November 2022

Dishwasher Tablets Market (By Product: Private Label, Branded; By Distribution Channel: E-commerce, Supermarkets & Hypermarkets, Convenience Stores, Others; By End User: Residential, Commercial) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

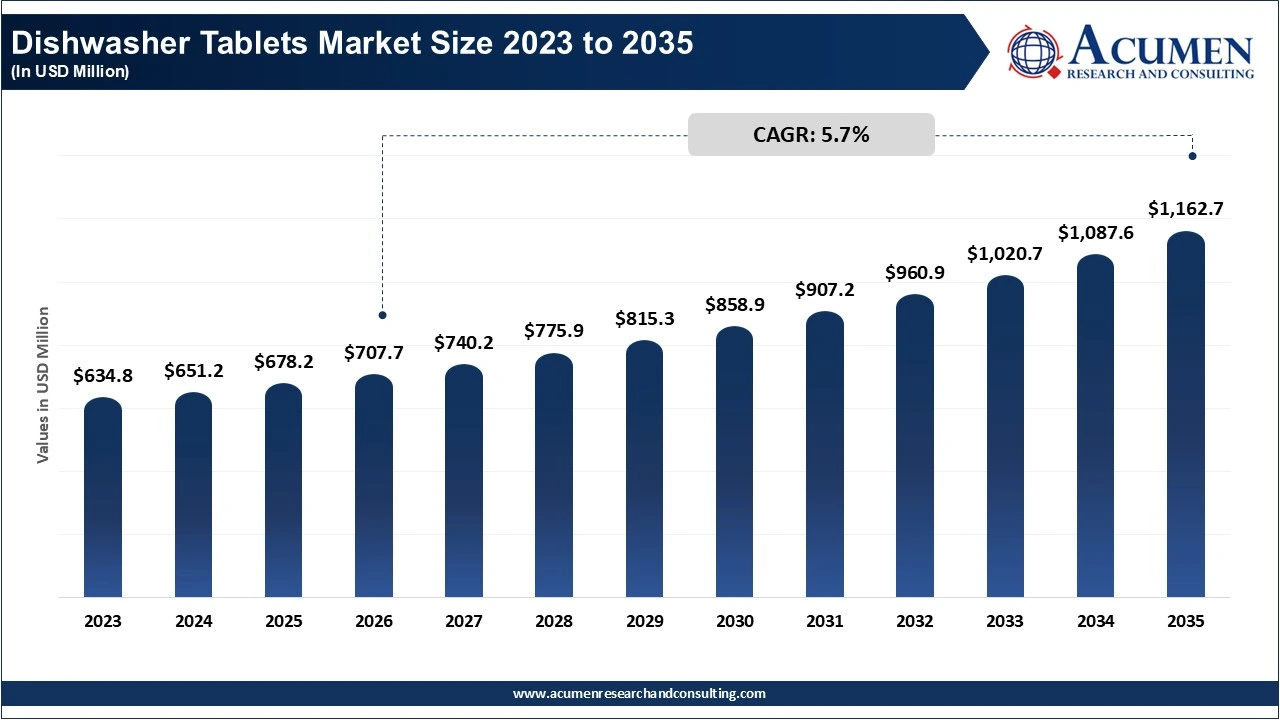

The global dishwasher tablets market size accounted for USD 678.2 million in 2025 and is estimated to reach around USD 1,162.7 million by 2035 growing at a CAGR of 5.7% from 2026 to 2035.

Dishwasher tablets are pre-measured cleansers for usage in dishwashers at home or in commercial setups. A dishwasher tablet consists of builders to soften and clean the water, enzymes to tackle protein and starch, bleach for breaking down specific stains, and surfactants for removing residue. These products combine detergents with enzymes and rinse aids in one product, and their use requires very little work for excellent cleaning and shine. As per the US Energy Information Administration, around 54% of homes in the US have a dishwasher installed, which calculates to over 80 million households in the country. The increasing urbanization, disposable income, and demand for time-saving cleaning products are rapidly driving the growth of the global market for dishwasher tablets.

Many dishwasher tablets are also friendly to the environment, biodegradable, phosphate-free, and comply with today's eco-friendly cleaning standards while effectively and efficiently cleaning dishes. Upscale innovations of all-in-one and multi-layer tablets create extra value in glass protection and low-temperature performance. The range of applications begins from residential to the sphere of hospitality, including hotels and restaurants. The manufacturing process is focused on green, plant-based formulations paired with recyclable packaging to appeal to today's ecologically sensitive consumers and improve brand equity in light of increasing environmental legislation.

