April 2024

Meal Kit Delivery Services Market (By Offering: Cook & Eat, Heat & Eat; By Service: Multiple, Single; By Platform: Offline, Online; By Meal Type: Vegan, Non-Vegetarian, Vegetarian) - Global Industry, Share, Analysis, Trends and Forecast 2026 - 2035

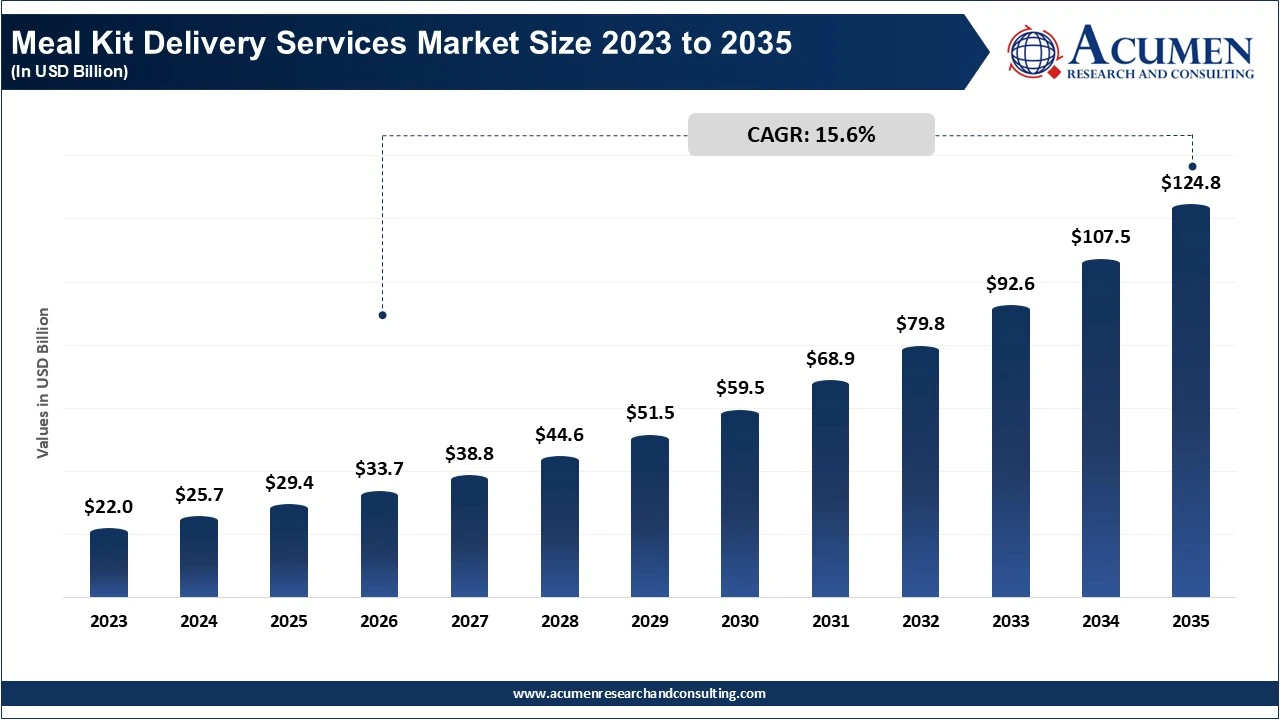

The global meal kit delivery services market size accounted for USD 29.41 billion in 2025 and is estimated to record USD 124.80 billion by 2035 growing at a CAGR of 15.6% from 2026 to 2035. Development of eco-friendly packaging to appeal to sustainability-focused consumers is a popular meal kit delivery services market trend that fuels the industry demand.

