November 2025

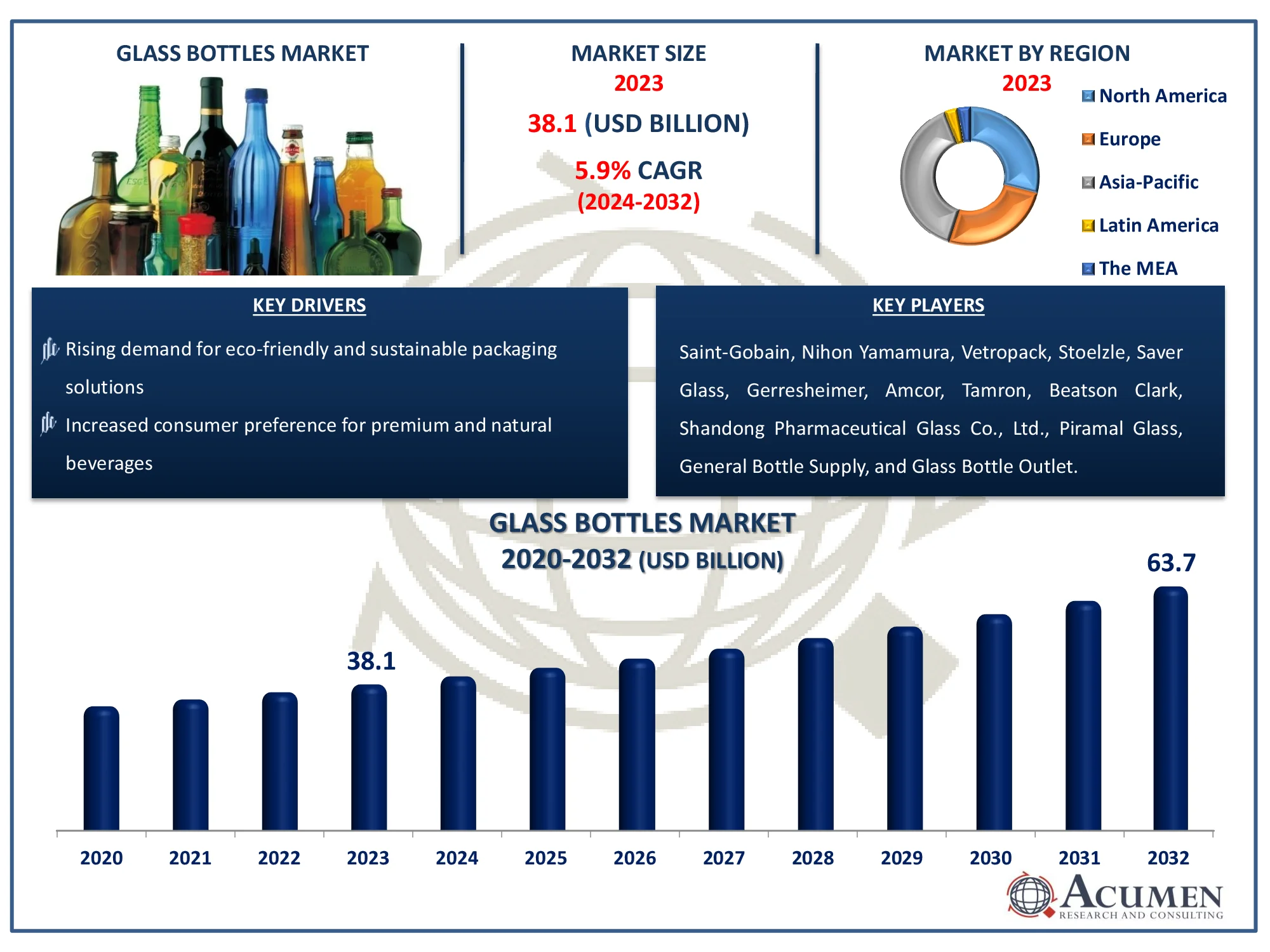

The Global Glass Bottles Market Size accounted for USD 38.1 Billion in 2023 and is estimated to achieve a market size of USD 63.7 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

The Global Glass Bottles Market Size accounted for USD 38.1 Billion in 2023 and is estimated to achieve a market size of USD 63.7 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

The pharmaceutical industry is witnessing rapid changes on a global level with ongoing investment and R&D activities for drug discovery. The approach towards generic medicines and the adoption of better packaging solutions are resulting in demand for glass bottles, which is driving the growth of the global glass bottle market. Pharmaceutical manufacturers are inclining towards glass bottles for drug containment due to its major advantage of maintaining a steady temperature. Glass is able to hold liquid or solid at a steady temperature without absorbing flavor, odor, and color.

