October 2023

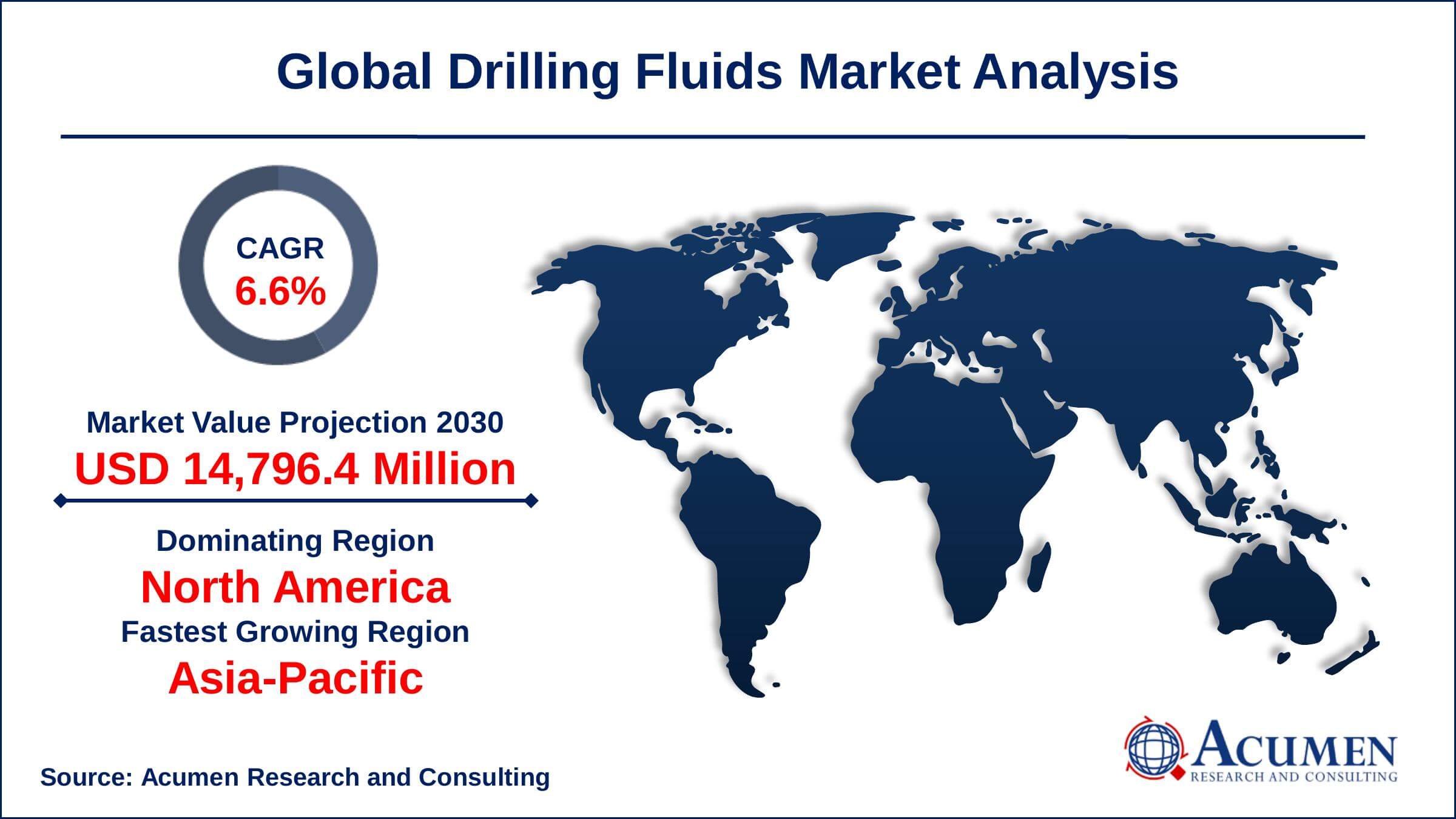

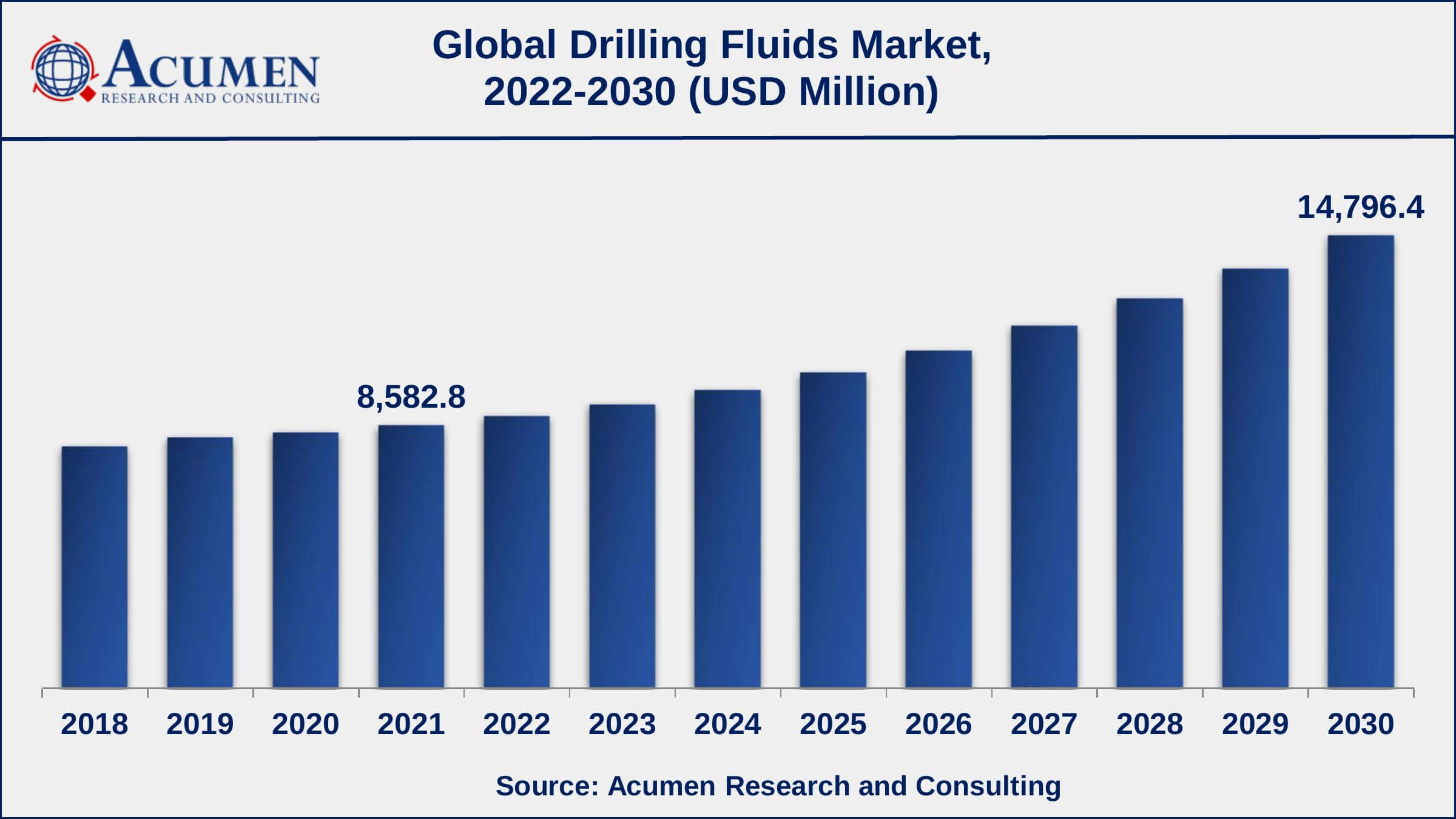

Drilling Fluids Market Size accounted for USD 8,582.8 Million in 2021 and is projected to occupy a market size of USD 14,796.4 Million by 2030 growing at a CAGR of 6.6% from 2022 to 2030.

The Global Drilling Fluids Market Size accounted for USD 8,582.8 Million in 2021 and is projected to occupy a market size of USD 14,796.4 Million by 2030 growing at a CAGR of 6.6% from 2022 to 2030.

Drilling fluids acts as a vital element in oil and gas exploration procedures. Drilling fluids are a combination of oil, water, clay and various chemicals. Drilling fluids are also called as drilling muds. These fluids execute several functions such as carrying the drill cutting to the surface, cooling the drill bit and grease its teeth and minimizing problems associated with drill pipe stuck during drilling operations. The report provides analysis of global drilling fluids market for the period 2022-2030, wherein 2022 to 2030 is the forecast period and 2021 is considered as the base year.