Meal kit delivery services are subscription-based or on-demand services that send pre-portioned supplies and step-by-step recipes directly to users' homes. These businesses seek to make home cooking easier by eliminating the need for meal planning and grocery shopping. Customers choose meals from a weekly menu, which are then packaged with fresh, often pre-made, ingredients for convenience. Meal kits are popular among busy professionals, health-conscious consumers, and families. They cater to a wide range of dietary restrictions, including vegetarian, keto, and gluten-free. In addition to saving time, these services help to reduce food waste by delivering just the right portions. Meal kit delivery services are developing in response to rising demand for convenient and healthy dining, integrating culinary variety with modern life demands.

| Coverage | Details |

| Meal Kit Delivery Services Market Size 2026 | USD 33.74 Billion |

| Meal Kit Delivery Services Market Forecast 2035 | USD 124.80 Billion |

| Meal Kit Delivery Services Market CAGR During 2026 - 2035 | 15.6% |

| Segments Covered | By Offering, By Service, By Platform, By Meal Type, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Hungryroot, Gobble, Blue Apron, LLC, Purple Carrot, Relish Labs LLC (Home Chef), Freshly Inc., Fresh n' Lean, Marley Spoon Inc., Sun Basket, and HelloFresh. |

The meal kit delivery services market is experiencing significant change as a result of changing consumer tastes, technological integration, and a greater emphasis on health-conscious convenience. According to the US Department of Agriculture, more than 55% of Americans prepare meals at home on a regular basis, resulting in a high demand for pre-portioned materials delivered to their door. This trend favors dual-income families and busy professionals looking for efficient cooking options.

Health consciousness is another important growth factor. According to the Centers for Disease Control and Prevention, over 60% of American adults are actively seeking dietary improvements, pushing meal kit companies to provide specific options such as gluten-free, vegan, and low-carb alternatives. Advanced smartphone apps with artificial intelligence now provide personalized recommendations based on user preferences, nutritional goals, and allergen concerns.

However, the industry faces numerous hurdles. Premium pricing in comparison to ordinary grocery shopping restricts market penetration among budget-conscious consumers. Cold chain logistics provide challenges in rural locations, and heavy packaging raises environmental issues, which have an impact on client retention, particularly among ecologically conscious customers.

These difficulties present chances for advancement. Emerging markets with expanding e-commerce infrastructure present opportunities for expansion, whilst corporate wellness partnerships can boost uptake through workplace programs. Companies that design sustainable packaging and carbon-neutral delivery technologies may gain a competitive advantage.

The combination of lifestyle changes, health consciousness, and technological capabilities has paved the way for future growth, meaning huge long-term potential for firms that strike a balance between convenience, cost-effectiveness, and environmental responsibility.

