September 2023

Eco-Friendly Food Packaging Market (By Product: Bags, Bottles & Jars, Boxes & Cartons, Others; By Material: Recyclable, Biodegradable, Compostable; By Application: Food Service, Retail, Food Processing) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

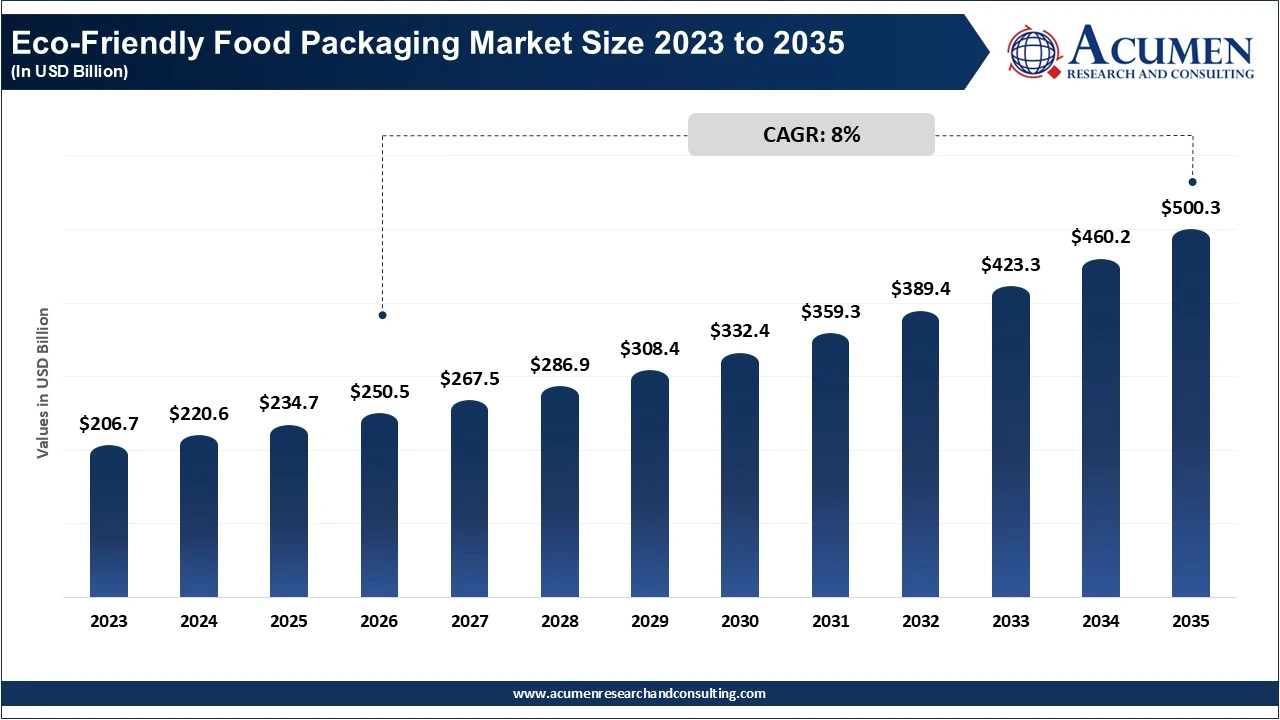

The global eco-friendly food packaging market size accounted for USD 234.7 billion in 2025 and is estimated to reach around USD 500.33 billion by 2035 growing at a CAGR of 8% from 2026 to 2035. Growing adoption in developing countries with improving infrastructure is a popular eco-friendly food packaging market trend that fuels the industry demand.

Eco-friendly food packaging is a sustainable method of confining and protecting food goods while minimizing environmental impact. This packaging makes use of recyclable, compostable, or naturally decomposing materials such as plant-based polymers, recycled paper, and biodegradable films. Unlike traditional packaging, which contributes to long-term waste accumulation, these alternatives decompose safely in the environment or can be recycled into new products. In comparison to traditional materials, the manufacturing process often uses less energy and emits fewer hazardous pollutants. Compostable takeout cartons, recyclable cardboard boxes, and reusable glass jars are some common examples. This packaging solution tackles growing environmental concerns while keeping food fresh and safe to consume.

The eco-friendly food packaging market is rapidly expanding as environmental awareness grows and regulatory frameworks become more stringent. Consumers nowadays are more aware of packaging waste, particularly in food products, which is accelerating the transition to sustainable alternatives. According to the US Environmental Protection Agency, packaging accounts for over 30% of total municipal solid waste in the United States, emphasizing the crucial need for long-term solutions.

Governments across multiple countries are enacting comprehensive rules to reduce plastic consumption. The European Union has banned single-use plastic items, while countries such as Canada and India have declared the gradual phase-out of non-compostable plastic packaging. These governmental regulations compel food manufacturers to use biodegradable, compostable, and recyclable materials.

Concurrent scientific developments in material science have resulted in inventions such as plant-based polymers, edible packaging solutions, and recycled paper alternatives. Nonetheless, the sustainable food packaging market faces substantial difficulties. Eco-friendly packaging often costs 20–30% more than traditional materials, creating financial difficulties for smaller producers. Furthermore, certain bio-based packaging has limited durability and a shorter shelf life than standard choices.