Drilling Fluids Market Report Statistics

Global Drilling Fluids Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Drilling Fluids Market Report Coverage

| Market | Drilling Fluids Market |

| Drilling Fluids Market Size 2021 | USD 8,582.8 Million |

| Drilling Fluids Market Forecast 2030 | USD 14,796.4 Million |

| Drilling Fluids Market CAGR During 2022 - 2030 | 6.6% |

| Drilling Fluids Market Analysis Period | 2018 - 2030 |

| Drilling Fluids Market Base Year | 2021 |

| Drilling Fluids Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Schlumberger Limited, Halliburton Inc, Newpark Resources Inc., Scomi Group Bhd, National Oilwell Varco., Anchor Drilling Fluids USA, LLC, Canadian Energy Services & Technology Corp., TETRA Technologies, Baker Hughes Incorporated, and Calumet |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Drilling Fluids Market Growth Factors

Drilling fluids are the main factor of the drilling activities and provide various purposes. These fluids are mainly implemented in the drilling of subterranean wells. Increasing investments in synthetic based muds, increasing demand for crude oil and natural gas in various energy concentrated industries, growth in the usage of water based muds, growing participation to maintain the demand for energy, increasing focus on developing new nanotechnology based solutions and rising concern about various environmental impact are some of the major factors that are propelling the drilling fluids market growth across the world.

Drilling fluids assist in reducing the pump capacity loss and improves mud pump efficiency with increased oil and gas throughput. Moreover, companies are extensively focusing on R&D to extend bio based drilling fluids made from vegetable oils. R&D facilities are also giving more attention on expanding drilling fluids hydraulics simulators for the development of fluids systems for difficult situations. Nanotechnology is one such popular development in the use of in drilling fluid activities. Nano particles are proficient of improving the permanence of drilling fluids at temperature and high pressure conditions. Execution of nanotechnology in various industries has forced the various market players to implement the nanotechnology in the oil and gas industry, thereby driving the growth of the global drilling market. Prominent players of drilling fluids are primarily focusing on the heavy investments in the drilling fluids technology development using nanotechnology.

Growing environmental concerns due to the dangerous effects related with using oil based fluids are resulting in increasing penetration of water-based drilling fluids. Multiple governments have implemented environmental regulations on the use of oil based muds, because these muds are harmful while drilling, thereby increasing the usage of water based muds. However, stringent government and environmental rules and regulations associated with the utilization and disposal of drilling fluids coupled with the various geopolitical problems in major oil and gas producing regions are some of the major factors that may restrict the growth of the drilling fluids market across the globe.

Drilling Fluids Market Segmentation

The global drilling fluids market is segmented based on product, application, and geography.

