April 2020

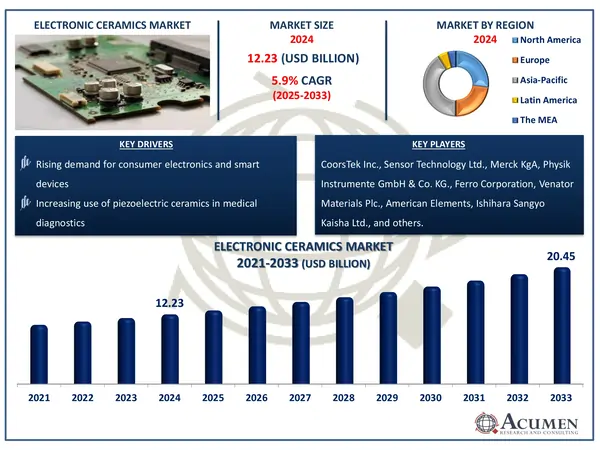

The Global Electronic Ceramics Market Size accounted for USD 12.23 Billion in 2024 and is estimated to achieve a market size of USD 20.45 Billion by 2033 growing at a CAGR of 5.9% from 2025 to 2033.

The Global Electronic Ceramics Market Size accounted for USD 12.23 Billion in 2024 and is estimated to achieve a market size of USD 20.45 Billion by 2033 growing at a CAGR of 5.9% from 2025 to 2033.

Electronic ceramics are advanced ceramic materials designed specifically for electrical, magnetic, and optical purposes. These materials have distinct features such as high dielectric strength, piezoelectricity, ferroelectricity, and semiconducting behavior, which make them indispensable in current electronics.

They are commonly found in capacitors, insulators, sensors, actuators, and transducers. Smartphones, medical ultrasonography equipment, vehicle sensors, and satellite communication networks all rely on electronic ceramics to function properly.

|

Market |

Electronic Ceramics Market |

|

Electronic Ceramics Market Size 2024 |

USD 12.23 Billion |

|

Electronic Ceramics Market Forecast 2033 |

USD 20.45 Billion |

|

Electronic Ceramics Market CAGR During 2025 - 2033 |

5.9% |

|

Electronic Ceramics Market Analysis Period |

2021 - 2033 |

|

Electronic Ceramics Market Base Year |

2024 |

|

Electronic Ceramics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Material, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

CoorsTek Inc., Sensor Technology Ltd., Merck KgA, Physik Instrumente GmbH & Co. KG., Ferro Corporation, Venator Materials Plc., American Elements, Ishihara Sangyo Kaisha Ltd., Compagnie de Saint-Gobain S.A., Noritake Co. Ltd., Hoganas AB, and L3Harris Technologies Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The rise of the semiconductor and electronics business and the consistent demand for electronic goods will in the future promote the global ceramics and electronic ceramics industry. For instance, according to a May 2024 analysis by the Semiconductor Industry Association (SIA) and Boston Consulting Group, the United States is predicted to more than treble its semiconductor production capacity between 2022 and 2032, representing the world's fastest growth rate over that period. The paper also predicts that by 2032, the United States would have 28% of the world's advanced chip (sub-10nm) production capacity and 28% of total global capital expenditures (capex) from 2024-2032.

In semi-conductors and electronic devices, electrical pottery is commonly used, including condensers, data storage systems, actuators and sensors, and power delivery systems. The goods are often strongly preferred for their potential to retain economic feasibility and technology, as well as maximize the space and size limitations of finished products, including computers, notebooks, smartphones and other consumer electronics.

The world demand for ceramics and electrical ceramics will have a high expense and technological difficulty in the production and deposition of ceramics. Any methods of physical vapor deposition of these ceramics are done at high temperatures, utilizing external equipment, adding costs and making morphology theoretically restricting the widespread use of such products in areas of high performance, such as fuels cells and some energy storage systems.

The worldwide market for electronic ceramics is split based on product, material, application, end-user, and geography.