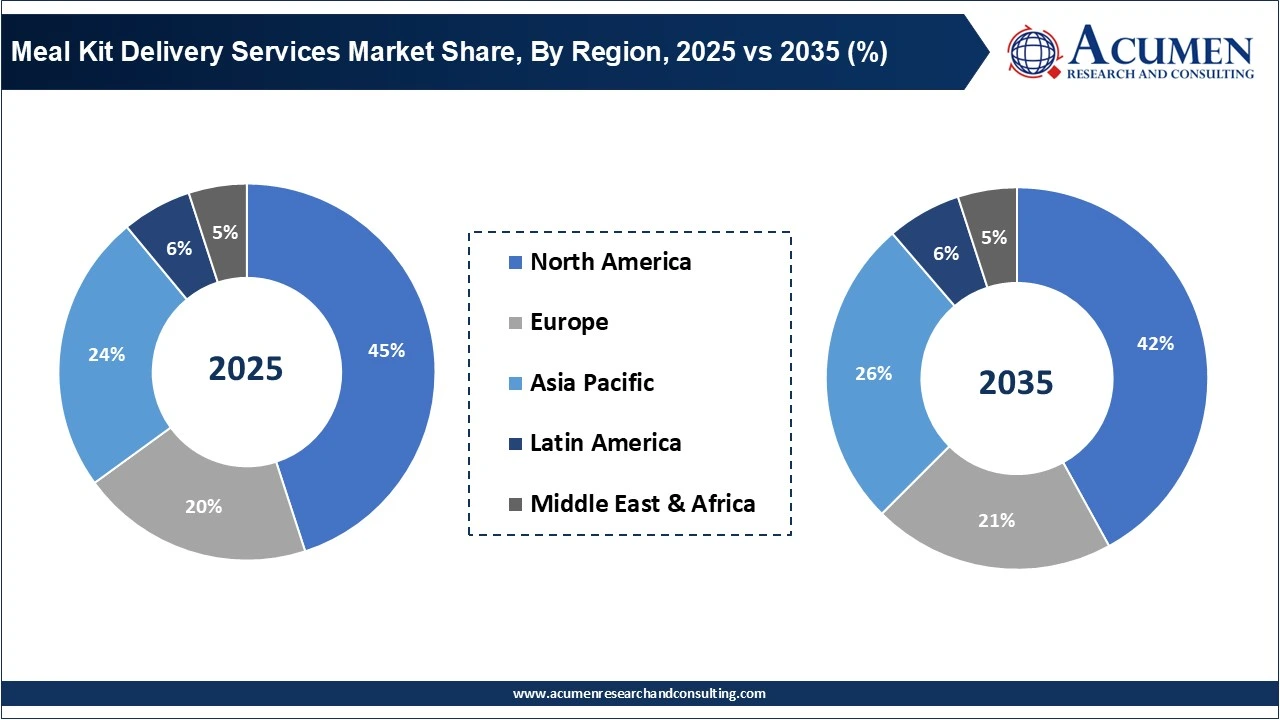

North America leads the market, accounting for around 45% of global revenue in 2025. This supremacy stems from high spending incomes, active lifestyles, and a well-developed e-commerce infrastructure. Major companies such as HelloFresh and Blue Apron have capitalized on these aspects, catering to health-conscious consumers seeking easy meal options.

Europe, which will account for over 20% of the market in 2025, is experiencing steady expansion due to increased health awareness and a desire for organic, locally produced foods. Consumers in countries such as the United Kingdom, Germany, and France are increasingly adopting meal kits that promote sustainable and healthful eating.

Asia-Pacific region is emerging as the fastest-growing region, accounting for 16.7% of the worldwide market by 2025. Rapid urbanization, rising disposable incomes, and shifting food preferences all contribute to this growth. Countries such as China, Japan, and India are witnessing rising demand for convenient and healthy meal options, with the market expected to rise at a maximum CAGR from 2025 to 2033.

Latin America, the Middle East, and Africa These regions contributed 6% and 5% of the global market in 2025, respectively. While currently smaller markets, they offer growth prospects due to urbanization and a growing interest in simple meal options.

Overall, the worldwide meal kit delivery market is expected to increase significantly, driven by shifting customer preferences for convenience, healthier meal options, and novel delivery service offerings.

The worldwide market for meal kit delivery services is split based on offering, service, platform, meal type, and geography.

The cook & eat segment dominates the meal kit delivery market because it addresses core consumer desires for convenience, culinary education, and fresh cooking experiences. These kits provide pre-portioned, fresh ingredients with detailed recipes, allowing customers to prepare restaurant-quality meals at home without meal planning or grocery shopping. The segment caters to busy professionals, families looking for diversity, and cooks who want to learn new skills. Unlike heat & eat choices, cook & eat kits provide the satisfaction of genuine cooking while reducing prep time and food waste. This blend of convenience and engagement leads to increased customer retention and market share gain.

Meal Kit Delivery Services Market Share, By Offering, 2025 (%)

| Offering | Market Share, 2025 (%) |

| Cook & Eat | 61% |

| Heat & Eat | 39% |

According to meal kit delivery services industry analysis, because of its tailored and specialized approach, the single service category generates significant revenue in the market. Companies that provide a single service can concentrate their efforts on building a single core offering, such as regular meal kits, family-friendly options, or dietary-specific solutions like keto or vegan meals. Because of their expertise in their field, this specialization leads to more effective operations, cheaper costs, and increased customer satisfaction. Single-service providers usually enhance client loyalty by becoming the go-to choice for certain needs, allowing for higher pricing and more consistent revenue streams. Their tailored marketing and operational efficiency provide them a long-term advantage over their numerous competitors.

Meal Kit Delivery Services Market Share, By Service, 2025 (%)

| Service | Market Share, 2025 (%) |

| Multiple | 43% |

| Single | 57% |

The offline segment in the meal kit delivery services market is anticipated to witness the fastest growth during the forecast period. This surge is primarily driven by the expansion of physical retail outlets and specialty food stores offering meal kits. Consumers place a higher value on in-store experiences that allow them to examine products in person, receive immediate advice, and access fresh, ready-to-cook meal alternatives. Additionally, offline availability encourages impulse purchases and appeals to customers who are less likely to use internet platforms. Brands are also working with supermarkets and food chains to improve accessibility and brand visibility. As hybrid buying behavior expands, offline channels provide a tangible and trustworthy alternative, contributing considerably to the segment's rapid growth in both established and emerging markets.