Conversely, expanding investment in research and development, alongside increased adoption of circular economy principles, creates substantial opportunities for sustainable packaging advancement. Consumer preferences continue shifting favorably, with surveys indicating that over 60% of global consumers prefer products featuring environmentally responsible packaging, demonstrating robust demand potential.

The sustainable food packaging market landscape is fundamentally shaped by the convergence of policy implementation, technological innovation, and evolving consumer behavior, generating both challenges and opportunities for sustainable packaging sector growth.

| Area of Focus | Details |

| Eco-Friendly Food Packaging Market Size 2024 | USD 220.61 Billion |

| Eco-Friendly Food Packaging Market Forecast 2035 | USD 500.33 Billion |

| Eco-Friendly Food Packaging Market CAGR During 2026 - 2035 | 8.0% |

| Eco-Friendly Food Packaging Market Analysis Period | 2023 - 2035 |

| Eco-Friendly Food Packaging Market Base Year | 2025 |

| Eco-Friendly Food Packaging Market Forecast Data | 2026 - 2035 |

| Segments Covered | By Product, By Material, By Application, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Silgan Holdings Inc., Graphic Packaging International, LLC, Huhtamaki, Mayr-Melnhof Karton AG, Crown Holdings, Inc., TOPPAN Inc., International Paper, Sealed Air, Amcor Berry Global, DS Smith, and Sonoco Products Company. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for eco-friendly food packaging is split based on product, material, application, and geography.

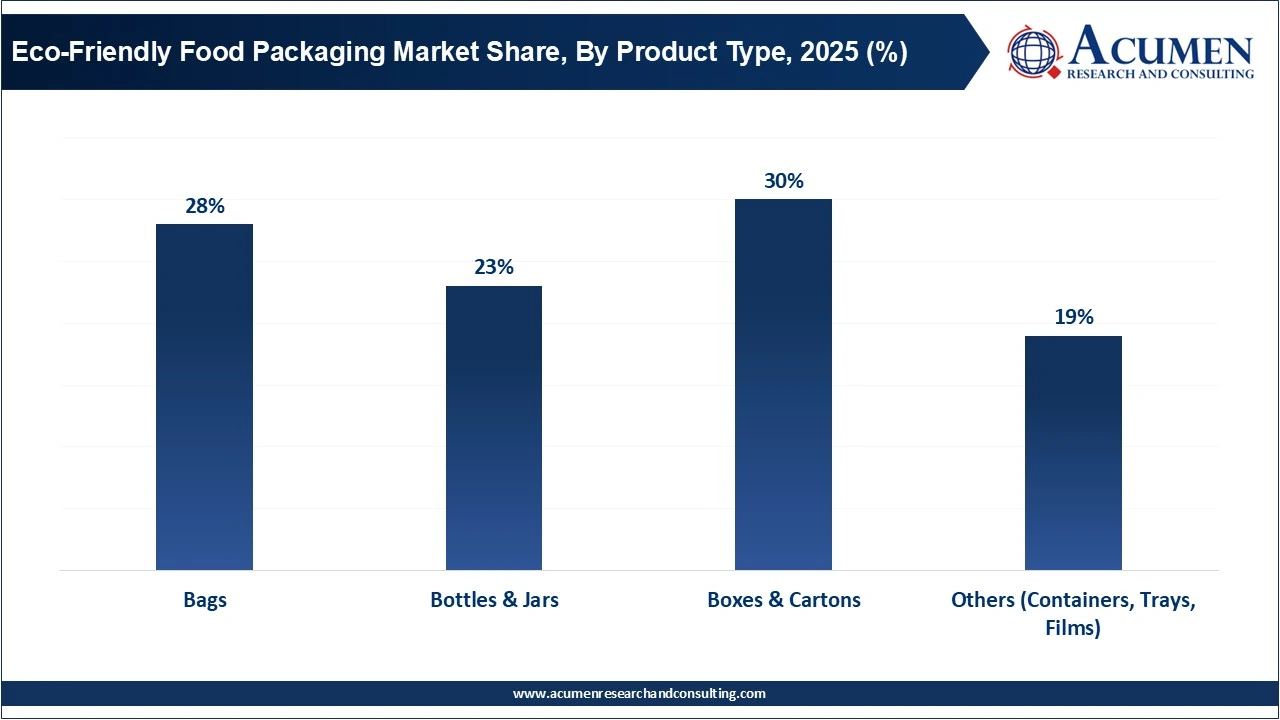

The boxes and cartons category is the largest segment accounting for nearly 30% of the total revenue. These packaging choices are popular due to their versatility, recyclable nature, and usage of renewable resources such as paper and cardboard. Many food makers use boxes and cartons because they offer good protection while remaining lightweight and easily customizable. Moreover, businesses are turning to recycled or biodegradable cartons to meet the need for environmentally friendly packaging. Boxes and cartons, unlike plastic packaging, degrade faster in the environment, lowering pollution levels. Their substantial presence in the retail and food delivery industries strengthens their market position. Overall, boxes and cartons are the most profitable eco-friendly food packaging option due to their combination of environmental benefits, cost-effectiveness, and consumer demand.

