August 2023

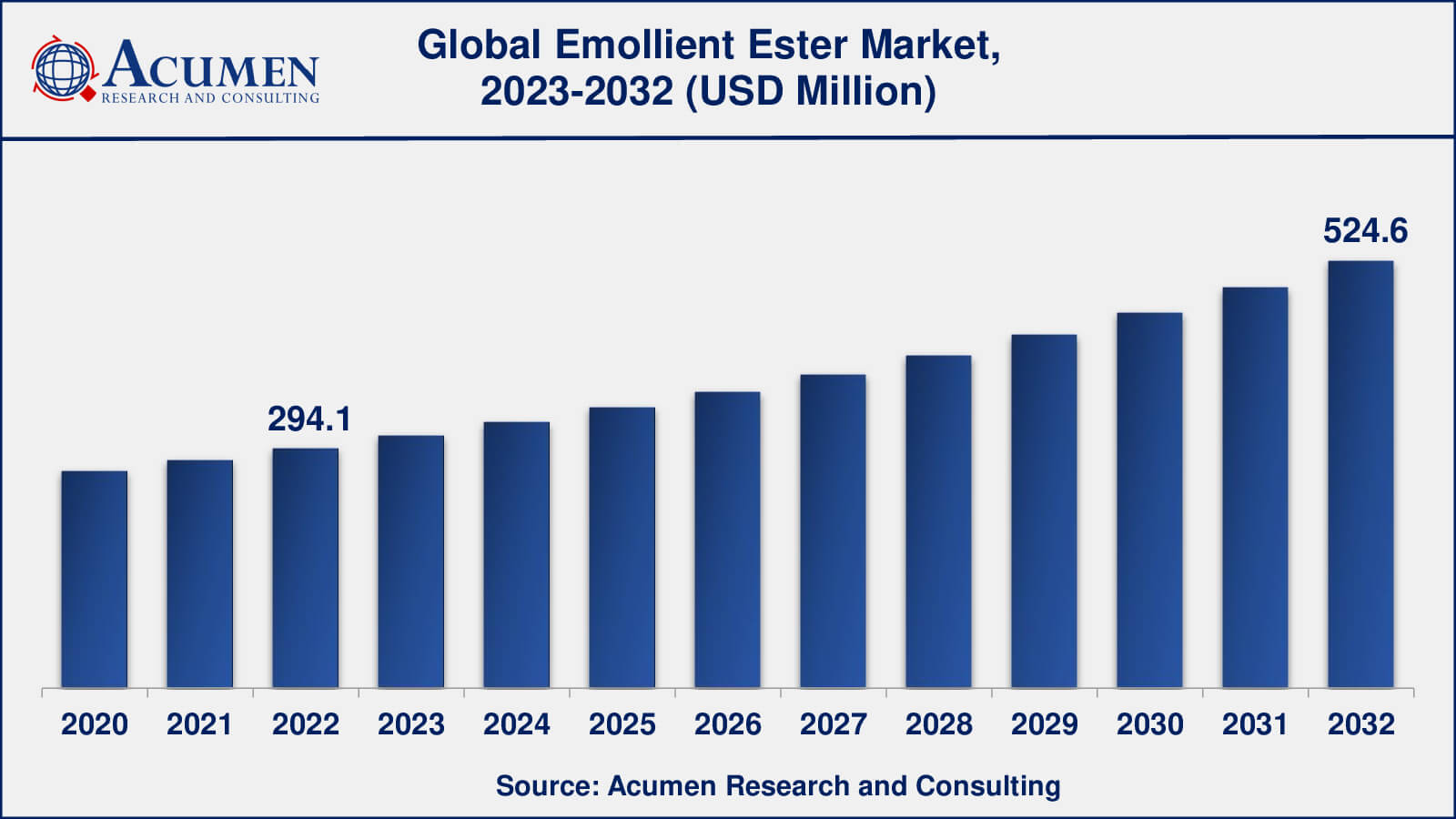

Emollient Esters Market Size accounted for USD 294.1 Million in 2022 and is estimated to achieve a market size of USD 524.6 Million by 2032 growing at a CAGR of 6.0% from 2023 to 2032.

The Global Emollient Esters Market Size accounted for USD 294.1 Million in 2022 and is estimated to achieve a market size of USD 524.6 Million by 2032 growing at a CAGR of 6.0% from 2023 to 2032.

