March 2025

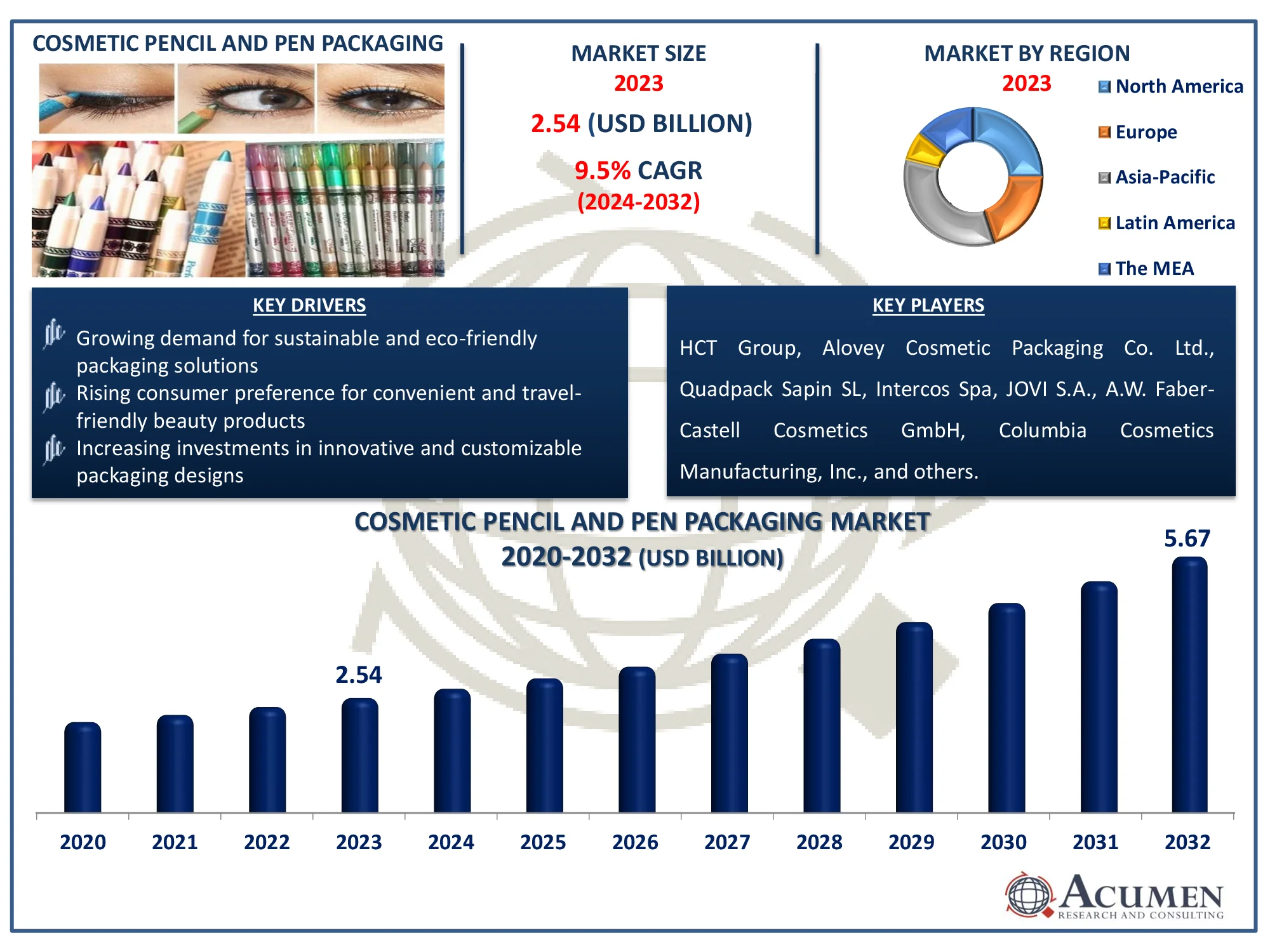

The cosmetic pencil and pen packaging market size is poised to reach around US$ 5.67 Billion by 2032, growing at a CAGR of 9.5% from forecast period 2024 to 2032

The Global Cosmetic Pencil and Pen Packaging Market Size accounted for USD 2.54 Billion in 2023 and is estimated to achieve a market size of USD 5.67 Billion by 2032 growing at a CAGR of 9.5% from 2024 to 2032.