Meal Kit Delivery Services Market Share, By Platform, 2025 (%)

| Platform | Market Share, 2025 (%) |

| Online | 64% |

| Offline | 36% |

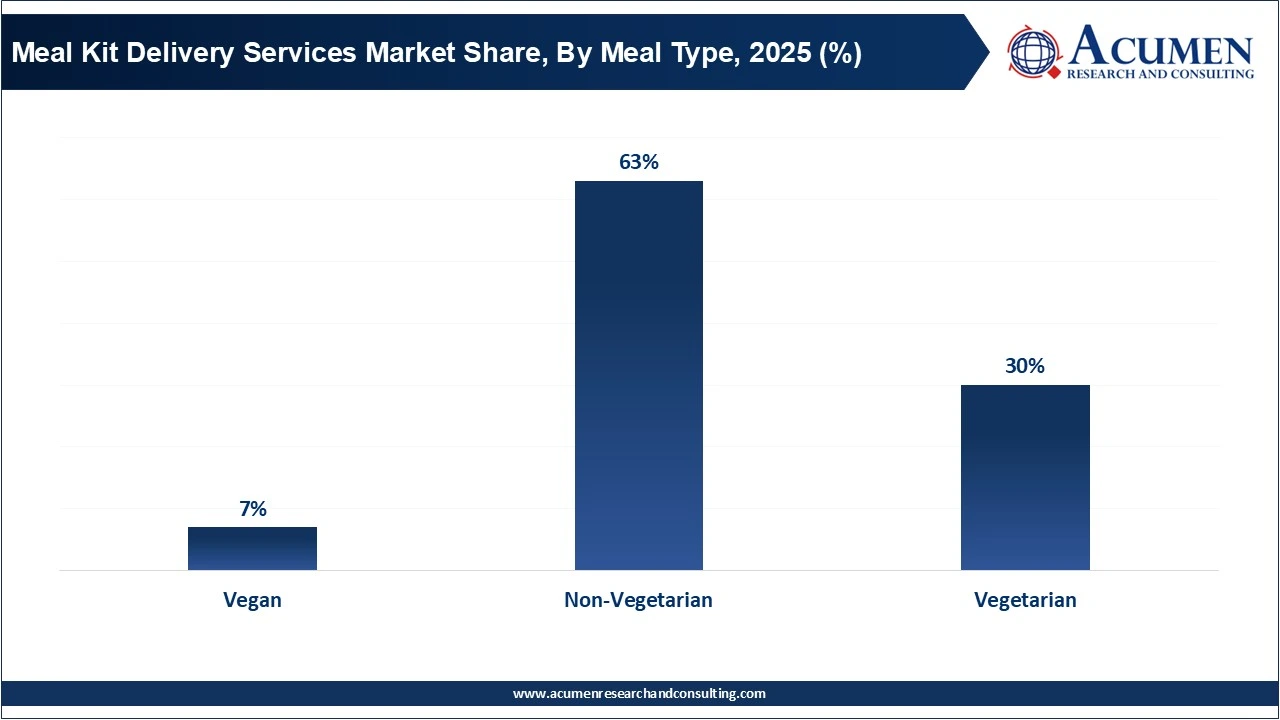

The non-vegetarian subsegment dominates the industry, owing to high customer demand for protein-rich and varied meal options. Many consumers choose meat-based foods due to their flavor, nutritional value, and cultural familiarity, making non-vegetarian kits quite popular. These kits frequently include premium proteins such as chicken, beef, shellfish, and pork, which appeal to a wide range of consumers. Furthermore, the addition of innovative and gourmet non-vegetarian cuisine increases client attention and satisfaction. Meal kit providers usually focus this area by providing a wide range of customizable alternatives, which strengthens their dominance. The sustained popularity of high-protein diets contributes to the subsegment's steady growth.

By Offering

By Meal Type

By Service

By Platform

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2024

December 2025

August 2018

June 2024