Emollient Esters Market Highlights

Emollient esters are lubricants and humectants in nature and are generally known as moisturizers in the common language. Emollient esters aid in keeping skin supple and moist by furnishing a protective film over the skin. Emollient esters are basically found in various beauty and skin products such as lotions, lipstick, and a wide variety of cosmetic products. The global emollient ester market furnishes huge potential due to the expectation of customers for relatively more functional properties despite moisturizing and softening, for instance, the presence of sunscreen. In addition, demand for herbal or natural-based emollient esters is rapidly increasing across the globe, thus driving the global emollient esters market over the forecast period. On the other hand, several sensory properties in the formulations of skin care are manufactured majorly by emollient esters, emulsifiers, humectants, and rheology modifiers among others. Hence, emollient esters play a crucial role in influencing the feel of skin formulations. Based on their chemical structures, emollient esters can be bifurcated as hydrocarbons, esters, ethers, glycerides, silicone derivatives, and fatty alcohols among others. During the formulation of cosmetics, the choice of emollient esters generally depends on various key aspects such as polarity, chemical structure, spreading attributes, molecular weight, solubility, viscosity, surface tension, and contact angle. Isopropyl myristate is the most widely used chemical in skincare and beauty products as skin conditioning emollient esters. Emollient esters are crucial cosmetic ingredients that offer a relatively soft feeling to the skin and are preferred by diverse personal care product manufacturers. Emollient esters also find an important application in bath oil formulations as well.

Global Emollient Esters Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Emollient Esters Market Report Coverage

| Market | Emollient Esters Market |

| Emollient Esters Market Size 2022 | USD 294.1 Million |

| Emollient Esters Market Forecast 2032 | USD 524.6 Million |

| Emollient Esters Market CAGR During 2023 - 2032 | 6.0% |

| Emollient Esters Market Analysis Period | 2020 - 2032 |

| Emollient Esters Market Base Year | 2022 |

| Emollient Esters Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AAK AB, Ashland, BASF SE, Croda International PLC, Evonik Industries AG, Innospec Inc, Lipo Chemicals, Lonza Group Ltd. , Stepan Company, and The Lubricol Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Emollient Esters Market Insights

Increasing growth in categories of products such as face cream, lipstick, body wash, etc. as well as rising consumer preferences towards an increased focus on overall skin and body care products are some of the key factors driving the growth of the global emollient esters market. This growth is attributed to the rising demand for emollient esters, especially anti-aging skin products, moisturizers, and sun care products. Fatty esters such as isopropyl myristate are most commonly preferred in skin care products. Despite skin care products, there is a surge in demand for emollient esters across other end-use applications such as cosmetics, hair care, and oral care. Europe is anticipated to account for the second largest share in the global emollient esters market, followed by North America. The increasing supply of products coupled with fluctuating pricing strategies of manufacturers of natural products contributes to the growth of the emollient esters market in Europe.

Emollient Esters Market Segmentation

The worldwide market for Emollient Esters is split based on Product, physical form, application, and geography.

