June 2024

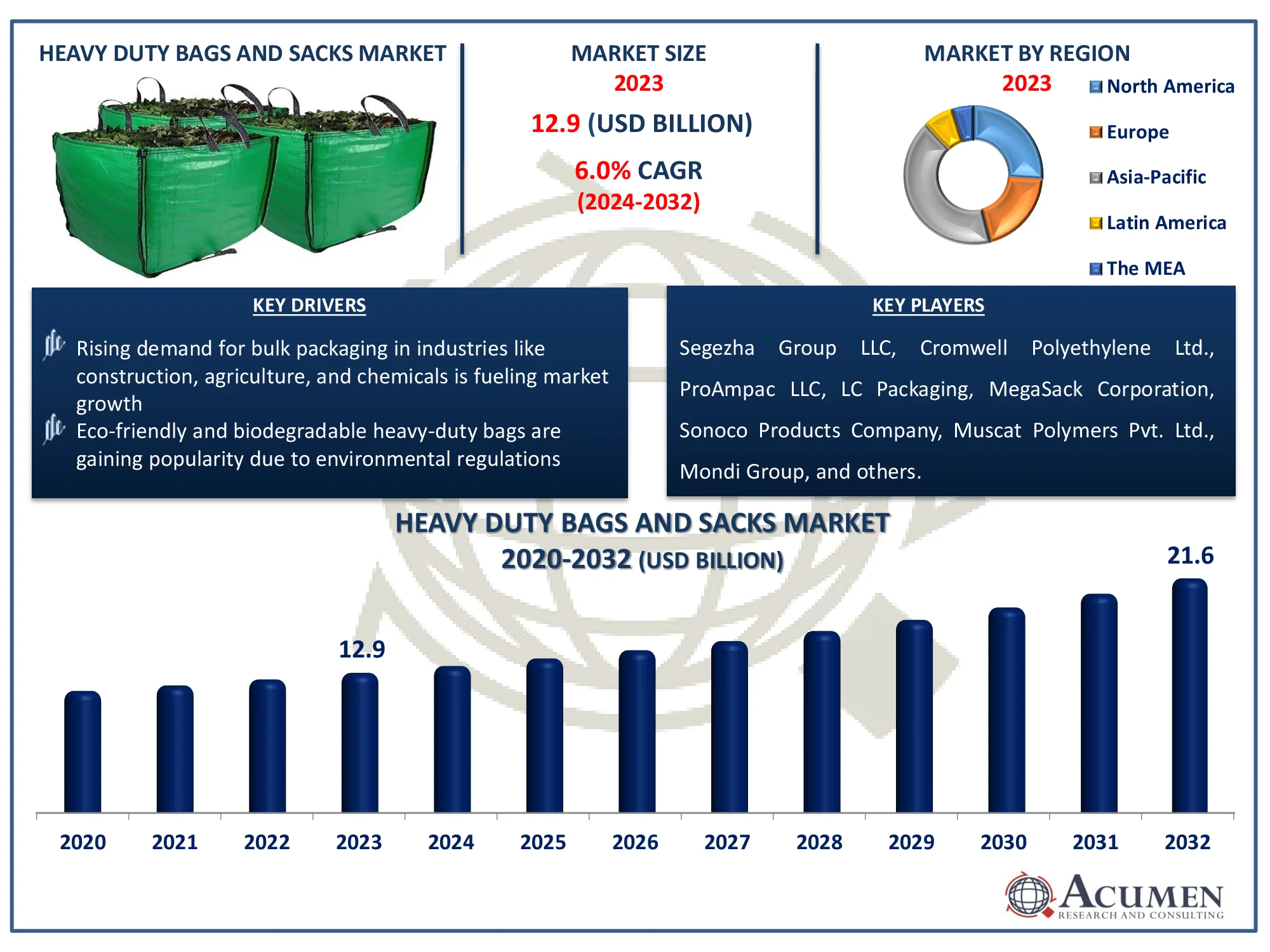

The Global Heavy Duty Bags and Sacks Market Size accounted for USD 12.9 Billion in 2023 and is estimated to achieve a market size of USD 21.6 Billion by 2032 growing at a CAGR of 6.0% from 2024 to 2032.