In addition, the flourishing food and beverage industry across the globe and increasing demand for flavored beverages are factors expected to increase the adoption of glass bottles from manufacturers, further supporting the growth of the global market. There is a gradual increase in small and mid-size enterprises providing various flavored beverage products.

|

Market |

Glass Bottles Market |

|

Glass Bottles Market Size 2023 |

USD 38.1 Billion |

|

Glass Bottles Market Forecast 2032 |

USD 63.7 Billion |

|

Glass Bottles Market CAGR During 2024 - 2032 |

5.9% |

|

Glass Bottles Market Analysis Period |

2020 - 2032 |

|

Glass Bottles Market Base Year |

2023 |

|

Glass Bottles Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Manufacturing Process, By Capacity, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Saint-Gobain, Nihon Yamamura, Vetropack, Stoelzle, Saver Glass, Gerresheimer, Amcor, Tamron, Beatson Clark, Shandong Pharmaceutical Glass Co., Ltd., Piramal Glass, General Bottle Supply, and Glass Bottle Outlet. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rising environmental concerns and an increase in recycling activities in developed and developing countries are expected to further support the growth of the global glass bottles market. Food & beverage manufacturers are focused on recycling glass waste and reusing it for other packaging. High consumer spending capacity on food and beverages and a gradual increase in dine-out activities are resulting in demand for products in glass bottles from restaurants, pubs, lounges, etc., which is expected to support the growth of the glass bottle market. According to the Glass Packaging Institute, about 18% of beverages are consumed on-premise, like a bar, restaurant, or hotel, and glass makes up about 80% of that container mix.

However, factors such as critical transportation issues due to breakage concerns are hampering the growth of the global glass bottle market. In addition, the availability of other packaging solutions is expected to challenge the growth of the global market.

Product development activities by major manufacturers, coupled with the development of glass bottles with high strength and lightweight properties along with various sizes and shapes, are factors expected to create new opportunities for players over the forecast period. In addition, business development activities aimed at increasing the customer base are expected to further support market revenue growth. The Corporate Modernization is intended to be a tax-free transaction for U.S. federal income tax purposes for the company and its stockholders.

Glass Bottles Market Segmentation

Glass Bottles Market SegmentationThe worldwide market for glass bottles is split based on type, manufacturing process, capacity, application, and geography.

According to glass bottles industry analysis, the colorless glass bottle category is likely to lead the market due to its widespread use in industries such as beverages, medicines, and cosmetics. These bottles are extremely popular in the food and beverage industry, particularly for packaging premium alcoholic beverages such as wine, vodka, and spirits, because they highlight product clarity and purity. Furthermore, pharmaceutical businesses employ colorless glass bottles to ensure that the contents are visible while still remaining chemically stable. Their recyclability and sustainability drive rising demand, which aligns with the growing global emphasis on environmentally friendly packaging. Increased customer desire for clear and high-quality packaging solutions is expected to strengthen the colorless glass bottle category's dominance in the coming years.

While moulded and tubular glass bottles serve distinct tasks, the moulded segment is expected to grow significantly in the glass bottle market. Molded bottles are created by molding molten glass into a mold, yielding a range of shapes, sizes, and designs. Their adaptability makes them suitable for packaging beverages, food products, cosmetics, and medications. The growing desire for personalized and visually appealing packaging is a major driver of growth in the molded glass bottle industry. Furthermore, advances in molding processes have enabled the manufacturing of lightweight yet robust bottles, which has increased their popularity.

Tubular glass bottles, on the other hand, are commonly employed in specialist applications such as pharmaceutical vials and ampoules. While they play a major role in several industries, their overall market share is lower than that of molded glass bottles.

The 500 ml and larger category might be to be the largest in the glass bottles market forecast period due to its widespread use in the beverage and pharmaceutical industries. Large-capacity glass bottles are frequently used to package alcoholic beverages, soft drinks, juices, and even medical syrups due to their durability and preservation characteristics. Their ability to maintain product integrity without chemical leaching makes them a better choice than plastic alternatives. Furthermore, ecological concerns and the desire for eco-friendly packaging solutions have boosted the popularity of larger glass bottles, particularly among premium beverage brands. With increasing customer demand for bulk packaging and low-cost solutions, this category is projected to drive market expansion in the future years.

Food and beverage is the most popular application area because of rising demand for glass packaging in alcoholic drinks, carbonated beverages, and dairy items. Glass bottles are popular because they are non-reactive, preserving the purity and integrity of the liquids they hold. The increasing customer preference for sustainable packaging has increased its acceptance, particularly among premium beverage manufacturers. Furthermore, government rules limiting plastic use in food packaging have prompted businesses to switch to glass alternatives. With an increasing desire for organic and natural drinks, as well as a premiumization trend in alcoholic beverages, the food and beverage category is likely to maintain its market leadership.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