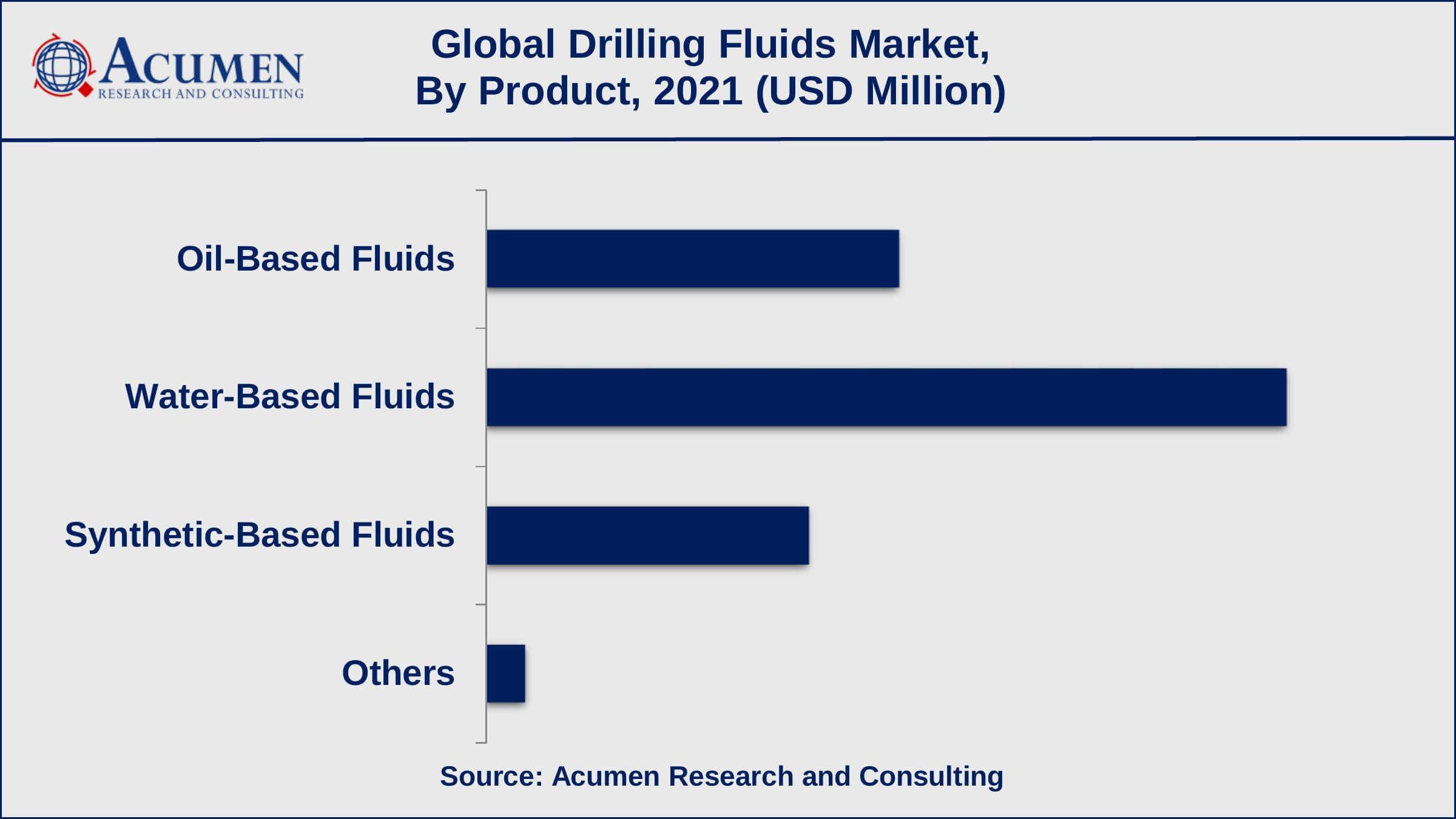

Drilling Fluids Market By Product

According to our drilling fluids industry analysis, the water-based fluids (WBF) sub-segment accounted US$ 4,373.3 revenue in 2021, and this trend is expected to continue in the coming years. However, the demand for synthetic-based fluids (SBF) is expected to rise in the coming years from 2022 to 2030. Synthetic-based fluids are more frequently used because they have a less environmental impact and are quicker to biodegrade than water- and oil-based fluids. Synthetic-based drilling fluids have several technological and environmental advantages over water-based (WBM) and oil-based drilling fluids and can cut total good costs in many cases. The initial cost of formulating synthetic base muds compared to conventional oil base muds (OBM) may be doubled but after considering the cost of containment, hauling, and disposal of OBM after use, the cost of using SBM turn out to be relatively cheaper

