March 2024

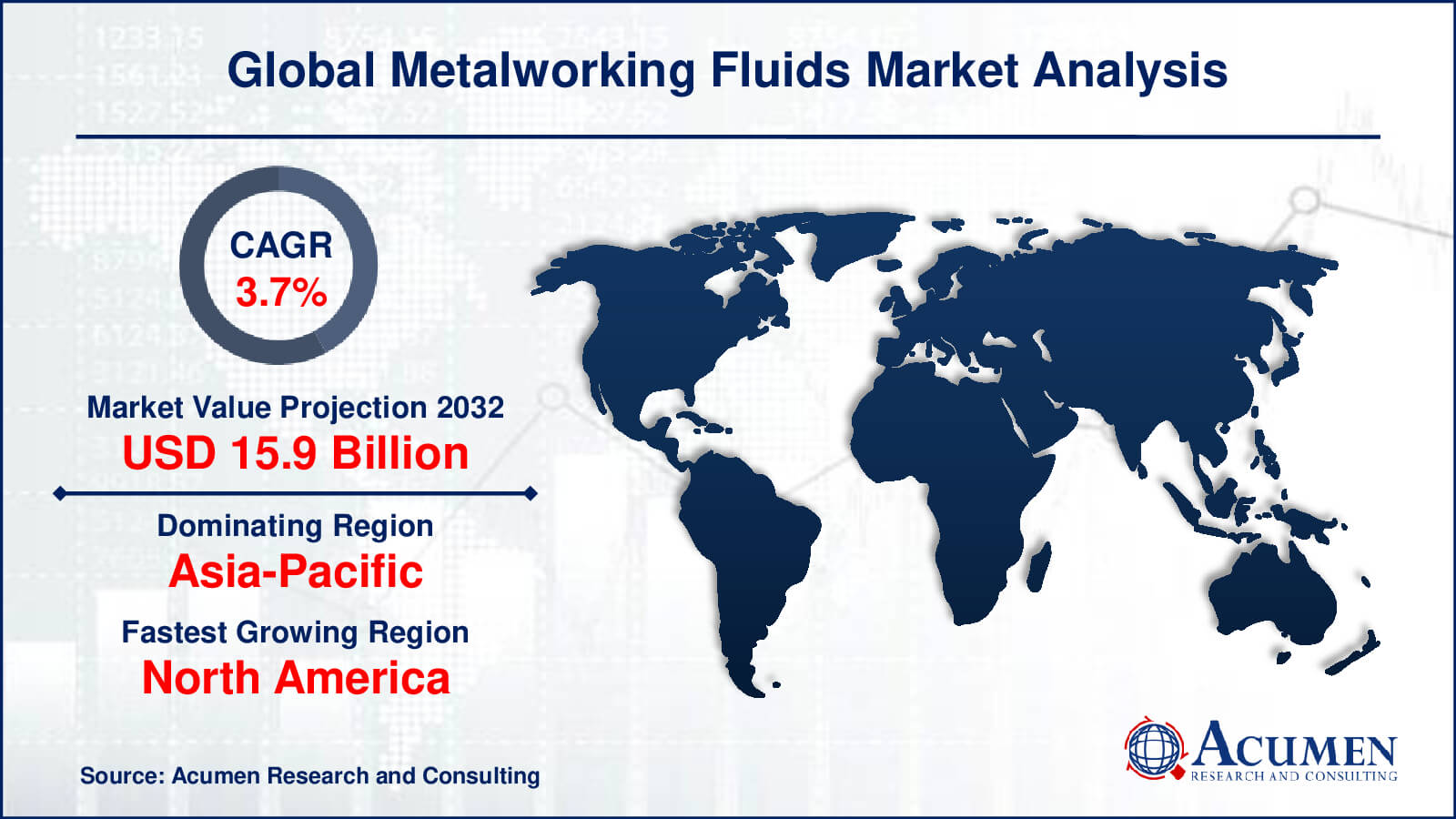

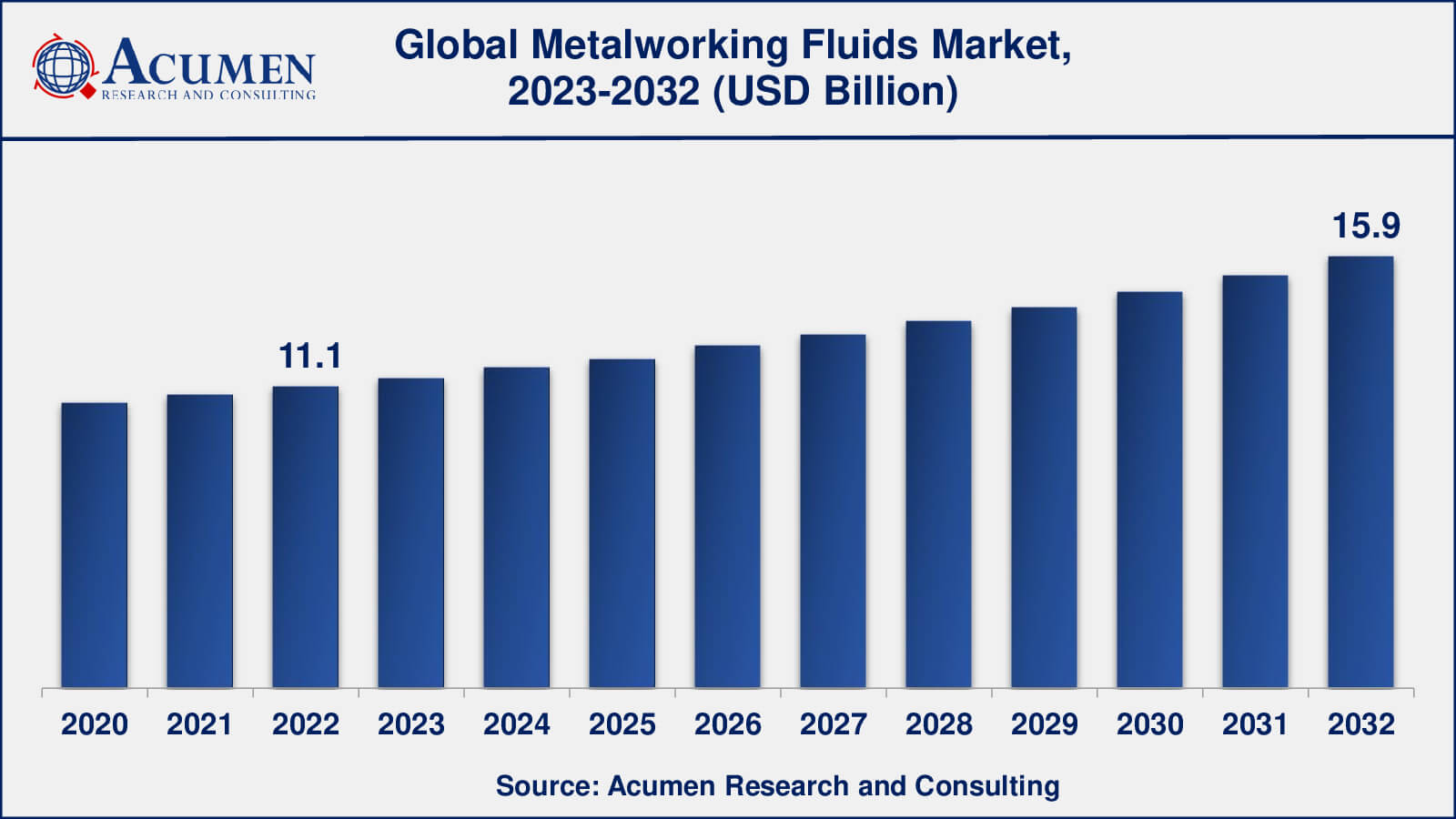

Metalworking Fluids Market Size collected USD 11.1 Billion in 2022 and is set to achieve a market size of USD 15.9 Billion in 2032 growing at a CAGR of 3.7% from 2023 to 2032.

The Global Metalworking Fluids Market Size collected USD 11.1 Billion in 2022 and is set to achieve a market size of USD 15.9 Billion in 2032 growing at a CAGR of 3.7% from 2023 to 2032.

Metalworking Fluids Market Report Statistics

Metal working fluids refer to those oils which are primarily used to cool down and lubricate the metal work structures when they are exposed to grinding processes including grinding, milling and machining among others. Metal working fluids generally reduce the heat and friction between the cutting tool and the metal piece and thus helps in preventing smoking or burning. The increasing popularity of metalworking fluids in order to improvise the tool life and surface finish is anticipated to be a key factor driving the growth of global metalworking fluids market during the forecast period. In addition, the global metal working fluids market is projected to be strongly fragmented attributing to more than 50% of market being served by small industry players which focuses on specific end users and applications along with key geographic areas having a loyal customer base. The removal fluid segment is projected to play a crucial role in propelling the overall growth of global metal working fluids market owing to its increasing use as a coolant across industrial applications and manufacturing units.