Increasing Adoption of Household Automation

Convenience and performance advantages of tablets over traditional formats

High Cost

Environmental concerns over packaging waste despite eco-focused initiatives

Growth in E-commerce Demand

Technological Advancements

| Area of Focus | Details |

| Dishwasher Tablets Market Size 2025 | USD 678.2 Million |

| Dishwasher Tablets Market Forecast 2035 | USD 1,162.7 Million |

| Dishwasher Tablets Market CAGR During 2026 – 2035 | 5.7% |

| Segments Covered | By Product, By Distribution Channel, By End User, and By Geography |

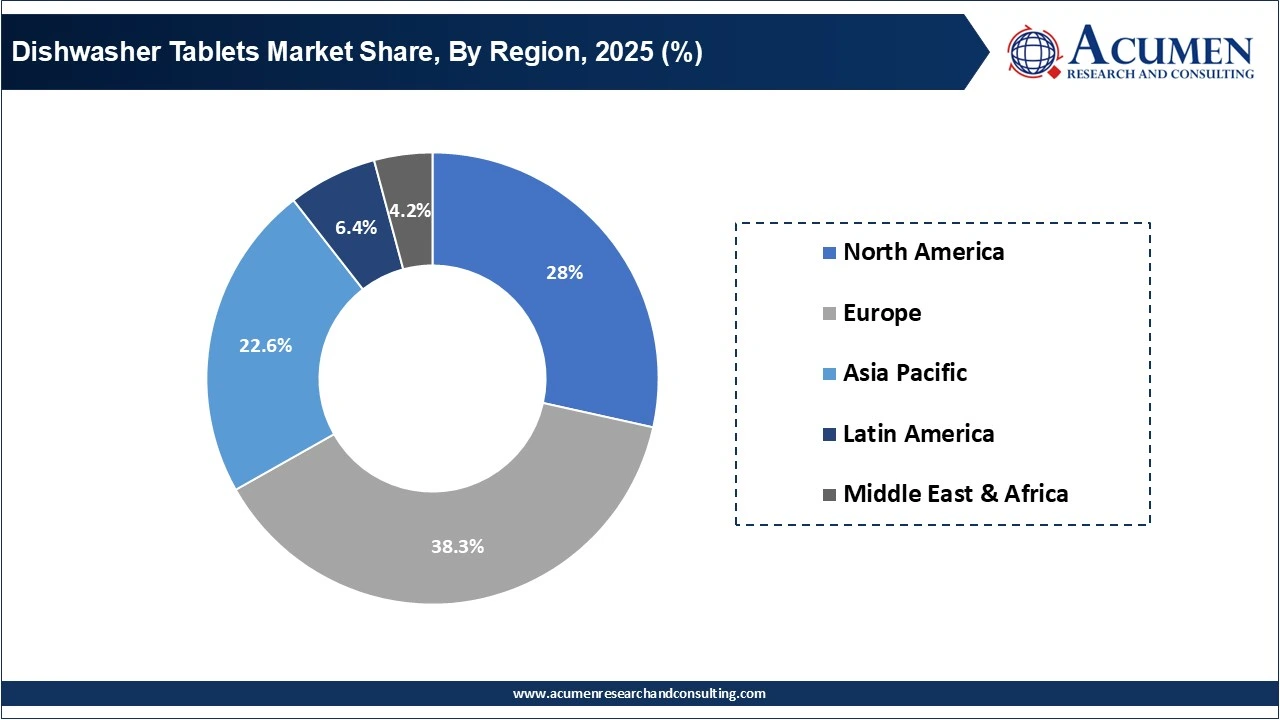

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Reckitt Benckiser, EUROTAB, Henkel AG & Co. KGaA, Unilever, Procter & Gamble, Amway Corp., Mc Bride Plc, Church & Dwight Co, Inc., Colgate-Palmolive Company, and Seventh Generation, Inc. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Geographically, Europe accounts for the largest share of the dishwasher tablets market, mainly because of high consumption of dishwashers within the residential sector and increased awareness related to convenience and cleanliness. According to the European Commission, there exist one dishwashing machine every two houses in Europe, running over 220+ cycles per year. European manufacturers are leading in the development of efficient formulations that include multi-layered tablets so that the active ingredient release is optimized in wash cycles for excellent cleaning performance. Moreover, hectic European lifestyles boost demand for dishwashers since they provide an easy and quick means of cleaning dishes without requiring lengthy human effort. Dishwasher tablet formulations typically include protective agents which prevent clouding and etching on glassware, assuring shiny and clean results post every wash. The European consumers are progressively inclined toward sustainable and eco-friendly solutions, encouraging manufacturers to transform and offer phosphate-free and biodegradable products.

There is expected to be a considerable growth of the dishwasher tablet market in the Asia-Pacific region due to increased spending on home appliances such as dishwashers coupled with the increase in disposable income in countries such as India and China. As more homes embrace dishwashers, more convenient and innovative products for cleaning, such as dishwasher tablets, will see the highest growth rates. Moreover, with the increase awareness of hygiene, consumers prefer efficient cleaning solutions that save time and effort as well. This combination of changing lifestyles, economic growth and increased awareness will result in exceptional growth of Asia-Pacific dishwasher tablets market over the next few years.

The worldwide market for dishwasher tablets is split based on product, distribution channel, end user, and geography.

