January 2023

India Data Center Market (By Component: Hardware, Software, Service; By Type: Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, Hyperscale Data Centers; By Tier Level: Tier 1 and Tier 2, Tier 3, Tier 4; By Data Center Size: Small, Medium, Large; By Industry: BFSI, IT & Telecom, Healthcare, Government, Manufacturing, Retail & E-commerce, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

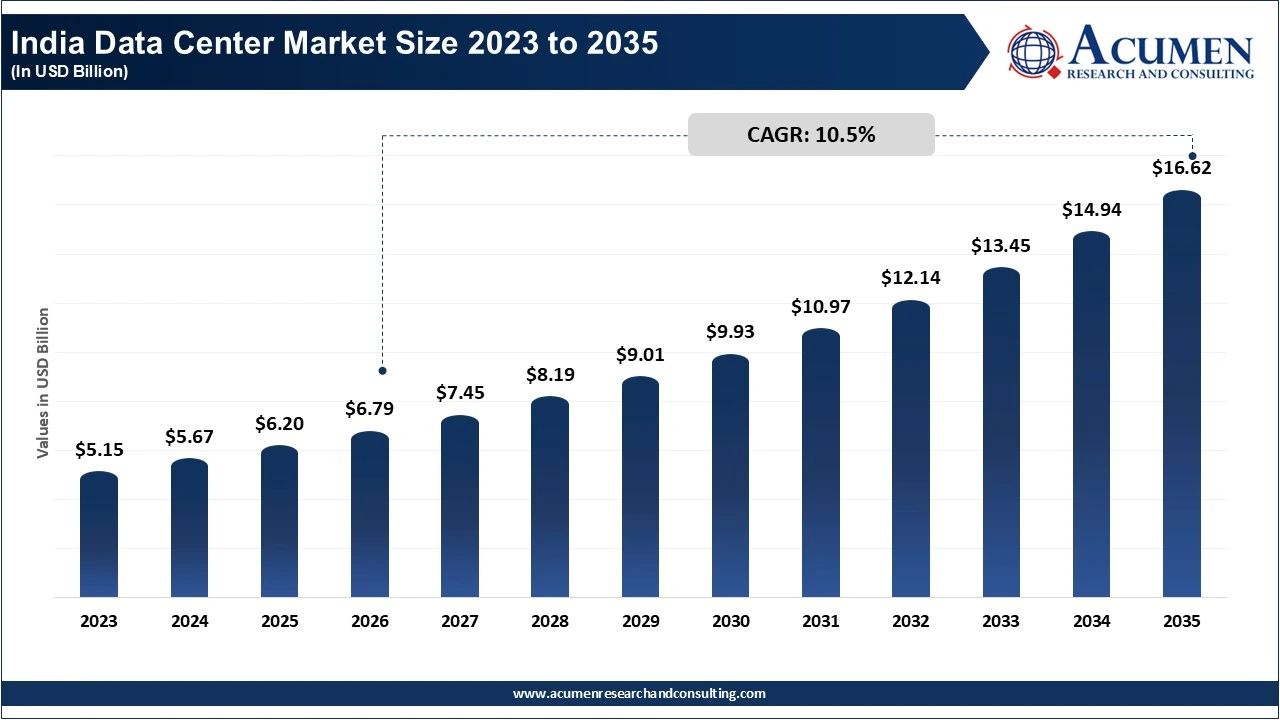

The India data center market is valued at USD 6.20 billion in 2025 and is expected to witness growth at CAGR of 10.5% during the period from 2026 to 2035 to reach a market size of USD 16.62 billion by 2035.

The significant growth of the India data center market is due to rapid growth of digital technologies, such as cloud computing, artificial intelligence, big data analytics, IoT, and 5G networks. As more people connect to the Internet and smartphones become more widely available, there is also an increase in OTT streaming, online gaming, and e-commerce. As a result, there is an exponential increase in the amount of data being generated, which requires scalable, secure, and low-latency data processing infrastructure. There is an increasing regulatory focus on data localization and compliance for financial services, government, and healthcare sectors, these trends continue to indicate the need for captive data center infrastructure to store and protect data and to enable disaster recovery options. These factors combined are leading enterprises and hyper scale companies to further develop their data center infrastructure across both major and emerging hubs within India.