Global Metalworking Fluids Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Metalworking Fluids Market Report Coverage

| Market | Metalworking Fluids Market |

| Metalworking Fluids Market Size 2022 | USD 11.1 Billion |

| Metalworking Fluids Market Forecast 2032 | USD 15.9 Billion |

| Metalworking Fluids Market CAGR During 2023 - 2032 | 3.7% |

| Metalworking Fluids Market Analysis Period | 2020 - 2032 |

| Metalworking Fluids Market Base Year | 2022 |

| Metalworking Fluids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use, By Industrial End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Blaser Swisslube, Houghton International Inc., Total S.A., BP, Fuchs, ExxonMobil Corp, Cimcool, Chevron Corporation, Eni S.p.A, Motul, Ashland, Inc, Indian Oil Corporation Limited, Kuwait Petroleum International, Petronas and Quaker Chemical Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Metalworking Fluids Market Growth Factors

The rapid growth of niche applications such as medical machining is a key factor accelerating the growth of the global metal working fluids market across the globe. However, some factors including regulations on the use of anti-microbial chemicals and vulnerability to microbial attack are posing a serious threat to the growth of metalworking fluids and are expected to maintain their effect throughout the forecast period. Furthermore, technological advancements including minimum quantity lubrication and high compression machining are projected to replace conventional metalworking machinery, thus boosting the demand for metalworking fluids over the forecast period. Also, increasing awareness among consumers regarding the ill and hazardous effects of metalworking fluids coupled with the high risk associated with the use of semi-synthetic and synthetic metalworking fluids has forced manufacturers to concentrate on research & development for the development of user-friendly and environment-friendly bio-based metal working fluids. Also, strong government initiatives in various developing countries support the manufacturing of metalworking fluids and have resulted in enhanced production output. This factor is expected to pose a positive impact on the global metalworking fluids market.

Metalworking Fluids Market Segmentation

The worldwide metalworking fluids market is categorized based on product, application, end-use, industrial end-use, and geography.