Emollient Ester Products

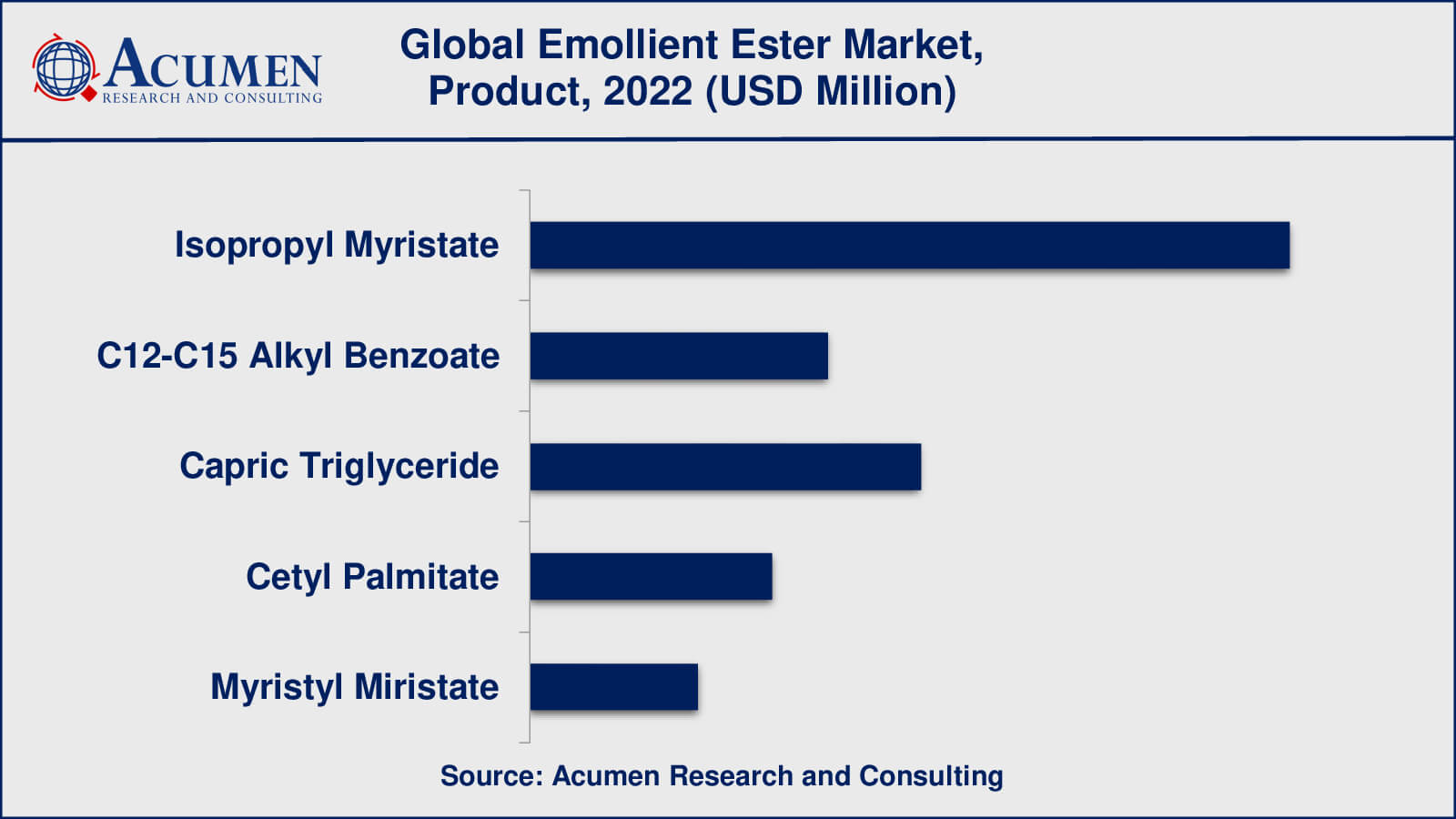

According to the emollient esters industry analysis, isopropyl myristate has been the dominant product type in the emollient esters market. Isopropyl Myristate is a popular emollient, moisturiser, and lubricant in the personal care industry, and it has excellent skin penetration and absorption properties. Because of its non-greasy and lightweight texture, it is commonly used in skincare, haircare, and cosmetic products. The growing popularity of natural and organic personal care products has increased the popularity of other emollient esters such as Capric Triglyceride and C12-C15 Alkyl Benzoate, which are derived from natural sources and provide similar benefits to Isopropyl Myristate.