Another major growth factor is the continued support from both the government and the private sector, as well as the increasing number of domestic and foreign investments into data center infrastructure and colocation facilities. The policy initiatives of Digital India, the designation of data centers as eligible for infrastructure status, and initiatives that make it easier to do business are enabling large-scale projects to be supported by both global cloud service providers and domestic operators. The emphasis placed on energy efficiency, integration of renewable energy, and advanced cooling technologies will also enable operators to increase efficiency and meet their long-term sustainability objectives. The development of edge data centers will allow for the support of applications requiring real-time processing and will also enable 5G applications and smart city initiatives will contribute, in partnership with cloud service providers, telecom service providers, technology vendors, and developers of urban infrastructure, to the broadening of the market and long-term growth of the data center infrastructure in India.

| Attributes | Details |

| India Data Center Market Size 2025 | USD 6.20 Billion |

| India Data Center Market Forecast 2035 | USD 16.62 Billion |

| India Data Center Market CAGR During 2026 - 2035 | 10.5% |

| Analysis Period | 2021 - 2035 |

| Base Year | 2025 |

| Forecast Data | 2026 - 2035 |

| Segments Covered | By Component, By Type, By Tier Level, By Data Center Size, By Industry, and By Geography |

| Key Companies Profiled | Sterling and Wilson Pvt. Ltd., Web Werks India Pvt. Ltd., CTRLS Datacenters Ltd., Equinix Inc., ESDS Software Solution Ltd., NetDataVault (NGBPS Limited), Nikom InfraSolutions Pvt. Ltd., Nippon Telegraph and Telephone Corporation, Nxtra Data Limited, Sify Technologies Limited, Adani Group, and Arshiya Limited. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for India data center is split based on component, type, tier level, data center size, and industry.

Hardware is currently the dominant component in the India data center market because it forms the physical data center infrastructure, including storage systems, servers, networking equipment (such as routers), backup power distribution units, backup systems, and cooling systems. Because of the high capital cost associated with the building, upgrading, and expanding of data centers, a majority of the total investment for a data center goes into hardware to ensure optimum performance, reliability, and availability. Increasingly large-scale colocation and hyper-scale data center development projects are continuing to create a consistent need for better-than-standard hardware installations and regular upgrades of the existing hardware infrastructure.

| Component | Market Share (%) | Key Highlights |

| Hardware | 55% | Dominates due to high capital investment in servers, storage, networking equipment, power distribution, cooling systems, and backup infrastructure forming the physical backbone of data centers. |

| Software | 25% | Growing steadily with adoption of DCIM, automation, virtualization, cybersecurity, and AI-based monitoring solutions for operational efficiency. |

| Service | 20% | Fastest-growing, driven by rising demand for managed services, cloud migration, system integration, remote monitoring, and maintenance support. |

Software is the fastest-growing component, due to an increased adoption of DCIM (Data Center Infrastructure Management) software, virtualization, automation, and AI-based service monitoring. The increasing size and complexity of data centers require a greater reliance on software to improve energy utilization, provide better overall operational efficiency, increase their security, and use predictive maintenance. The accelerating shift toward cloud-native solutions and software defined infrastructures is contributing significantly to the increased adoption of software for commercial and enterprise data center environments.

Colocation data centers dominate the market due to the preference of enterprises, digital platforms and cloud service providers for leasing space rather than investing into building up their own data center facilitie. Which provides customers with cost efficiency, scalability, high availability and faster time to market. Therefore, both domestic and global players favor this model. The growing presence of large colocation campuses in major metropolitan cities has contributed to the growth of colocation data centers in India.

| Component | Market Share (%) | Key Highlights |

| Enterprise Data Centers | 11% | Used mainly for captive workloads by large enterprises requiring control over sensitive internal operations. |

| Colocation Data Centers | 63% | Dominant segment, preferred for scalability, cost efficiency, regulatory compliance, and rapid deployment by enterprises and hyperscalers. |

| Edge Data Centers | 10% | Expanding to support low-latency applications, 5G, IoT, and localized data processing in tier-II and tier-III cities. |

| Hyperscale Data Centers | 16% | Fastest-growing, fueled by aggressive expansion from global cloud providers supporting AI, cloud, and big data workloads. |

Hyperscale data centers are the fastest-growing segment, due to robust growth in global cloud provider efforts to meet demand for cloud computing, artificial intelligence (AI), big data analytics and digital platforms. The increasing requirement for scalable compute power and storage, along with data localization regulations, has resulted in hyperscale's heavily investing in India. Hyperscale data centers can accommodate large amounts of data processing, reduce operational costs and allow for quick growth within the larger data center ecosystem.