The Global Heavy Duty Bags and Sacks Market Size accounted for USD 12.9 Billion in 2023 and is estimated to achieve a market size of USD 21.6 Billion by 2032 growing at a CAGR of 6.0% from 2024 to 2032.

Heavy duty bags and sacks are high-strength packaging options for storing, transporting, and protecting bulk items in a variety of sectors. These bags, made of sturdy materials such as polyethylene, polypropylene, paper, and jute, can withstand heavy weights, severe handling, and environmental variables. They are widely used in industries such as agriculture, construction, chemicals, food, and waste management due to their great strength and cost-effectiveness. Their importance arises from ensuring safe and efficient storage, reducing product loss, and optimizing logistics with space-saving and reusable designs. Furthermore, as environmental concerns develop, biodegradable and recyclable heavy-duty bags are becoming increasingly popular as environmentally acceptable alternatives.

|

Market |

Heavy Duty Bags and Sacks Market |

|

Heavy Duty Bags and Sacks Market Size 2023 |

USD 12.9 Billion |

|

Heavy Duty Bags and Sacks Market Forecast 2032 |

USD 21.6 Billion |

|

Heavy Duty Bags and Sacks Market CAGR During 2024 - 2032 |

6.0% |

|

Heavy Duty Bags and Sacks Market Analysis Period |

2020 - 2032 |

|

Heavy Duty Bags and Sacks Market Base Year |

2023 |

|

Heavy Duty Bags and Sacks Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Capacity, By Material Type, By Product Type, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Segezha Group LLC, Cromwell Polyethylene Ltd., ProAmpac LLC, LC Packaging, MegaSack Corporation, Sonoco Products Company, Muscat Polymers Pvt. Ltd., Mondi Group, Berry Global, Inc., Al-Tawfiq Company, Global-Pak Inc., and Inteplast Group. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The global market for heavy-duty bags and sacks is expected to increase significantly, owing to their rising acceptance in a variety of end-user sectors seeking improved durability and effective packaging solutions. These bags are more space-efficient and cost-effective than normal bags, and they can support higher loads. Packaging is currently the fifth largest industry in the Indian economy, demonstrating its significance in encouraging industrial development. Notably, the industry has a strong structural framework, with over 900 paper units and a total installed capacity of more than 4,990,000 tons. Furthermore, India has 861 paper mills, including 526 operational units, illustrating the country's significant capacity for paper and paperboard production. This would help to develop the heavy-duty bag and sacks business by highlighting India's strong paper manufacturing capabilities, which provides a steady supply of raw materials for eco-friendly packaging.

Fluctuations in raw material costs for plastic and paper have an impact on production expenses and overall profitability. When material prices rise, producers incur more costs, making it more difficult to maintain competitive pricing. This presents financial hurdles for enterprises in the heavy-duty bag and sack sector.

Advances in biodegradable and compostable packaging solutions are generating new business opportunities. According to RSC Publishing, innovations in sustainable materials such as hybrid nanoparticle coatings and bio-nanocomposite films improve packaging strength and environmental friendliness. Nanomaterials such as protein, silver, zinc oxide, and titanium dioxide nanoparticles increase durability while minimizing the need for synthetic chemicals, addressing customer demand for safer, greener packaging. With growing environmental concerns and stringent laws, businesses are introducing eco-friendly alternatives to typical plastic bags. These solutions not only lessen environmental effect, but also appeal to environmentally concerned customers and businesses.

Heavy Duty Bags and Sacks Market Segmentation

Heavy Duty Bags and Sacks Market SegmentationThe worldwide market for heavy duty bags and sacks is split based on capacity, material type, product type, end-use, and geography.

According to the heavy duty bags and sacks industry analysis, 20-40 kg segment is predicted to lead due to its broad application in a variety of industries, including agriculture, construction, food and chemicals. This capacity range is generally recommended for packing products such as cement, fertilizers, grains, animal feed, and industrial raw materials because it strikes the ideal balance between weight, durability, and simplicity of handling. Furthermore, tight packaging regulations in industries such as food and chemicals drive up demand for medium-capacity heavy-duty bags, which are the market's major revenue generator. However, the Above 40 kg segment is expanding, especially in large industrial applications.

