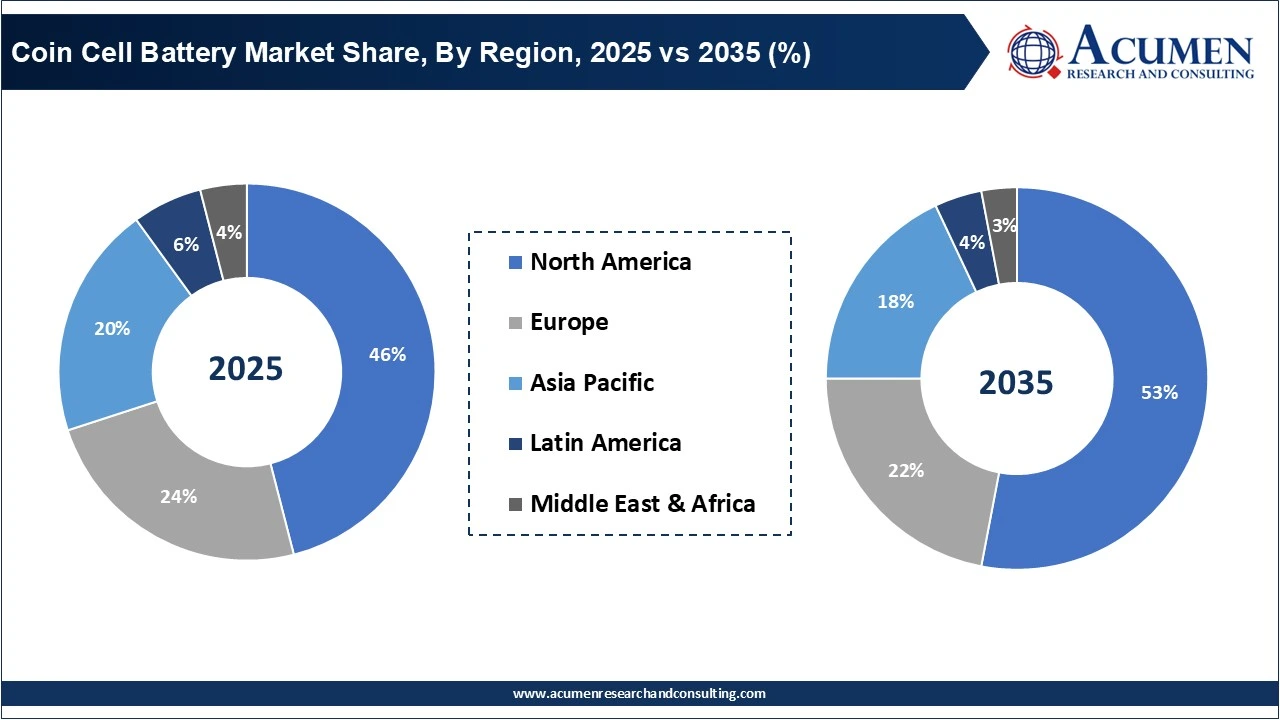

The Asia-Pacific region leads the coin cell battery market, due to a strong electronics manufacturing sector and high consumer demand for portable devices. Major manufacturers of consumer electronics, wearables and IoT, in countries such as China, Japan, and South Korea, use coin cell batteries in almost all of their products. The Asia-Pacific region improves its market position with the manufacturing of many of the world's battery manufacturers and advancements in lithium and solid-state technology. Moreover, investments in healthcare and automotive electronics have expanded the appeal of using coin cell batteries in many applications.

North America has emerged as one of the fastest growing markets for coin cell batteries. The growth in the coin cell battery market was driven by local adoption of smart home technologies, medical devices, and IoT-based applications. Growth in consumer spending of advanced electronics continues to grow with increased focus on sustainability and rechargeable battery applications driving this market to expand in the region. In addition, ongoing R&D, collaboration efforts from technology firms on advancing battery performance, safety solutions, and recycling solutions continue to support steady market growth in the region.

By Type

By Application

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

September 2024

February 2024

April 2020