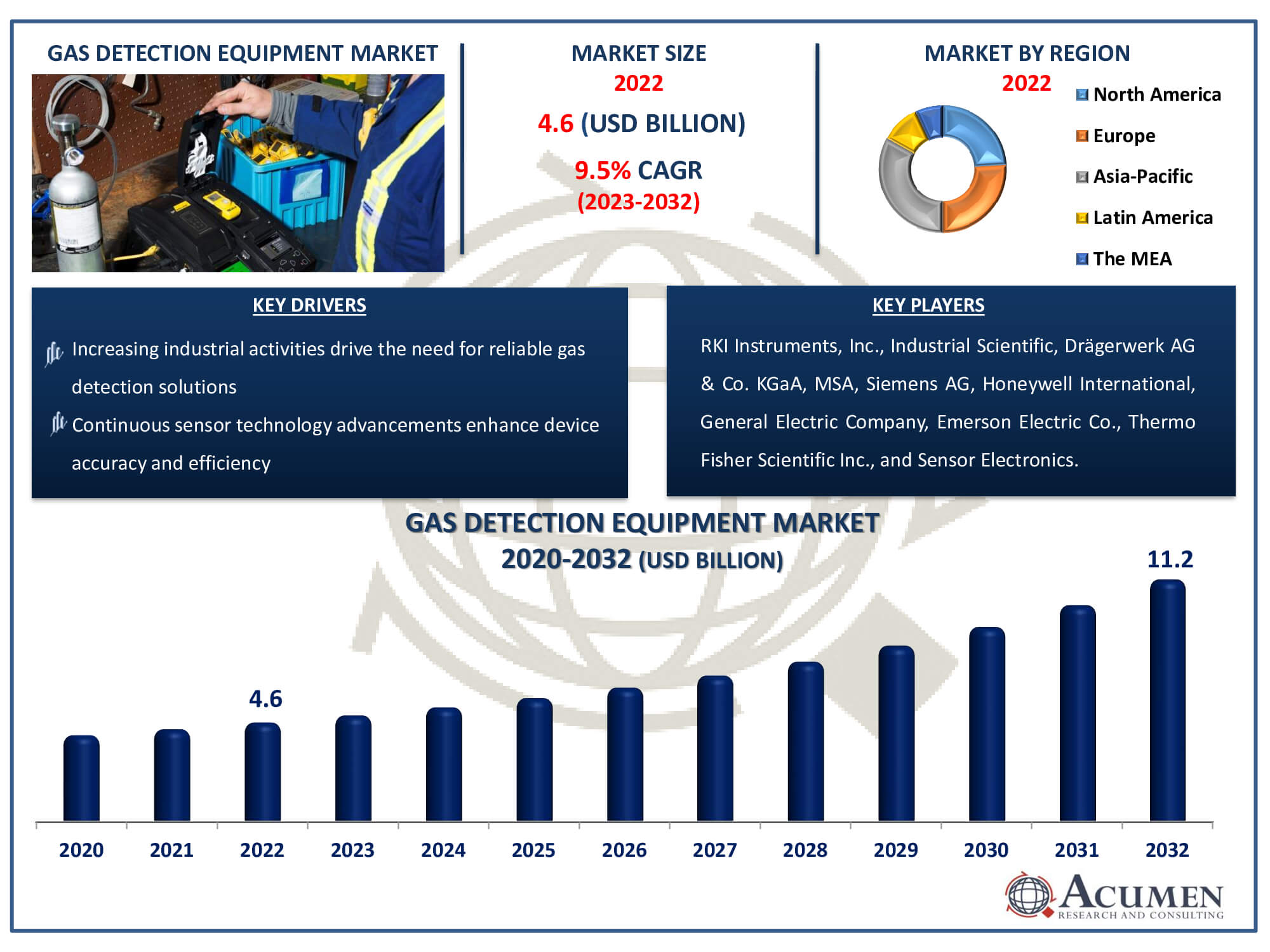

Gas Detection Equipment Market Size accounted for USD 4.6 Billion in 2022 and is estimated to achieve a market size of USD 11.2 Billion by 2032 growing at a CAGR of 9.5% from 2023 to 2032.

The Gas Detection Equipment Market Size accounted for USD 4.6 Billion in 2022 and is estimated to achieve a market size of USD 11.2 Billion by 2032 growing at a CAGR of 9.5% from 2023 to 2032.

Gas Detection Equipment Market Highlights

The development and provision of instruments intended to identify the existence of dangerous gases in diverse settings is the primary function of the gas detection equipment market. These tools are essential for maintaining environmental preservation, worker safety, and regulatory compliance. Growing awareness of the possible risks caused by flammable and hazardous gases in several industries, including mining, oil and gas, manufacturing, and environmental monitoring, is propelling the market. Stricter safety laws, technical developments that result in creative detection methods, and an increasing focus on worker safety are important drivers driving market expansion. In order to protect people, property, and the environment from the dangers connected with gas-related catastrophes, the gas detection equipment market is essential.