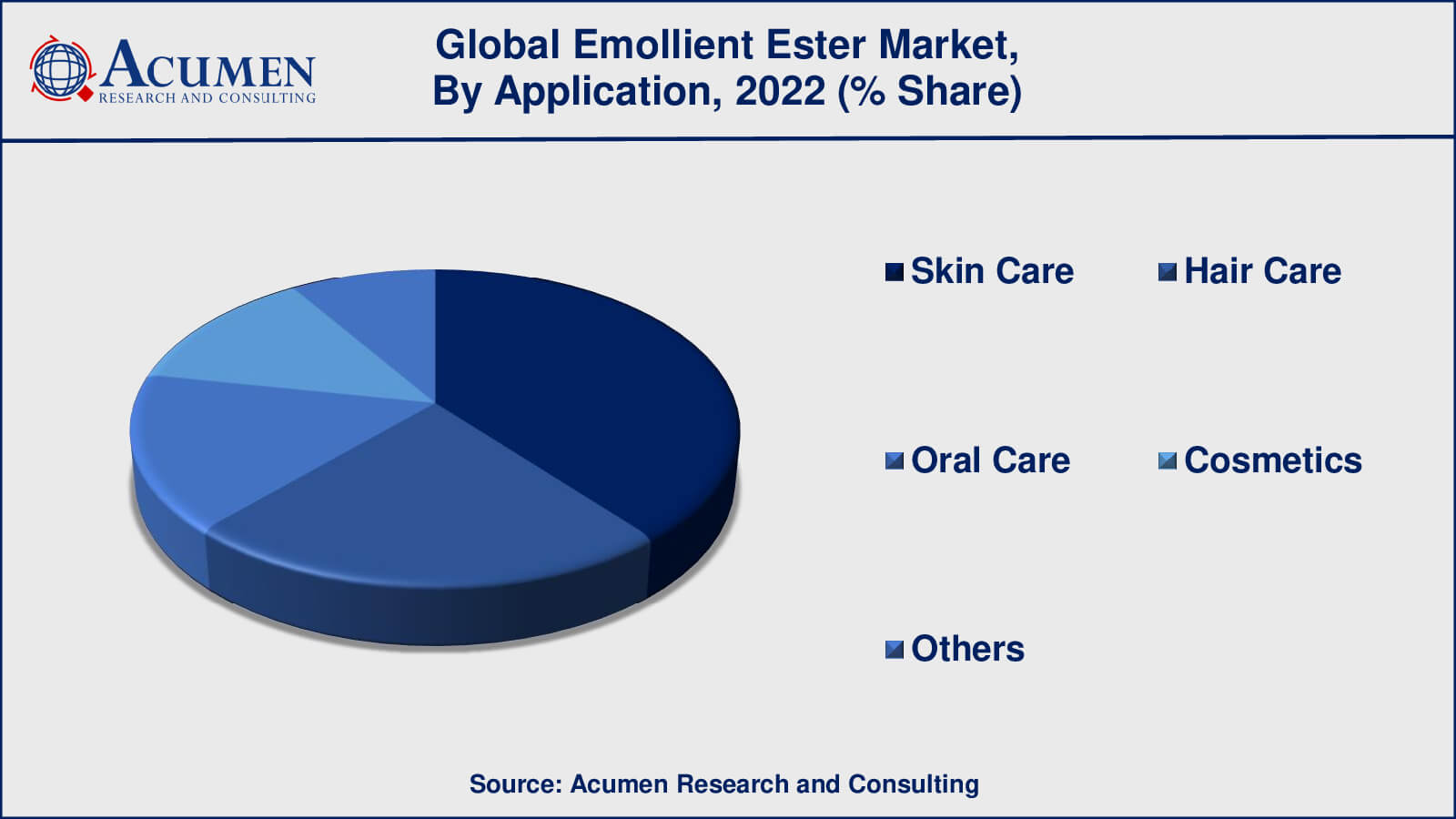

Emollient Ester Applications

As per the emollient esters market forecast, the skincare application segment is expected to dominate the industry from 2023 to 2032. Because of their moisturising, softening, and skin-conditioning properties, emollient esters are widely used in skincare products. They help to improve skin texture and feel, increase product spreadability and absorption, and provide a smooth, non-greasy finish. Emollient esters are frequently found in lotions, creams, and serums, as well as sunscreens and other protective products.

Emollient esters have another important application in hair care, where they are used to improve the manageability, shine, and softness of hair. Emollient esters are found in shampoos, conditioners, and hair styling products, where they condition and lubricate hair fibres.

Emollient esters are also widely used in the cosmetics industry, where they provide smoothness and ease of application in a variety of products such as lipsticks, eye shadows, and foundations.

Emollient Esters Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Emollient Esters Market Regional Analysis

North America is the largest market for emollient esters because of the region's high demand for personal care products and cosmetics. The United States is a significant contributor to the North American emollient esters market because of the presence of major manufacturers and suppliers of emollient esters in the country.

Europe is the second-largest market for emollient esters, with major contributors to market growth including Germany, France, and the United Kingdom. The growing consumer demand for natural and organic personal care products, combined with increased awareness about the benefits of using emollient esters in cosmetics and skincare products is expected to drive growth in the European emollient esters market.

The Asia-Pacific region is expected to experience the fastest growth in the emollient esters market, owing to rising population, disposable income, and demand for personal care products in countries such as China, India, and Japan. The region is also seeing an increase in the use of natural and organic ingredients in personal care products, which is expected to fuel the growth of the Asia-Pacific emollient esters market.

Emollient Esters Market Players

Some of the top emollient esters companies offered in the professional report include AAK AB, Ashland, BASF SE, Croda International PLC, Evonik Industries AG, Innospec Inc, Lipo Chemicals, Lonza Group Ltd., Stepan Company, and The Lubricol Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2023

April 2024

July 2022

February 2023