Cosmetic pens and pencils are personal grooming products designed to enhance facial look. They come in a wide range of colors, styles, and brands, and are used in a number of products such as eyeliners, kajal, lip liners, lipsticks, and lip glosses. These products are intended to provide best outcomes while reducing the risk of unpleasant or allergic responses. Advanced formulas include waterproof qualities, dual usage for lips and eyes, extended shelf life, smooth and soft application, rich color depth, long-lasting wear, and vitamin E enrichment.

According to the National Institute of Health (NIH), as people get older, their concerns about their appearance become more focused on their faces. For example, Goodman (1994) interviewed 24 women, 12 of whom underwent cosmetic surgery and 12 who did not. The ages ranged from 29 to 75 years. This rising attention of many women on their skin will lead the cosmetic pencil and pen packaging market.

|

Market |

Cosmetic Pencil and Pen Packaging Market |

|

Cosmetic Pencil and Pen Packaging Market Size 2023 |

USD 2.54 Billion |

|

Cosmetic Pencil and Pen Packaging Market Forecast 2032 |

USD 5.67 Billion |

|

Cosmetic Pencil and Pen Packaging Market CAGR During 2024 - 2032 |

9.5% |

|

Cosmetic Pencil and Pen Packaging Market Analysis Period |

2020 - 2032 |

|

Cosmetic Pencil and Pen Packaging Market Base Year |

2023 |

|

Cosmetic Pencil and Pen Packaging Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Material, By Product Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

HCT Group, Alovey Cosmetic Packaging Co. Ltd., Quadpack Sapin SL, Intercos Spa, JOVI S.A., A.W. Faber-Castell Cosmetics GmbH, Columbia Cosmetics Manufacturing, Inc., Schwan-STABILO Cosmetics GmbH & Co. KG, Swallowfield PLC, Alkos Cosmétiques S.A., Oxygen Development LLC, Eugeng International Trade Co., Ltd., Ningbo Beautiful Daily Cosmetic Packaging Co., Ltd., and CONFALONIERI MATITE S.R.L |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing number of working women, combined with rising disposable money, is a fundamental driver of market expansion. The increasing emphasis on aesthetic appeal among women is driving the global demand for cosmetics. Furthermore, the aging population's increased desire for a young appearance is driving up the need for cosmetic items. Furthermore, the adoption of innovative and environmentally friendly solutions is projected to drive demand during the projection period.

The American Board of Cosmetic Surgery requires a one-year specialized training program in cosmetic operations, which is approved by the American Academy of Cosmetic Surgery. The fellowship needs a minimum of 300 procedures and provides hands-on training in both surgical and non-surgical therapies. This training comes after a 3-5 year residency in a relevant medical field, ensuring proficiency in cosmetic surgery. This increases consumer confidence in cosmetic treatments, which drives up demand for beauty items. As a result, the market for cosmetic pencil and pen packaging grows faster.

The use of modern materials and specialized manufacturing techniques often results in increased production costs when eco-friendly packaging is adopted. Many sustainable options, such as bioplastics and paper-based solutions, cost more than traditional plastic packaging. These higher expenses may make it difficult for manufacturers, especially small and medium-sized businesses, to maintain competitive pricing.

Furthermore, consumers place a larger value on ecologically friendly products, prompting firms to use sustainable packaging materials such as biodegradable, recyclable, and refillable options. The CAS Organization projects that the natural ingredients market would grow from USD $642 million in 2022 to USD $1,095 million by 2030, demonstrating the cosmetics industry's shift toward sustainability. This development reflects a significant shift in consumer behavior, with more than 40% of purchasers preferring natural ingredients in beauty and personal care products. This measure not only reduces environmental effect but also enhances brand image and customer loyalty.