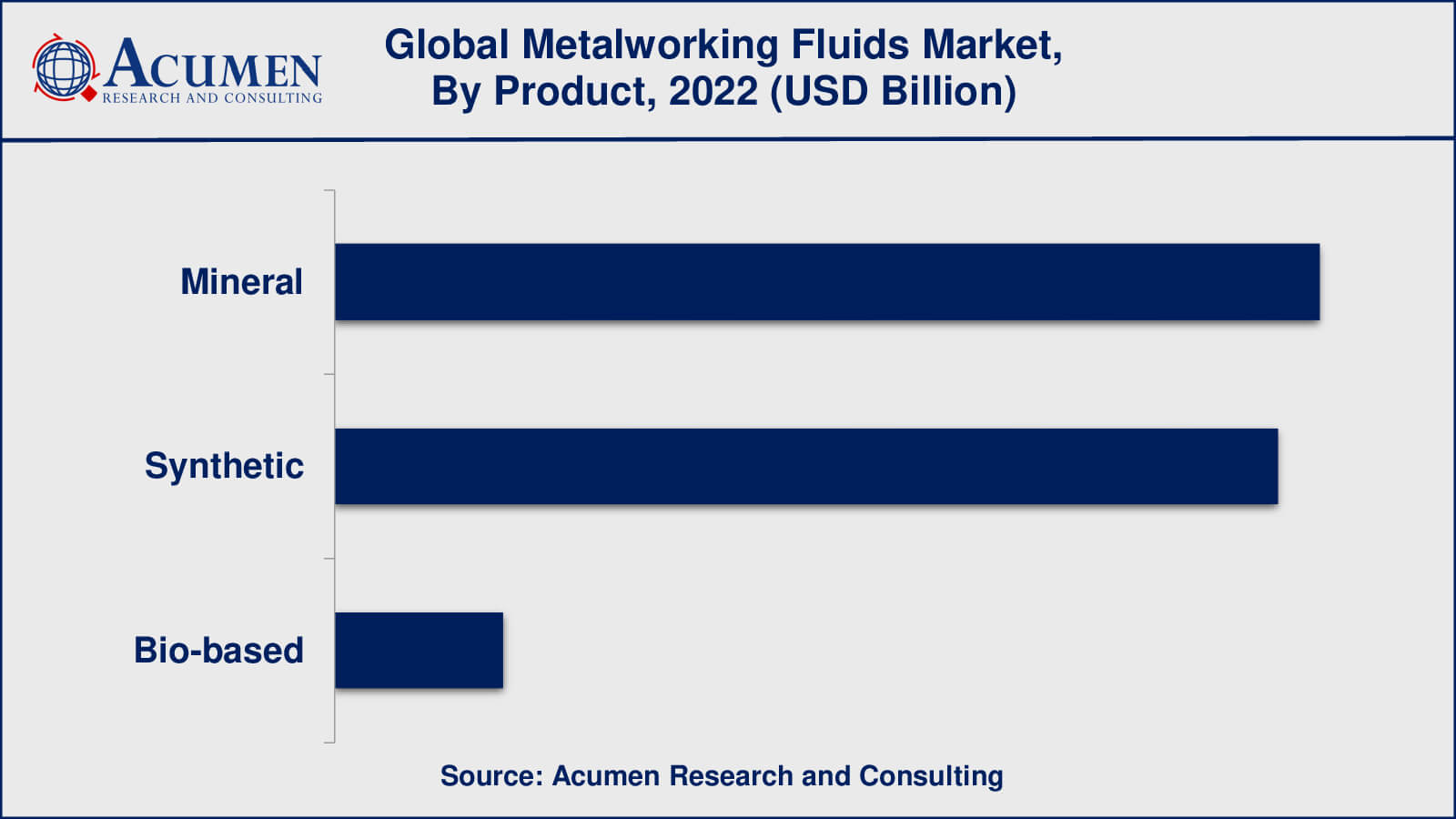

Metalworking Fluids Market By Product

The metalworking fluids market forecast predicts that synthetic-based fluids will surpass the mineral fluids share in the upcoming years due to their superior qualities and expanding uptake by manufacturers. When compared to mineral-based fluids, synthetic-based fluids are made from chemical compounds and provide better lubrication, cooling, and corrosion protection. They are better suited for high-performance machining applications because they last longer and require less maintenance than conventional fluids do. The ability of synthetic-based fluids to improve productivity and efficiency in manufacturing processes is driving up demand for them. Manufacturers who want to reduce their environmental impact and improve their sustainability also prefer them.

