February 2023

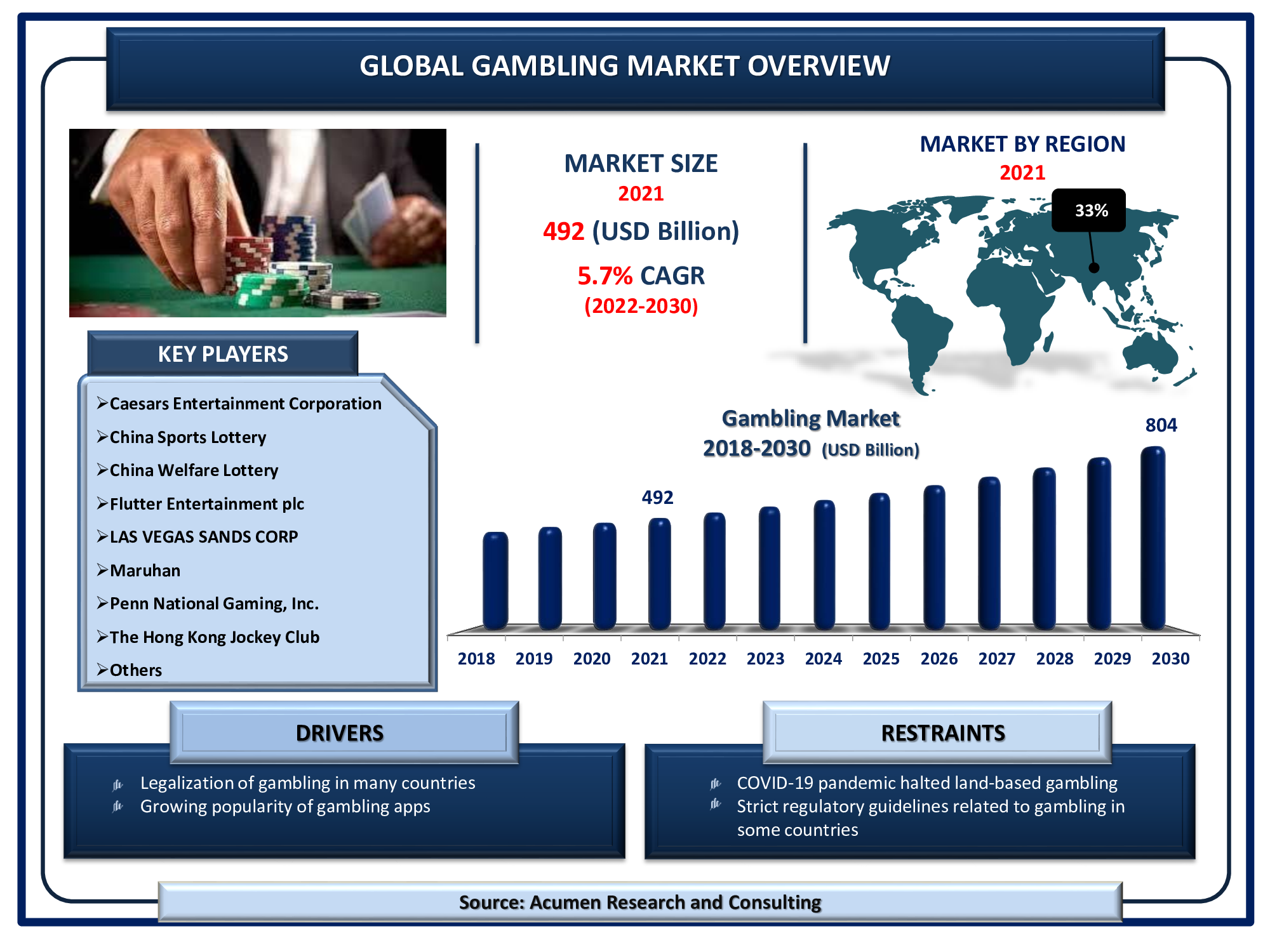

Gambling Market is projected to reach a market size of USD 804 billion by 2030; growing at a CAGR of 5.7%

The Global Gambling Market size accounted for USD 492 billion in 2021 and is projected to reach a market size of USD 804 billion by 2030; growing at a CAGR of 5.7%.

The legalization of gambling is the primary factor boosting the global gambling market revenue. The paradigm shift of gamblers from land-based to online platforms is a prominent gambling market trend. Additionally, rapid urbanization, increasing disposable income, and changing consumer gambling habits are some of the factors that are fueling the gambling market value. Gambling is associated with the act of playing for stakes in the hope of winning. Gambling is a major international activity and the increasing number of online gamblers is flourishing the industry growth.