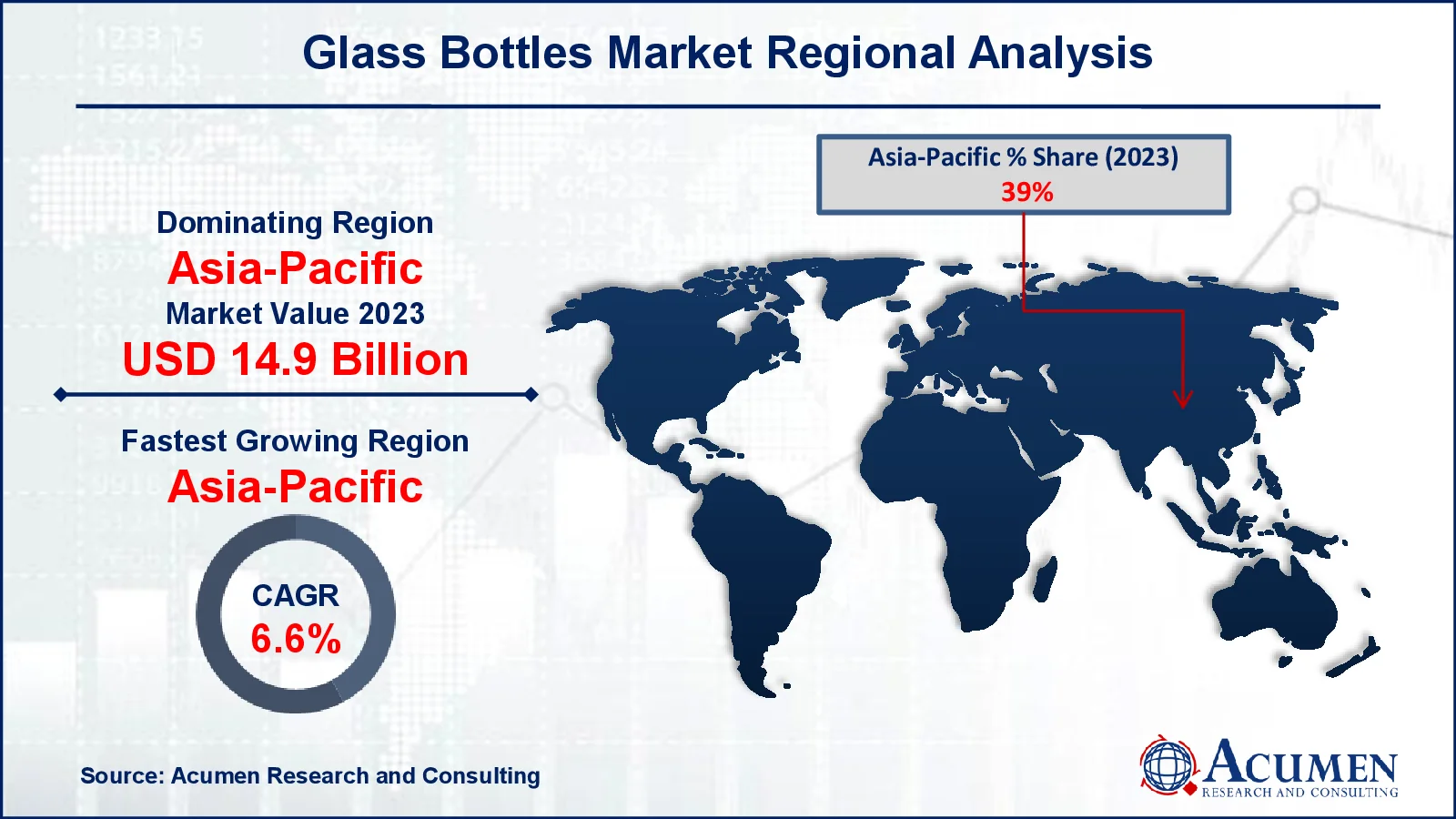

Glass Bottles Market Regional Analysis

Glass Bottles Market Regional AnalysisAsia-Pacific is expected to largest and have fastest growth in the near future due to increasing presence of major food and beverage manufactures and large pool of consumers that are food lovers. This can be attributed to the region's rapidly growing population, rising disposable incomes, and increasing consumption of alcoholic beverages, particularly in countries like China and India. The flourishing food and beverage industry, coupled with a strong preference for premium packaging, further fuels the demand for glass bottles in this region.

The market in North America is expected to account for second largest revenue share in the global glass bottles market forecast period due to high demand for glass bottles from food & beverage manufacturers. In addition, introduction of innovative products from glass manufacturers with different size and shape is expected to further support the growth of the target market. In addition, business development activities through strategic mergers and acquisitions are factors expected to further revenue support the regional growth.

Some of the top glass bottles companies offered in our report include Saint-Gobain, Nihon Yamamura, Vetropack, Stoelzle, Saver Glass, Gerresheimer, Amcor, Tamron, Beatson Clark, Shandong Pharmaceutical Glass Co., Ltd., Piramal Glass, General Bottle Supply, and Glass Bottle Outlet.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2025

March 2024

December 2024

April 2020