Tier 3 data centers dominate the market because they provide customers with a strong combination of cost-effectiveness and availability. Many enterprises and colocation providers use tier 3 data centers because they have redundant systems for power and cooling and offer very little downtime, which allows customers to meet their daily operational requirements easily. Tier 3 data centers are also used extensively to run commercial workloads that require reliability, but do not need tier 4-level redundancy. Thus, tier 3 has become the most popular standard for large-scale deployments in India.

| Tier Level | Market Share (%) | Key Highlights |

| Tier 1 & Tier 2 | 22% | Suitable for non-critical workloads with lower redundancy and cost requirements. |

| Tier 3 | 60% | Dominant, offering an optimal balance between cost, redundancy, and availability for most commercial and colocation deployments. |

| Tier 4 | 18% | Fastest-growing, driven by mission-critical applications requiring maximum fault tolerance and near-zero downtime. |

Tier 4 data centers are the fastest-growing tier segment due to the growing need for maximum uptime and fault-tolerant systems for mission-critical applications in sectors like banking, finance, insurance, and government, as well as hyperscale cloud service providers. As such, industries that require low or near-zero downtime and extremely high levels of redundancy and resiliency before they can offer their products or services are turning to tier 4 facilities for all sensitive applications. Due to their high capital investment requirements and the rapidly growing demands associated with increased reliance on digital technology and higher levels of compliance by regulatory authorities, adoption rates of tier 4 facilities are expected to increase significantly in the near future.

Large data centers dominate the market as hyperscale facilities and large colocations account for the most substantial part of the total IT load capacity and capital investment. In addition to providing the infrastructure to support cloud platforms, OTT services, enterprise applications, and the related heavy-duty power and space demands required by large scale AI workloads, large facilities provide several advantages over smaller colocations due to their ability to achieve economies of scale through a centralized approach to data center management and high levels of efficiency. Thus, large data center facilities have a dominant position in the overall data center market due to their scale and efficiency.

| Data Center Size | Market Share (%) | Key Highlights |

| Large | 51% | Dominant, supported by hyperscale facilities and large colocation campuses handling massive IT loads and cloud platforms. |

| Medium | 29% | Used by regional operators and enterprises requiring moderate scalability and capacity. |

| Small | 20% | Fastest-growing, driven by edge computing, 5G rollout, and demand for low-latency localized data processing. |

Small data centers are the fastest-growing segment due to the increasing popularity of edge computing and the demand for low-latency service. The rise in 5G networks, the introduction of IoT applications, and the emergence of real-time analytics are causing the development of smaller facilities that are located much closer to end-users. As a result of this trend, we are seeing a growing number of businesses operating in the tier-2 and tier-3 cities because these companies want to have more localized data processing capabilities and lower latency in terms of their data transmissions. Lower development costs and faster time-to-market are also contributing factors that will help to create continued growth within this segment.

IT & telecom dominate the India data center market due to the unique nature of their data storage, processing, and network connectivity requirements, as compared to other industries. Increased demand for cloud, mobile data traffic, OTT services, and enterprise digital transformations is creating significant demand for this sector of the market. As a result, telecom operators, internet service providers, and cloud service providers heavily depend on data center support to provide uninterrupted service, deliver content, and offer scalable digital services, thereby maintaining the lead in consumption of this portion of the market over time.

| Industry | Market Share (%) | Key Highlights |

| IT & Telecom | 44% | Dominant, driven by cloud services, data traffic growth, OTT platforms, and telecom network expansion. |

| BFSI | 20% | Fastest-growing, supported by digital banking, fintech growth, data localization mandates, and cybersecurity requirements. |

| Healthcare | 5% | Increasing use of digital health records, telemedicine, and secure data storage. |

| Government | 10% | Driven by e-governance, national digital platforms, and citizen data management. |

| Manufacturing | 7% | Adoption of Industry 4.0, IoT, and smart factory analytics. |

| Retail & E-commerce | 8% | High data volumes from online transactions, analytics, and customer platforms. |

| Others | 6% | Growth supported by OTT streaming, gaming, and digital content delivery. |

BFSI is the fastest-growing segment in the India data center market, due to the fast adoption of digital banking, the emergence of new fintech firms, and the rise in online transactions occurring every day. The ongoing implementation of data localization regulations means that companies will need to continue investing significantly in their secure and high-availability data center infrastructures to stay competitive. Increased use of digital payment methods, mobile banking, and growing regulation requirements will further increase the need for reliable, easy-to-use, and highly secure solutions that support disaster recovery and data protection.

By Component

By Type

By Tier Level

By Data Center Size

By Industry

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2023

January 2023

October 2023

November 2023