June 2024

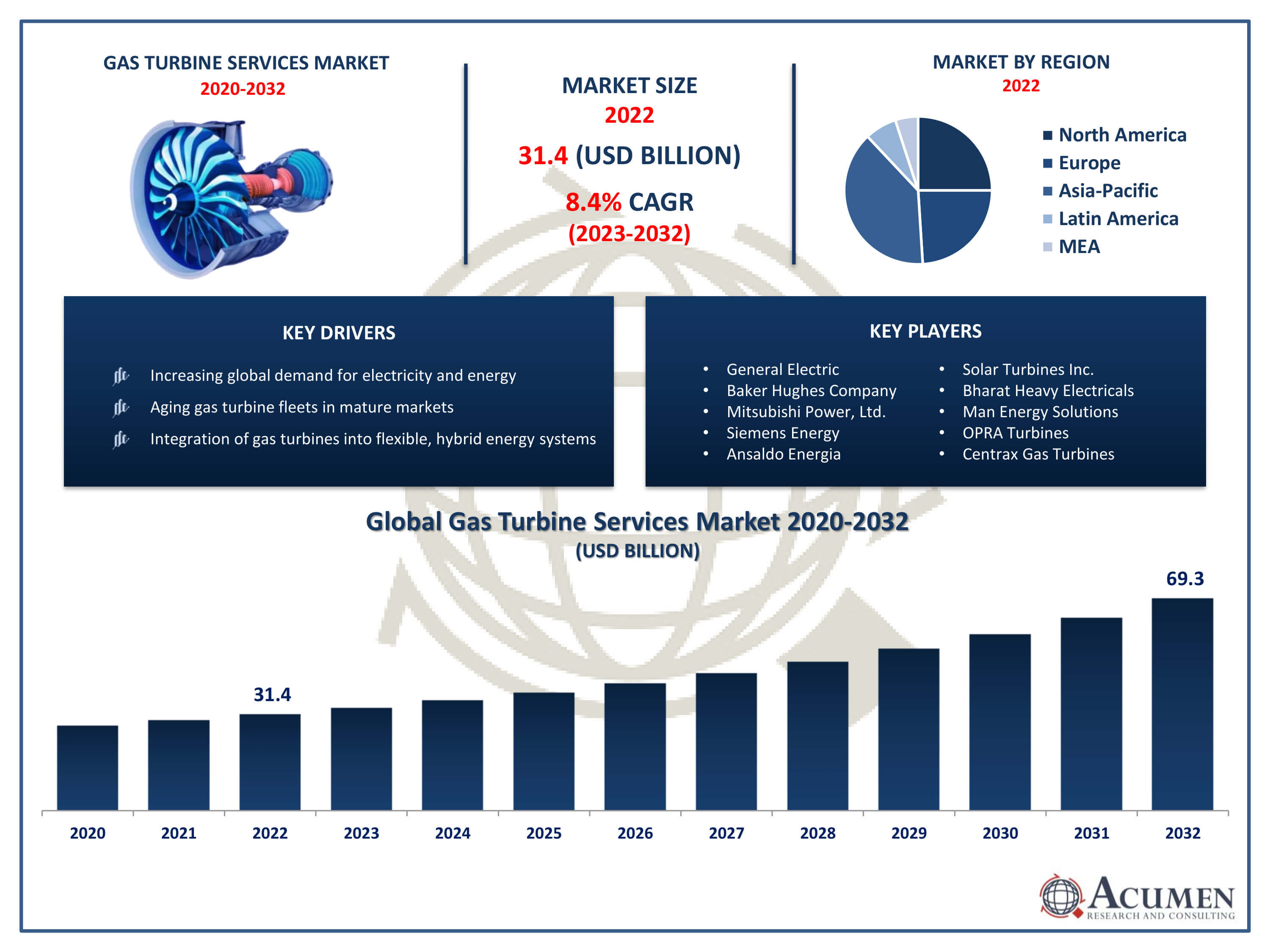

Gas Turbine Services Market Size accounted for USD 31.4 Billion in 2022 and is projected to achieve a market size of USD 69.3 Billion by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