Global Gambling Market DRO’s

Market Drivers:

Market Restraints:

Market Opportunities:

Report Coverage

| Market | Gambling Market |

| Market Size 2021 | USD 492 Billion |

| Market Forecast 2030 | USD 804 Billion |

| CAGR During 2022 - 2030 | 5.7% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Caesars Entertainment Corporation, China Sports Lottery, China Welfare Lottery, Flutter Entertainment plc., LAS VEGAS SANDS CORP, Maruhan, Penn National Gaming, Inc., Sociedad Estatal Loterias y Apuestas del Estado S.A., Tabcorp Holdings Ltd., and The Hong Kong Jockey Club. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Gambling Market Dynamics

The legalization of gambling in many countries is one of the key factors driving the gambling market growth. Legalized gambling has presented governments with a significant source of revenue, served as a tourist attraction in many cities, and created a safer environment for those who enjoy gambling. In addition to that, legalized gambling attracts tourists, which increases the gambling industry's share. When a casino opens, a flow of cash enters the community's economy because of the number of tourists. Las Vegas exemplifies how tourist dollars can transform a desolate desert into a preferable desired destination. The increased number of tourists leads to increased spending in the community, creating job opportunities and boosting the hospitality industry.

The growing popularity of gambling among millennials is another factor boosting industry growth. Because of the highest number of millennials in the world and the increasing penetration of smartphones by this generation, the market has been extremely supportive of growth. According to Pew Research, more than nine out of ten millennials (93 percent of those aged 23 to 38) own smartphones. Along with that, the rising number of online gambling apps automatically supports the industry share throughout the forecast timeframe from 2022 to 2030.

Strenuous gambling regulations are expected to stifle market growth. There are numerous types of gambling, and each country has its own set of legal guidelines for each. Some of the most important markets for gambling companies are Australia, Canada, China, Finland, India, Ireland, New Zealand, the United Kingdom, the United States, and Thailand. However, gambling is illegal in many countries, including the UAE, Japan, Qatar, and Poland among others. With the awareness of revenue generation, tourist attraction, and numerous other benefits, some of these countries are loosening gambling regulations. Online gambling, for example, is still strictly prohibited in Japan, but casinos can now open in resorts as long as they include entertainment venues, an international conference hall, and a hotel. Operators are subject to stringent screening, and the overall process of legalizing land-based casino gambling was accomplished during the 2018 Diet session in Japan.

Gambling Market Segmentation

The worldwide gambling market is split based on type, channel, and geography.