Cosmetic Pencil and Pen Packaging Market Segmentation

Cosmetic Pencil and Pen Packaging Market SegmentationThe worldwide market for cosmetic pencil and pen packaging is split based on material, product type, application, and geography.

According to the cosmetic pencil and pen packaging industry analysis, plastic dominates because of its low cost, durability, and variety in design. It provides lightweight and shatter-resistant packaging, making it perfect for mass production and consumer convenience. Furthermore, advances in recyclable and biodegradable plastics are driving up demand in the business. Glass is popular for premium and luxury cosmetic packaging because of its aesthetics and recyclability. Paper and wood are gaining popularity as sustainable alternatives, whilst metal provides a stylish, long-lasting solution for luxury firms.

Wooden pencils are predicted to dominate the cosmetic pencil and pen packaging industry because of its timeless appeal, ease of use, and sustainability. They are commonly utilized in items such as eyeliner and lip liners, providing a natural feel and dependable performance. Wooden pencils are also popular due to their eco-friendly image and flexibility of customisation in design. Moulded pencils are increasingly popular due to their smooth application and ability to hold complicated drawings. Mechanical pencils, which combine precision and ease with retractable tips, are popular in high-end cosmetic goods because to their user-friendly design and long-lasting performance.

According to the cosmetic pencil and pen packaging market forecast, the most popular eye items are eyeliners, kajal, and brow pencils. These items are indispensable in daily cosmetic processes and are prized for their precision and ease of use. The eye category continues to lead because it appeals to a wide range of consumers at different price points and brands. Lip cosmetics, such as lip liners and lip pencils, are popular due to their color accuracy and long-lasting usage. Concealer, cheek balm, and sculpting pencils are becoming popular as customers seek versatile cosmetic tools for specific makeup applications.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