Global Gas Detection Equipment Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Gas Detection Equipment Market Report Coverage

| Market | Gas Detection Equipment Market |

| Gas Detection Equipment Market Size 2022 | USD 4.6 Billion |

| Gas Detection Equipment Market Forecast 2032 | USD 11.2 Billion |

| Gas Detection Equipment Market CAGR During 2023 - 2032 | 9.5% |

| Gas Detection Equipment Market Analysis Period | 2020 - 2032 |

| Gas Detection Equipment Market Base Year |

2022 |

| Gas Detection Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | RKI Instruments, Inc., Industrial Scientific, Drägerwerk AG & Co. KGaA, MSA, Siemens AG, Honeywell International, General Electric Company, Emerson Electric Co., Thermo Fisher Scientific Inc., and Sensor Electronics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gas Detection Equipment Market Insights

Rising consumer awareness regarding toxic gases, increasing incidents of gas leakage in various industries, and stringent government regulations related to workplace safety are major drivers expected to propel the growth of the global market. In 2020, a significant gas leak occurred at the LG Polymers plant in Visakhapatnam, resulting in 11 fatalities and hospitalizing 800 others. Similarly, in 2016, a massive leak vented millions of pounds of natural gas from a Los Angeles storage facility, releasing about 5 billion cubic feet of methane into the atmosphere.

Governments are implementing various workplace and household safety regulations to prevent mishaps. According to the International Safety Equipment Association, companies must install fire and gas sensors in enclosed classified areas to ensure safety.

Major players are pursuing business development through strategic acquisitions, enhancing customer bases, and expanding product offerings, thereby contributing to the global market's growth.

In 2019, MSA Safety Inc., a global safety products manufacturer, acquired Sierra Monitor Corporation, focusing on enriching the company's product portfolio in fixed gas and flame detection instruments and Industrial Internet of Things (IIoT) solutions. This acquisition aimed to enhance customer base and increase revenue share.

In the same year, Amphenol, a major producer of electronic connectors, cable, and interconnect systems, acquired SSI Controls Technologies, enhancing the company's sensor technology product portfolio.

Furthermore, major players' substantial investments in product development and the introduction of innovative solutions are expected to impact the target market's growth positively. In 2020, Sensirion AG, a global environmental and flow sensors manufacturer, launched the SGP40 VOC sensor for indoor air quality applications. This move aimed to enhance the company's business presence and expand the customer base.

Factors such as technological glitches and complex manufacturing processes may hinder the growth of the global gas detection equipment market. Additionally, a highly competitive scenario forcing players to operate on low-profit margins poses a challenge. However, rapid technological advancements by major players, the introduction of more enhanced and precise products, and the increasing adoption of green building concepts present new opportunities for players operating in the gas detection equipment industry forecast period. Moreover, increasing partnerships between regional and international players are expected to support the target market's revenue transactions.

Gas Detection Equipment Market Segmentation

The worldwide market for gas detection equipment is split based on product, technology, end use, and geography.

Gas Detection Equipment Products

According to the gas detection equipment industry analysis, the market is now dominated by the fixed gas system segment because of its extensive use and capacity for continuous monitoring. These systems are put in place continuously in buildings to identify and warn against the presence of dangerous gases, guaranteeing an early reaction to any possible dangers. Fixed Gas Systems provide a proactive approach to safety by enabling real-time monitoring of gas concentrations in industries like petrochemical, industrial, and utilities. The permanent installation facilitates timely preventive measures, regulatory compliance, and improved overall operating safety. Because of this, the fixed gas system is well-known, which is appropriate given its significant contribution to industrial safety and risk management.

Gas Detection Equipment Technology

The infrared (IR) category has the largest market share of gas detector equipment, in large part because of its higher accuracy and dependability in gas detection. With the use of infrared technology, gases can be precisely identified and measured by detecting the absorption of infrared light at particular wavelengths. This technique works well for identifying a wide range of gases and is quite adaptable for use in chemical, environmental, and oil and gas sectors. Its ability to provide real-time, selective, and non-disruptive gas analysis is what accounts for the IR segment's supremacy in the market. As a result, it is a preferred option for applications requiring sophisticated and reliable gas detection capabilities.

Gas Detection Equipment End Uses

With the biggest market share in the gas detection equipment market, the industrial segment emphasises the importance of this equipment in maintaining worker safety in a variety of industrial settings. Industries such as manufacturing, chemicals, and utilities extensively utilise gas detection systems to monitor and manage the risks associated with dangerous gases. Strong and ongoing monitoring is necessary for industrial applications to protect people, property, and the environment. The Industrial segment is dominated by the necessity of proactive risk management and the existence of strict safety requirements. Its dominant position in the industry is thus cemented by the fact that gas detection technologies designed for industrial application are essential for preserving a safe working environment.