The branded products are preferred more owing to the increasing consumer demand for reliable and popular products. Branded products are linked to superior quality and exceptional cleaning performance, inspiring repeat consumption from buyers. Moreover, well-known brands significantly invest in product innovation, assuring they meet fluctuating consumer demands for sustainability. For instance, Reckitt Benckiser offers multi-functional tablets that integrate rinse aid, detergent, and other features in a single product.

| Product | Market Share (%) | Key Highlights |

| Private Label | 34% | Commonly used by institutional buyers and consumers that are price-sensitive. |

| Branded | 66% | Dominant due to rising consumer demand for popular and reliable products offering excellent quality. |

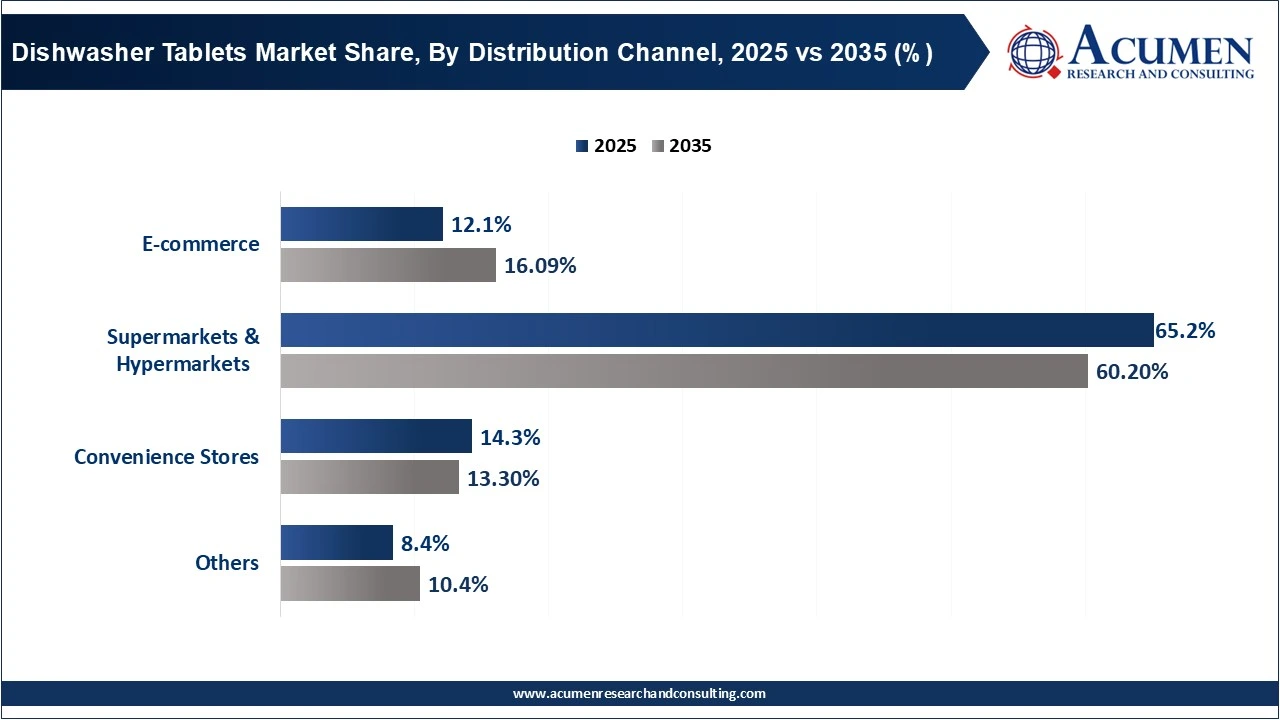

The supermarkets & hypermarkets segment dominates the dishwasher tablets sector due to the prevalent availability of these stores and a widespread range of offerings. As these stores stock a diverse set of products and brands, consumers can effortlessly compare options and select products based on their needs. Bulk purchasing and promotional displays options further leverage sales in such retail spaces. Additionally, the option to physically read labels and examine packaging boosts the confidence of buyers toward their choices, making supermarkets & hypermarkets a preferred shopping space for household cleaning products.

| Distribution Channel | Market Share (%) | Key Highlights |

| E-commerce | 12% | Emerged as a rapidly growing channel, driven by convenience of home delivery and rising penetration of internet. |

| Supermarkets & Hypermarkets | 65% | Dominant as it offers a widespread range of offerings with product visibility and in-store promotional campaigns. |

| Convenience Stores | 14% | Gaining popularity for small-quantity purchases. |

| Others | 8% | Include direct-to-consumer websites, institutional sales, and wholesale clubs. |

The commercial segment is projected to dominate the industry because of the developing demand from the hospitality and institutional foodservice sectors, including hotels, restaurants, and catering services, which witness a huge demand for efficient and high-performance cleaners. These establishments run several dishwashing cycles daily and are dependent on reliable, time-saving, and cost-effective cleaning agents that can help them maintain standards of hygiene and working efficiency.

| End User | Market Share (%) | Key Highlights |

| Residential | 27% | Growth in adoption of plant-based dishwashing tablets is a major trend in the residential sector. |

| Commercial | 73% | Dominant due to proliferating demand for high-performance cleaners from the hotel and foodservice sectors. |

By Product

By Distribution Channel

By End User

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2022

March 2023

May 2023

October 2018