The Gas Turbine Services Market Size accounted for USD 31.4 Billion in 2022 and is projected to achieve a market size of USD 69.3 Billion by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

Gas Turbine Services Market Highlights

Gas turbine services refer to maintenance, repair, and optimization solutions for gas turbines used in various industrial applications, such as power generation, oil and gas production, and aerospace. These services encompass a wide range of activities, including inspections, parts replacement, performance upgrades, and troubleshooting to ensure the efficient and reliable operation of gas turbine assets.

The market for gas turbine services has been experiencing steady growth due to several factors. First, the increasing demand for electricity and energy worldwide has led to the expansion of gas turbine installations in power plants as they offer a cost-effective and environmentally friendly option compared to traditional fossil fuel-based generators. Additionally, the aging infrastructure of existing gas turbine fleets requires regular maintenance and upgrades to prolong their lifespan and enhance efficiency, driving the demand for aftermarket services. Moreover, technological advancements in condition monitoring, predictive analytics, and digitalization have enabled service providers to offer more proactive and data-driven solutions, further driving the growth of the market.

Global Gas Turbine Services Market Trends

Market Drivers

Market Restraints

Market Opportunities

Gas Turbine Services Market Report Coverage

| Market | Gas Turbine Services Market |

| Gas Turbine Services Market Size 2022 | USD 31.4 Billion |

| Gas Turbine Services Market Forecast 2032 | USD 69.3 Billion |

| Gas Turbine Services Market CAGR During 2023 - 2032 | 8.4% |

| Gas Turbine Services Market Analysis Period | 2020 - 2032 |

| Gas Turbine Services Market Base Year |

2022 |

| Gas Turbine Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Services, By Service Provider, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | General Electric, Baker Hughes Company, Mitsubishi Power, Ltd., Siemens Energy, Kawasaki Heavy Industries, Ltd., Ansaldo Energia, Solar Turbines Inc., Bharat Heavy Electricals Ltd., Man Energy Solutions, OPRA Turbines, Centrax Gas Turbines, and MJB International LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Gas turbine services encompass a suite of maintenance, repair, and overhaul activities aimed at ensuring the efficient and reliable operation of gas turbine engines across various industries. These services are vital for optimizing the performance, extending the operational life, and minimizing downtime of gas turbines, which are widely utilized for power generation, aviation, and industrial applications. Gas turbine services typically include regular inspections, component repairs, parts replacement, performance upgrades, and troubleshooting to address issues and maintain peak efficiency. In the power generation sector, gas turbines play a crucial role in meeting electricity demand due to their efficiency, flexibility, and relatively low emissions compared to other fossil fuel-based technologies. Gas turbine services are essential for maintaining the reliability and availability of power plants, whether they operate as standalone units or in combined cycle configurations alongside steam turbines.

The gas turbine services market has experienced robust growth in recent years, driven by several key factors. One significant driver is the increasing global demand for electricity and the expansion of power generation capacity. Gas turbines are favored for their efficiency and flexibility in electricity generation, particularly in regions where natural gas is abundant and cost-effective. This demand has led to a substantial installed base of gas turbine assets that require regular maintenance, repair, and overhaul services to ensure reliable operation and maximize performance. Moreover, the aging of existing gas turbine fleets in mature markets has further fueled the growth of the services market. As gas turbines age, they require more frequent maintenance and upgrades to maintain efficiency and reliability. This has created a lucrative market for retrofitting and refurbishment services aimed at extending the operational life of aging assets.

Gas Turbine Services Market Segmentation

The global gas turbine services market segmentation is based on type, services, service provider, end-user, and geography.