According to electronic ceramics industry analysis, piezoelectric ceramics are a leading segment because of their capacity to transform mechanical energy to electrical energy and vice versa. These materials are essential in applications that need precise sensing, actuation, and control. They're commonly employed in ultrasonic imaging, sonar systems, automobile sensors, and microelectromechanical systems (MEMS). The increased demand for smart gadgets, medical diagnostics, and industrial automation continues to boost the use of piezoelectric ceramics in a variety of industries.

Based on the material, alumina (aluminum oxide) dominate the electronic ceramics market because of its high thermal conductivity, electrical insulation, and mechanical strength. It is an essential material for substrates, insulators, and packaging components in electronic devices. Alumina's broad use in semiconductors, LED lighting, and power electronics makes it very coveted. With increased demand for high-performance and long-lasting electronic components, alumina's market dominance is predicted to continuously increase.

According to application segment, the capacitors sub-segment is likely to account for a major portion of the electronic ceramics market because of the strong demand for multilayer ceramic capacitors (MLCCs). These components are essential for energy storage, voltage management, and signal filtering in electronic circuits. As consumer electronics, automotive electronics, and 5G infrastructure grow, so does the demand for compact, dependable, high-capacitance devices. This development establishes ceramic capacitors as a foundational component of modern electronic applications.

According to electronic ceramics market forecast, electronics end-user segment leads in market as a result of increased continuous innovation and miniaturization in consumer electronics, which drives the demand for sophisticated ceramic components.

For example, according to the Industrial Development Bureau (IDB), the electronics industry is one of Abu Dhabi's fastest-growing industries and plays an important role in the UAE economy. Abu Dhabi accounts for 16% of the UAE's total electronics manufacturing and imports electronics worth USD 36 billion, highlighting the region's growing desire for high-tech items. Aside from production and imports, the industry contributes significantly to employment, with 41.4% of its workforce consisting of highly skilled professionals. This expanding electronics output will retain segment supremacy in the industry.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

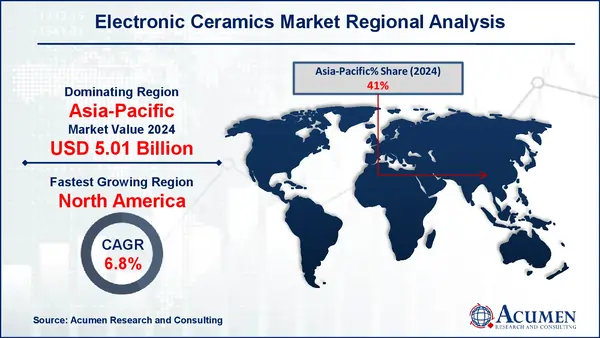

In terms of regional segments, as a major contributing factor to global subscriber growth in the past few years with strong growth to be seen in the coming decade, Asia-Pacific’s electronic ceramics market was valued at over USD 12.23 billion in 2024. In Asia-Pacific, more than half of the world's mobile subscribers are in China and India in particular. In addition, in Asia-Pacific or three quarters of the population, there will be over 3.5 billion mobile subscribers. With similar amounts of positive and negative effects, the US telecommunications market is matched with.

North America is likely to drive growth in electronic ceramics market. The Federal Communications Commission (FCC), the new telecommunications regulatory organization in the administration of the Trump government, is less restrictive than the administration of Obama and will probably reverse several regulations under the previous regime. The number of Internet and cell phone users will increase significantly, and the market for electronic ceramics will grow further. The government has agreed to increase the provision of broadband in rural villages. Rural broadband provision will continue to influence demand for electronic ceramics and be one part of the ambition of its $1 billion infrastructure project.

The telecommunications sector in the Middle East and Africa (MEA) is undergoing strong growth and investment driven mainly by significant demographic expansion and technology. These regional factors boost the sales of regional electronic ceramics services market.

Some of the top electronic ceramics companies offered in our report include CoorsTek Inc., Sensor Technology Ltd., Merck KgA, Physik Instrumente GmbH & Co. KG., Ferro Corporation, Venator Materials Plc., American Elements, Ishihara Sangyo Kaisha Ltd., Compagnie de Saint-Gobain S.A., Noritake Co. Ltd., Hoganas AB, and L3Harris Technologies Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2020

March 2023

July 2022

April 2025