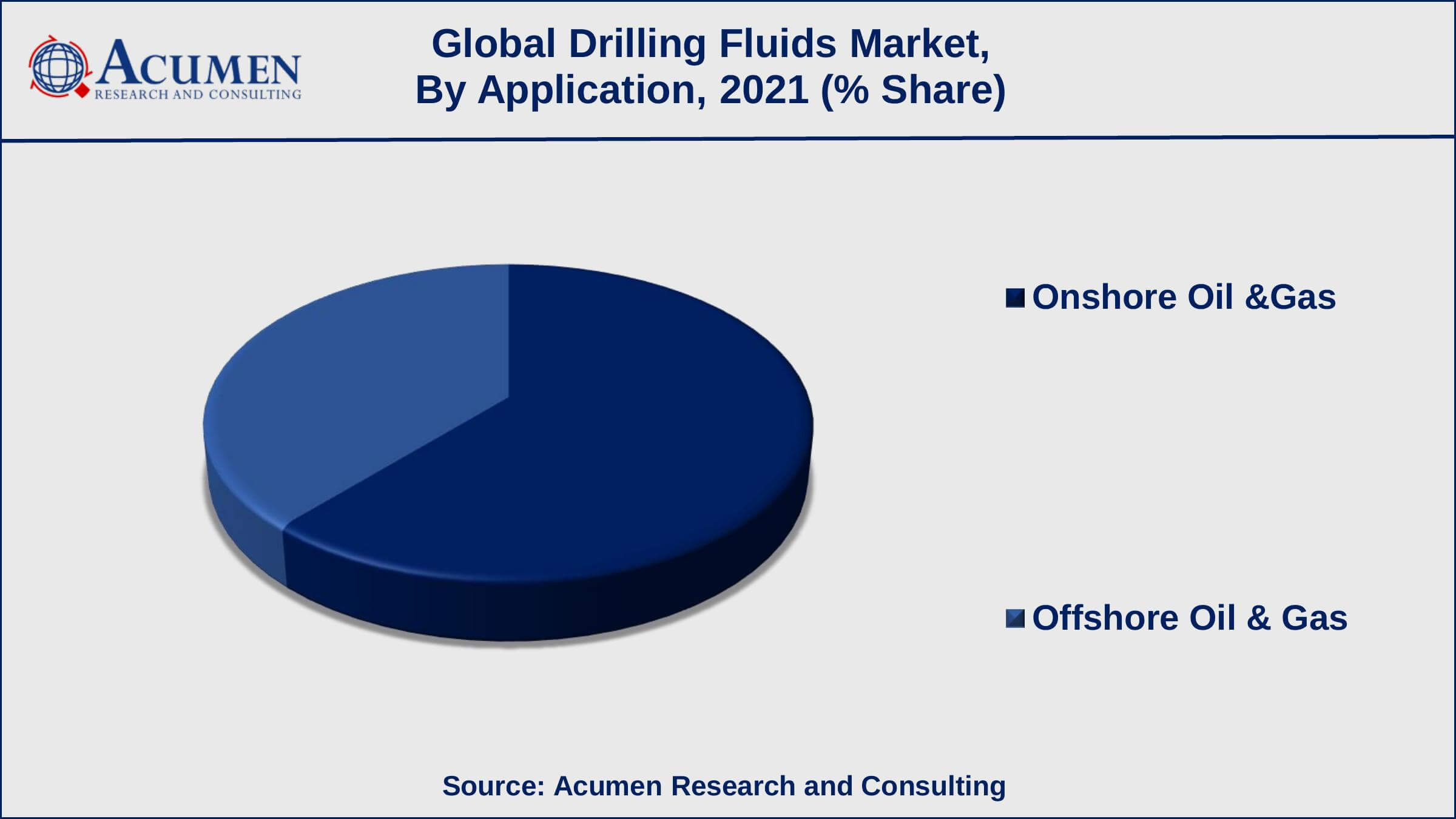

Drilling Fluids Market By Application

According to our drilling fluids market forecast, the onshore oil & gas application will account for a sizable market share from 2022 to 2030. The significant increase in the segment's growth is attributed to an increase in the number of projects being revived in various onshore oilfields and abandoned oil wells. As a result, the volume of oil and gas production around the world is anticipated to increase significantly. The offshore segment, on the other hand, is expected to grow at the fastest rate during the projected timeframe. As oil prices have recovered, offshore oil exploration activities have increased. For example, operating offshore rigs increased by about 23.0% year on year in January 2019, compared to a 2.0% increase for onshore rigs in the same month.

Drilling Fluids Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Drilling Fluids Market Regional Analysis

The market for North American drilling fluids market has dominated the market share and is likely to continue its trend during the forecast period. There is no doubt; North America is leading the drilling fluids market due to the presence of the grand global players in this particular region as well as increased technological advancement. In addition, due to increased adoption of several cloud-based services by way of production systems and by several distribution channels also boosts the North American market. The United States is one of the largest drilling fluids markets across the world, due to many wells being drilled every year. In the global rig count, the United States accounted for almost half of the onshore global average rig count for the period of January to September 2019.

Asia-Pacific has been one of the world's main oil-importing economies. In 2016, Asia-Pacific oil consumption was almost 400 percent more than the region's total oil production. The demand for energy is predicted to continue to climb during the projection period as the world's population, urbanization, and industry continue to grow. Asia-Pacific has been one of the world's main oil-importing economies. In 2016, Asia-Pacific oil consumption was almost 400 percent more than the region's total oil production. The demand for energy is predicted to continue to climb during the projection period as the world's population, urbanization, and industry continue to grow.

Drilling Fluids Market Players

The global drilling fluids market is characterized by the presence of experienced and established players. The global Drilling Fluids market is characterized by the presence of experienced and established players. Some of the key players include Schlumberger Limited, Halliburton Inc, Newpark Resources Inc., Scomi Group Bhd, National Oilwell Varco., Anchor Drilling Fluids USA, LLC, Canadian Energy Services & Technology Corp., TETRA Technologies, Baker Hughes Incorporated, and Calumet.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2023

August 2022

February 2023

February 2023