Bags: Widely used in grocery stores, cafés, bakeries, and fast food outlets, driven by demand for takeaway, delivery, and reusable or disposable sustainable alternatives.

Bottles & Jars: These are typically made from recyclable or eco-materials (e.g., recycled PET, glass) and are used for sauces, beverages, spreads, and other food-grade liquids. The growth of this segment is somewhat more moderate, as rigid container formats (bottles / jars) require more robust material and higher-cost eco solutions.

Boxes & Cartons: Largest segment. The popularity of boxes/cartons is largely due to their use in ready-to-eat meals, bakery items, frozen foods, and takeout packaging. Many of these cartons are made from recycled paperboard or sustainably sourced paper and often have water-based or compostable coatings to improve moisture resistance.

Others (containers, trays, films): “Others” includes a variety of formats such as trays, containers, molded-fiber packaging, films, tubes, etc. The demand for these products is reinforced by the need for durable, sustainable, high-volume packaging solutions in foodservice and takeaway (e.g., molded fiber trays, compostable containers).

The recyclable materials dominated the eco-friendly food packaging industry with over 44% market share due to their widespread availability, cost-effectiveness, and customer acceptance. Paper, cardboard, aluminum, and certain polymers can be reused several times, lowering the demand for new raw materials. Governments and regulatory agencies around the world are supporting recycling through strict waste management policies, increasing adoption of recyclable packaging. Brands are also labeling their items more clearly to encourage customers to properly dispose of them. Recycling materials are better supported by existing infrastructure than biodegradable or compostable options, making them a more scalable option. Recycling materials are the most popular choice in today's eco-friendly packaging industry due to their environmental benefits and greater awareness of sustainability.

| Material | Market Share (%) | Key Highlights |

| Recyclable | 44% | Currently dominate the eco-friendly food packaging market because they are widely accepted in recycling systems, and many established packaging formats (paperboard, glass, plastic) are recyclable. |

| Biodegradable | 40% | The growth of this material segment is driven by growing demand and disposability convenience. |

| Compostable | 16% | Compostable packaging, while still a smaller share compared to recyclable, is growing very quickly, thanks to increasing industrial composting infrastructure and regulatory push toward truly biodegradable materials. |

The food service segment is likely to experience considerable expansion in the industry. This growth is being driven by increased demand for environmentally friendly packaging solutions in restaurants, cafes, quick-service restaurants, and food delivery services. As consumers become more environmentally conscious, foodservice operators are switching from single-use plastic to recyclable, compostable, or biodegradable alternatives. Many countries' governments have banned plastic food containers and utensils, urging businesses to adopt more environmentally friendly practices. Furthermore, the rapid expansion of online food delivery services has raised demand for safe, environmentally friendly, and brandable packaging. These trends position the foodservice industry as a key driver of the expanding global use of environmentally friendly packaging solutions.

| Application | Market Share (%) | Key Highlights |

| Food Service | 42% | Food service is both the largest and fastest-growing application, driven by food delivery, QSR demand, and disposables. |

| Retail | 30% | Retail is a heavyweight segment, with considerable share; sustainability in packaging is now a consumer-facing differentiator. |

| Food Processing | 28% | Food Processing (manufacturers) is very significant in value: processors are anchoring a lot of demand for eco-friendly packaging, and are increasingly investing in greener packaging for high-volume products. |

North America holds a prominent position in the eco-friendly food packaging market in 2025 as a result of robust legislative frameworks and increased consumer environmental awareness. Regional governments, particularly in the United States and Canada, have enacted rigorous restrictions limiting plastic usage, supporting the use of biodegradable and recyclable packaging alternatives. The US Environmental Protection Agency's Sustainable Materials Management Program highlights government activities that promote responsible packaging practices across industries. These legislative restrictions have driven businesses to shift to more sustainable alternatives, such as paper-based materials, paperboard, and plant-derived polymers for food packaging applications.

The region's well-established food and beverage industry increases need for environmentally friendly packaging. Major North American corporations have increasingly committed to sustainability goals that align with existing regulatory limits. The combination of political pressure and business environmental concern has created a favorable sustainable food packaging market environment for eco-friendly packaging technologies. The synergy between government policy enforcement and industry compliance demonstrates North America's leadership in sustainable packaging transformation, establishing the region as a benchmark for global environmental packaging standards.

Asia-Pacific, on the other hand, is experiencing the fastest development in the environmentally friendly food packaging market. Government-led programs in China, India, and South Korea are fueling the growing trend. The Asia-Pacific eco-friendly food packaging market is projected to witness growth at a CAGR of 9.4% from 2026 to 2035. Policies like China's prohibition on single-use plastics and India's Plastic Waste Management Rules have sparked widespread change, promoting innovation in compostable and reusable food packaging.

By Product

By Material

By Application

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2023

June 2023

March 2025

March 2020