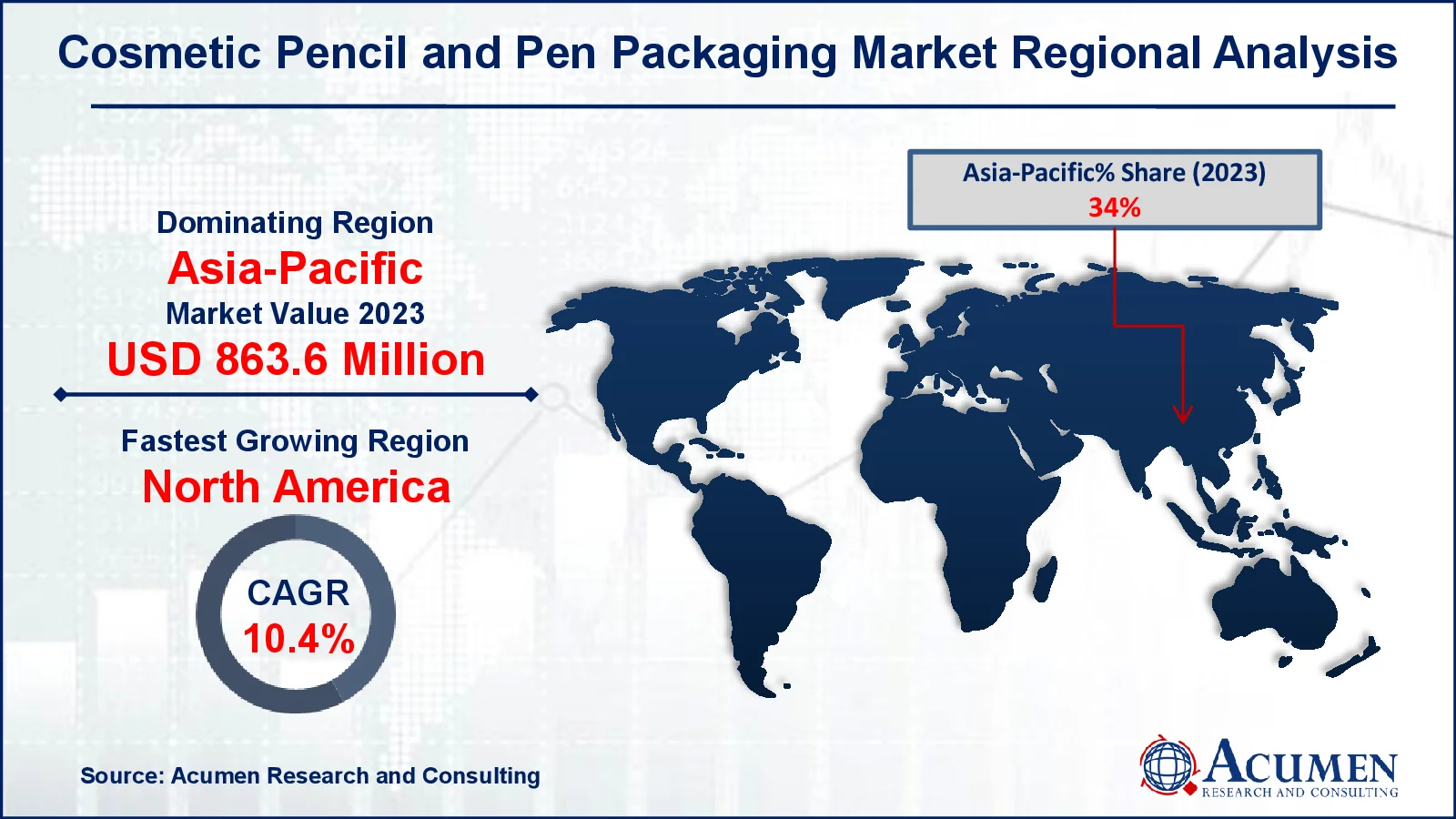

Cosmetic Pencil and Pen Packaging Market Regional Analysis

Cosmetic Pencil and Pen Packaging Market Regional AnalysisFor several reasons, Asia-Pacific region dominates, due to a growing female working-class population. The rising disposable income, combined with a burgeoning urban population and increased investment by global manufacturers in the regional market as a result of improving economic conditions in economies like as China and India, is adding to the regional market's worth. According to the India Brand Equity Foundation, businesses are focusing on increasing their retail presence, while international investors are eager to invest in beauty startups. Due to economic concerns in China, Asia's largest cosmetics market, corporations are now shifting their focus to India for growth prospects.

North America is likely to grow the quickest over the forecast period in cosmetic pencil and pen packaging market due to its well-established cosmetic industry, which is supported by top brands and ongoing product innovation. For example, in June 2024, The Estée Lauder Companies announced that it had completed its acquisition of DECIEM Beauty Group Inc. After acquiring full ownership in 2021, Estée Lauder paid over USD 860 million for the remaining shares on May 31, 2024. DECIEM, best known for its flagship brand The Ordinary, significantly broadens The Estée Lauder Companies' skincare portfolio, bolstering the company's position in the premium skincare industry, particularly in North America and Europe, where DECIEM has achieved significant market leadership. The Estée Lauder Companies' acquisition of DECIEM is predicted to boost the cosmetic pencil and pen packaging market by expanding their skincare options, resulting in increased demand for cosmetic products and packaging in North America and Europe.

Some of the top cosmetic pencil and pen packaging companies offered in our report include HCT Group, Alovey Cosmetic Packaging Co. Ltd., Quadpack Sapin SL, Intercos Spa, JOVI S.A., A.W. Faber-Castell Cosmetics GmbH, Columbia Cosmetics Manufacturing, Inc., Schwan-STABILO Cosmetics GmbH & Co. KG, Swallowfield PLC, Alkos Cosmétiques S.A., Oxygen Development LLC, Eugeng International Trade Co., Ltd., Ningbo Beautiful Daily Cosmetic Packaging Co., Ltd., and CONFALONIERI MATITE S.R.L.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2025

February 2020

October 2020

June 2023