Gas Turbine Services Market By Type

According to the gas turbine services industry analysis, the heavy-duty segment accounted for the largest market share in 2022. One significant factor is the increasing demand for electricity and power generation capacity in industrial and utility sectors. Heavy-duty gas turbines are commonly used in large-scale power plants, industrial facilities, and cogeneration applications due to their high efficiency and reliability. As global energy demand continues to rise, particularly in emerging economies, the deployment of heavy-duty gas turbines for electricity generation has expanded, leading to a corresponding increase in the demand for maintenance, repair, and overhaul (MRO) services.

Gas Turbine Services Market By Services

In terms of services, the spare parts supply segment is expected to witness significant growth in the coming years. One primary driver is the increasing number of installed gas turbine units globally, which has led to a higher demand for spare parts to support ongoing maintenance and repair activities. As gas turbines age, the need for replacement parts becomes more frequent, creating a steady market for suppliers offering a wide range of components, including blades, combustors, seals, and bearings. Moreover, the evolution of gas turbine technology has resulted in a more diverse and specialized range of spare parts required to support various turbine models and configurations. This complexity has driven the demand for suppliers capable of providing not only standard replacement parts but also customized solutions tailored to specific turbine designs and operational requirements.

Gas Turbine Services Market By Service Provider

According to the gas turbine services market forecast, the OEM segment is expected to witness significant growth in the coming years. One significant factor is the increasing demand for integrated solutions and comprehensive service offerings from OEMs. As operators seek to optimize the performance and reliability of their gas turbine assets, they are turning to OEMs for a wide range of services beyond traditional equipment supply. OEMs are well-positioned to provide expertise in maintenance, repair, and overhaul (MRO) activities, leveraging their in-depth knowledge of turbine design and engineering. Additionally, OEMs are increasingly focusing on providing value-added services such as digital monitoring, predictive maintenance, and performance optimization.

Gas Turbine Services Market By End-User

Based on the end-user, the power plant segment is expected to continue its growth trajectory in the coming years. One significant factor is the increasing global demand for electricity, particularly in emerging economies with expanding populations and industrialization. Gas turbines are favored for power generation due to their high efficiency, fast startup times, and ability to support grid stability. As a result, there has been a significant deployment of gas turbine power plants worldwide, leading to a growing need for maintenance, repair, and overhaul (MRO) services to ensure reliable and uninterrupted operation. Moreover, the aging of existing gas turbine power plants in mature markets has contributed to the growth of the services market within this segment. Many power plants have been in operation for decades, requiring regular inspections, upgrades, and component replacements to maintain efficiency and compliance with environmental regulations.