According to the heavy duty bags and sacks industry analysis, plastic section is widely utilized because of its great durability, cost-effectiveness, and resistance to moisture, chemicals, and ripping. Polyethylene (PE) and polypropylene (PP) are the most commonly used polymers, with PE (HDPE, LDPE, LLDPE) dominating due to its strength, flexibility, and lightweight qualities. These materials are widely utilized in industries such as construction, agriculture, chemicals, and food packaging, making them the ideal choice for heavy-duty bags. However, as environmental concerns grow, paper and jute bags are gaining popularity as sustainable alternatives, particularly in places with tight plastic laws.

According to the heavy duty bags and sacks industry analysis, woven sacks are widely utilized because of their great strength, durability, and versatility in industries such as agriculture, construction, chemicals, and food packaging. Woven sacks, which are typically made of polypropylene (PP) or polyethylene (PE), have superior load-bearing capacity, moisture resistance, and cost-effectiveness, making them the preferred option for bulk storage and transportation of products such as grains, fertilizers, cement, and industrial raw materials. Furthermore, the garbage sacks industry is experiencing rapid expansion, driven by increased demand for waste management solutions, notably in the urban and industrial sectors. However, environmental concerns and governmental limitations on plastic use may drive future innovation toward biodegradable weaving sacks and eco-friendly waste bags.

According to the heavy duty bags and sacks market forecast, food and agriculture industries are experiencing increased demand for bulk packaging of grains, seeds, animal feed, and other agricultural items. These sectors demand long-lasting, moisture-resistant, and low-cost storage and transportation bags, thus heavy-duty woven sacks and polyethylene bags are the best options. Furthermore, the chemical and fertilizers segment has a considerable market share because to the growing demand for secure and long-lasting packaging solutions for shipping industrial chemicals, fertilizers, and hazardous products. The building and construction industry also makes a significant contribution, with heavy-duty sacks commonly used for cement, sand, and construction supplies.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Heavy Duty Bags and Sacks Market Regional Analysis

Heavy Duty Bags and Sacks Market Regional AnalysisFor several reasons, the Asia-Pacific region held the greatest share of the worldwide heavy duty bags and sacks market in 2023, owing to recent retail expansion and rising need for low-cost packaging. For example, the India Brand Equity Foundation (IBEF) reports that between April 2000 and June 2024, India's retail retailing sector attracted $4.68 billion in FDIs. It will enhance need for efficient, long-lasting, and sustainable packaging solutions across a wide range of industries, boosting industrial demand in Asia. Countries such as China and India are quickly industrializing, creating enormous growth opportunities for the regional sector. According to the World Bank, China's economy grew at a solid 5.0 percent in the first half of 2024, boosted by consumer spending on services, exports, and investment in industry and public infrastructure. China's economic development in 2024 is predicted to be favorable for the market, driven by industrial expansion, exports, retail consumption, and infrastructure projects.

Meanwhile, Europe was the second-largest market in 2023, particularly in the biodegradable heavy-duty bags and sacks segment, and is expected to grow at the fastest CAGR during the forecast period due to rising environmental concerns, a shift toward sustainable packaging solutions, and advancements in biodegradable and recyclable materials, which are further driving market expansion. For example, studies conducted by the Institute for Energy and Environmental Research (Germany) found that paper-based packaging had a substantially lower environmental impact than several alternative materials. This will accelerate the growth of the heavy-duty bags and sacks market by increasing demand for environmentally friendly paper-based packaging options.

Some of the top heavy duty bags and sacks companies offered in our report include Segezha Group LLC, Cromwell Polyethylene Ltd., ProAmpac LLC, LC Packaging, MegaSack Corporation, Sonoco Products Company, Muscat Polymers Pvt. Ltd., Mondi Group, Berry Global, Inc., Al-Tawfiq Company, Global-Pak Inc., and Inteplast Group.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2024

February 2023

September 2023

July 2021