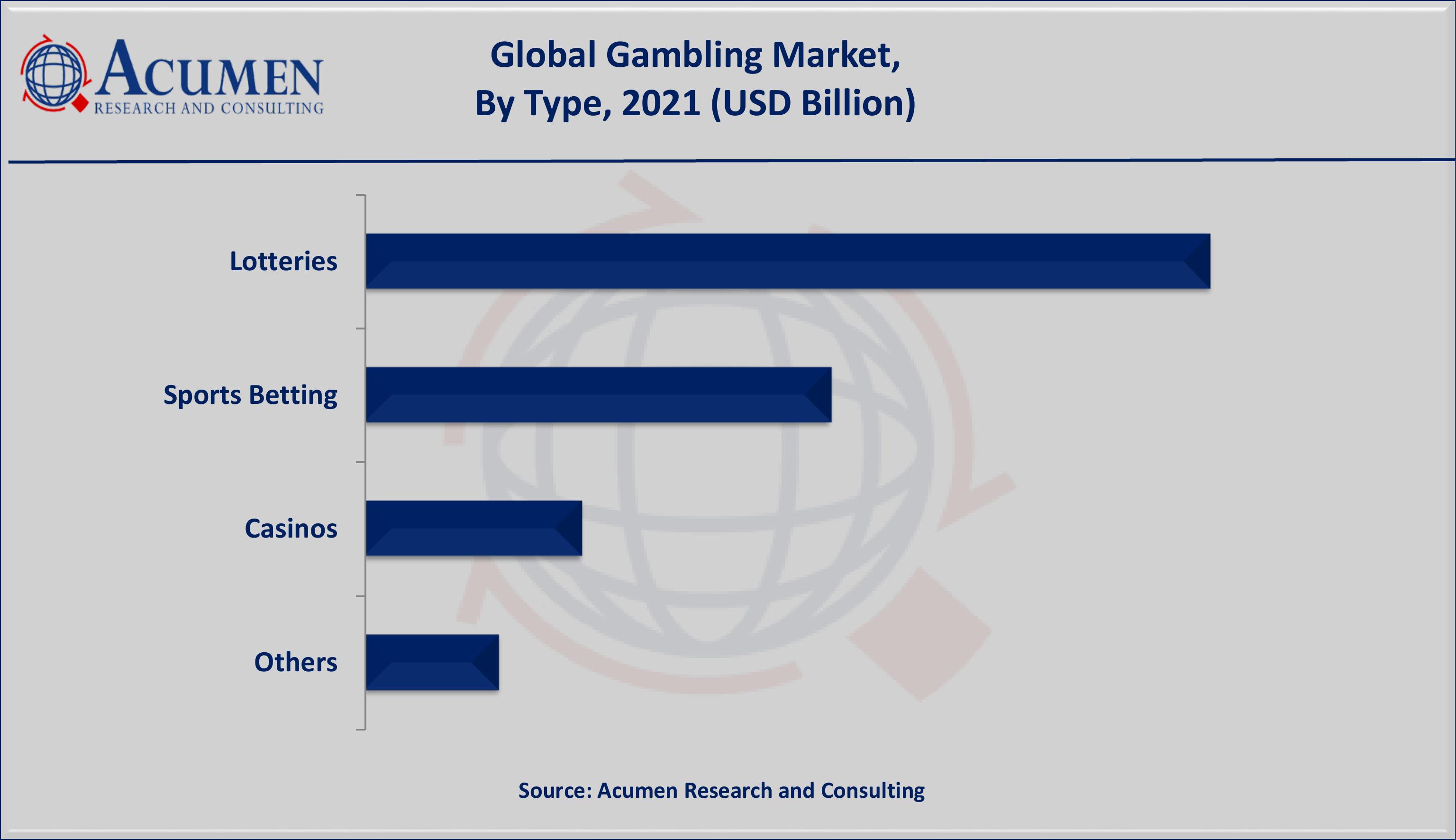

Market by Type

According to our gambling industry analysis, the lotteries segment will have a sizable market share in 2021. A lottery is a prominent form of gambling in which specific numbers or groups of participants are drawn to win prizes. Lottery prizes come in a variety of forms, including cash and goods, and they are frequently used in sports team draughts. Financial lotteries allow participants to win large sums of money, making them an addictive form of gambling. On the other hand, the proceeds from lotteries are also used for charitable purposes in the public sector.

On the other hand, the sports betting sub-segment is anticipated to witness the fastest growth rate in the coming years, due to the increasing number of sports enthusiasts, rising international sports events, and the growing millennial population betting on sports such as football, cricket, horse racing, etc.

Market by Channel

As per our gambling market forecast, the offline sub-segment generated a considerable gambling market share from 2022 to 2030. Even today, many gamblers prefer offline gambling because it provides entertainment, transparency, and the presence of cutting-edge amenities. Furthermore, offline or land-based channels are popular because they frequently provide a variety of non-gambling-related amenities. However, the online gambling market is expected to grow at a rapid pace over the forecasted period. The region's rapid growth can be attributed to an increase in the number of online gamblers, increased internet penetration, and the arrival of the COVID-19 pandemic, which shut down land-based casinos and increased demand for online channels.

Gambling Market Regional Outlook

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

The ease of regulations in Asian countries fuels the Asia-Pacific gambling market growth

According to the gambling market regional outlook, Asia-Pacific was the highest revenue-generating region in 2021. In general, the Asian-Pacific market tends to increase gambling revenues while also spreading legalization. Countries that have legalized gambling now make enormous profits, and offshore casinos are very prevalent in states where gambling is illegal. Gambling in Australia, China, India, Singapore, and South Korea has mixed regulations but the industry is growing at a significant rate.

Europe on the other hand is likely to attain a noteworthy growth rate during the projected years. This is attributed to the ease in regulations for gambling, and the presence of the largest market for sports betting in countries like the UK, Italy, Spain, Germany, etc.

Gambling Market Players

Some of the top gambling companies offered in the professional report include Caesars Entertainment Corporation, China Sports Lottery, China Welfare Lottery, Flutter Entertainment plc., LAS VEGAS SANDS CORP, Maruhan, Penn National Gaming, Inc., Sociedad Estatal Loterias y Apuestas del Estado S.A., Tabcorp Holdings Ltd., and The Hong Kong Jockey Club.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2023

November 2023

July 2020

March 2023