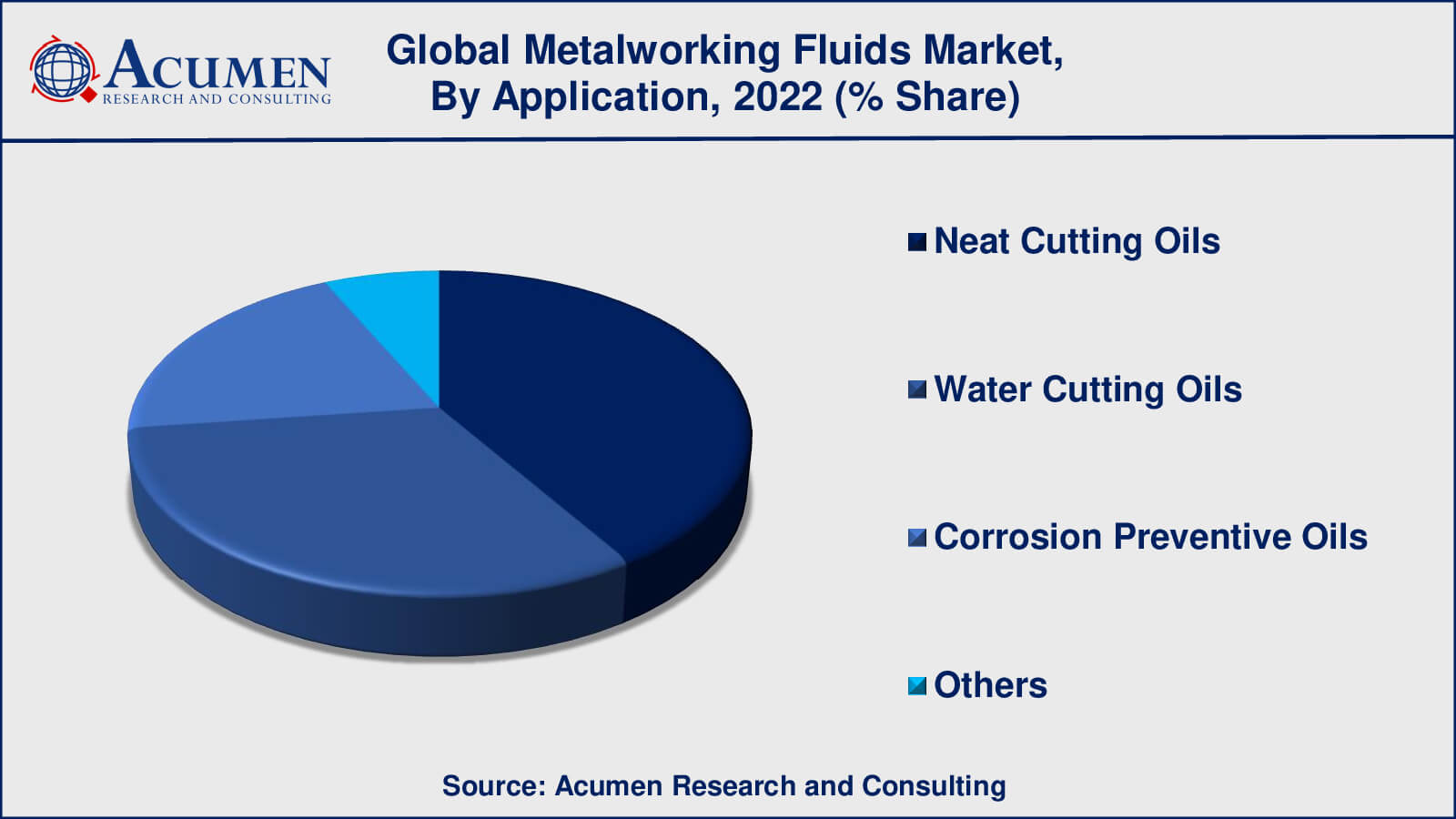

Metalworking Fluids Market By Application

According to our recent analysis, neat cutting oils are the largest application segment in the metalworking fluids market. Neat cutting oils are applied directly to the cutting tool and workpiece without the use of water during metal cutting operations. These oils have superior lubrication and cooling properties, resulting in better cutting performance, longer tool life, and a smoother surface finish. The growing demand for precision machining in industries such as automotive, aerospace, and medical devices is driving the demand for neat cutting oils. To meet their stringent quality and performance requirements, these industries require high-performance cutting fluids. Water cutting oils account for a sizable portion of the metalworking fluids market. Water-based fluids are popular because they are less expensive, easier to use, and less harmful to the environment. They are used in applications where less lubrication is required, such as grinding, drilling, and tapping.

Metalworking Fluids Market By End-Use

Metalworking fluids are critical in these industries' manufacturing processes, where they are used for cutting, grinding, drilling, and other metalworking operations. The growing demand for lightweight materials, which necessitate advanced machining processes to achieve high precision and quality, drives the demand for metalworking fluids in the transportation equipment industry. Metalworking fluids also have an important function in ensuring the long-term reliability of metal components in transportation equipment.

One other significant end-use segment in the metalworking fluids market is the machinery industry. Machine tools, pumps, compressors, and construction equipment are examples of industrial equipment. Metalworking fluids are required in these industries for a variety of applications such as cutting, drilling, and forming.

Metal fabrication is another important end-use segment in the metalworking fluids market. Metal fabrication encompasses the creation of metal parts and components for a variety of industries, including construction, consumer goods, and electronics. Metalworking fluids are required in metal fabrication processes such as cutting, grinding, and welding.

Metalworking Fluids Market By Industrial End-Use

According to metalworking fluids industry analysis, the automobile industry has been the market's dominant end-use in recent years. The automotive sector consumes a huge amount of metalworking fluids due to the substantial amount of metal components required in the creation of automobiles. To maintain the quality and accuracy of the components, metalworking fluids are used in a variety of manufacturing processes like machining, stamping, and forming. Another large end-use market for metalworking fluids is the aerospace sector. Metalworking fluids are essential in assuring the quality and endurance of aerospace components, which need high-precision machining. Another large end-use market for metalworking fluids is the construction sector. Both the manufacture of construction machinery and the machining of metal building block components involve metalworking fluids.

Metalworking Fluids Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Metalworking Fluids Market Regional Analysis

The largest regional market for metalworking fluids is in the Asia-Pacific, which represents a sizeable portion of the global market. The fast industrialization and urbanization taking place in nations like China, India, Japan, and South Korea are what are driving the expansion of the metalworking fluids market in the Asia-Pacific region. The market for metalworking fluids is expanding as a result of the rising demand for consumer items, machinery, and vehicles in the area.

Additionally important geographical markets for metalworking fluids include those in North America and Europe. The need for metalworking fluids is being driven by the large aerospace, automotive, and machinery sectors that are present in these areas. Additionally, the demand for bio-based metalworking fluids in these areas is being driven by the growing emphasis on sustainability and environmental legislation.

Metalworking Fluids Market Players

Some of the global metalworking fluids companies profiled in the report include Blaser Swisslube, Houghton International Inc., Total S.A., BP, Fuchs, ExxonMobil Corp, Cimcool, Chevron Corporation, Eni S.p.A, Motul, Ashland, Inc, Indian Oil Corporation Limited, Kuwait Petroleum International, Petronas and Quaker Chemical Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2024

December 2023

November 2024

March 2023