Gas Detection Equipment Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

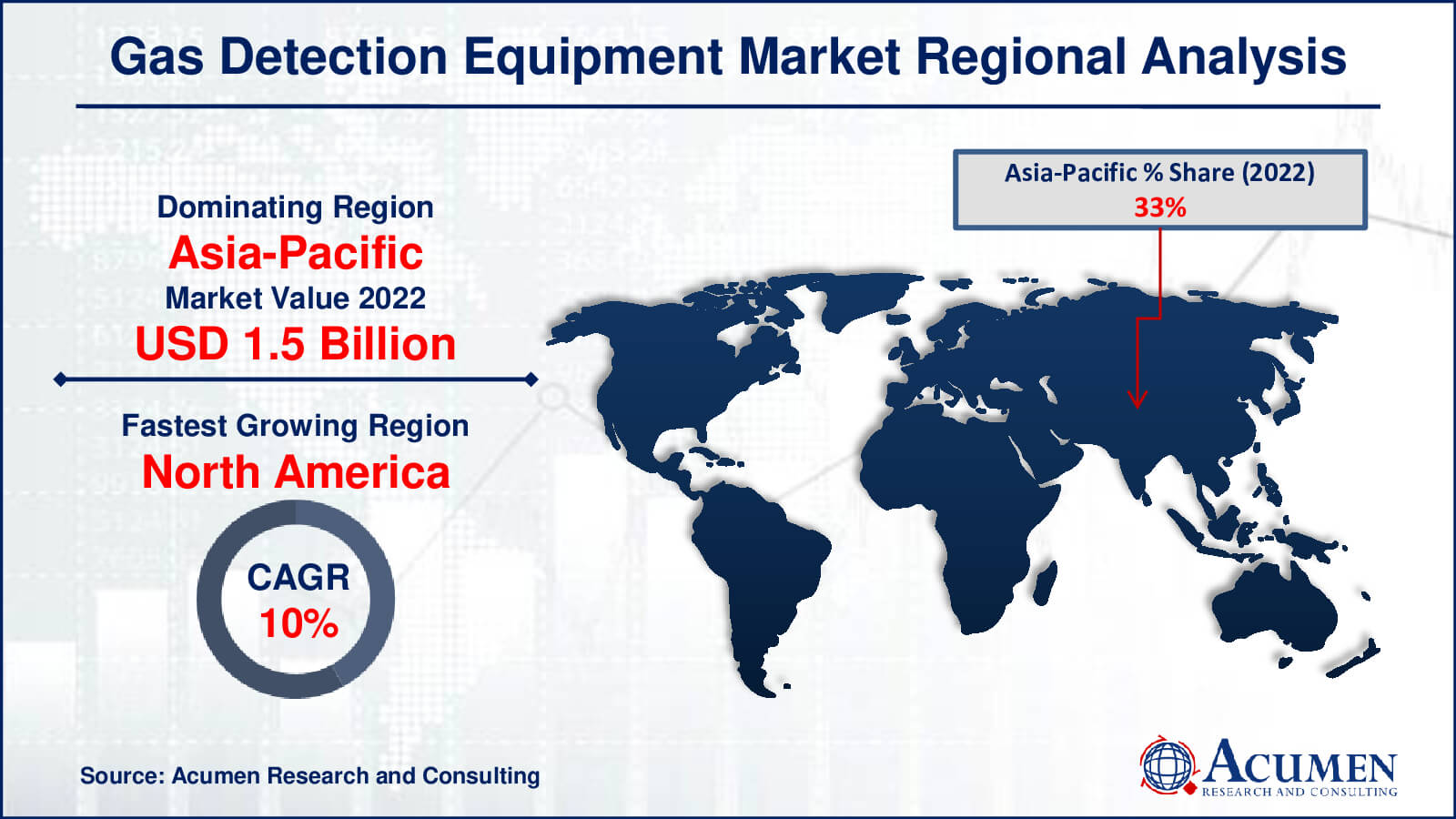

Gas Detection Equipment Market Regional Analysis

The Asia-Pacific market is expected to largest region in the gas detection equipment sector, attributed to evolving government regulations on consumer safety. The swift industrialization in developing countries and the establishment of new facilities are generating a demand for gas detection equipment, influencing the growth of the target market in this region.

The North American market is fastest growing region and its anticipated to contribute significantly to the global market's revenue share, driven by increasing consumer awareness. The presence of a large number of industry players, coupled with the introduction of innovative solutions, is expected to further boost market growth in this region throughout the gas detection equipment market forecast period that is 2023 to 2032. Moreover, the ongoing acquisition activities by major players are poised to support revenue growth.

Gas Detection Equipment Market Players

Some of the top gas detection equipment companies offered in our report includes RKI Instruments, Inc., Industrial Scientific, Drägerwerk AG & Co. KGaA, MSA, Siemens AG, Honeywell International, General Electric Company, Emerson Electric Co., Thermo Fisher Scientific Inc., and Sensor Electronics.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@acumenresearchandconsulting.com