Gas Turbine Services Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

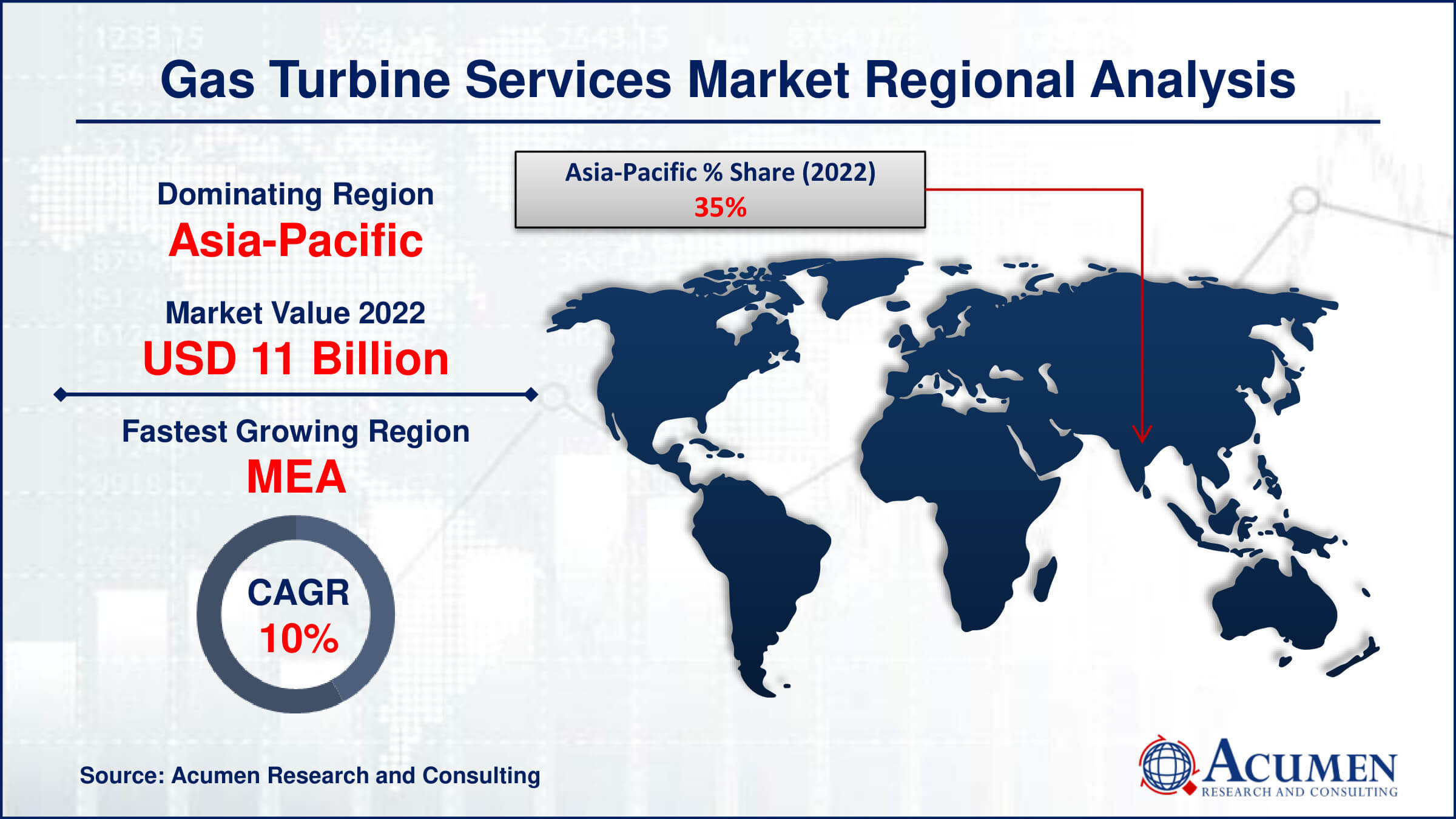

Gas Turbine Services Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the gas turbine services market due to several key factors. One significant driver is the rapid industrialization and urbanization taking place across many countries in the region. This has led to a substantial increase in energy demand, driving the deployment of gas turbine power plants for electricity generation. As a result, there is a growing need for maintenance, repair, and overhaul (MRO) services to support the operation of these gas turbine assets, creating a lucrative market for service providers. Furthermore, the Asia-Pacific region is witnessing significant investments in infrastructure development, particularly in sectors such as power generation, oil and gas, and aviation. Gas turbines play a crucial role in these industries for their reliability, efficiency, and flexibility, further driving demand for services related to turbine maintenance and optimization. Moreover, many countries in the region are prioritizing the expansion of their energy infrastructure and transitioning towards cleaner and more sustainable energy sources, including natural gas. This transition has led to increased investments in gas-fired power generation capacity, boosting the demand for gas turbine services across the Asia-Pacific region.

Gas Turbine Services Market Player

Some of the top gas turbine services market companies offered in the professional report include General Electric, Baker Hughes Company, Mitsubishi Power, Ltd., Siemens Energy, Kawasaki Heavy Industries, Ltd., Ansaldo Energia, Solar Turbines Inc., Bharat Heavy Electricals Ltd., Man Energy Solutions, OPRA Turbines, Centrax Gas Turbines, and MJB International LLC.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2024

May 2025

April 2025

March 2023