May 2024

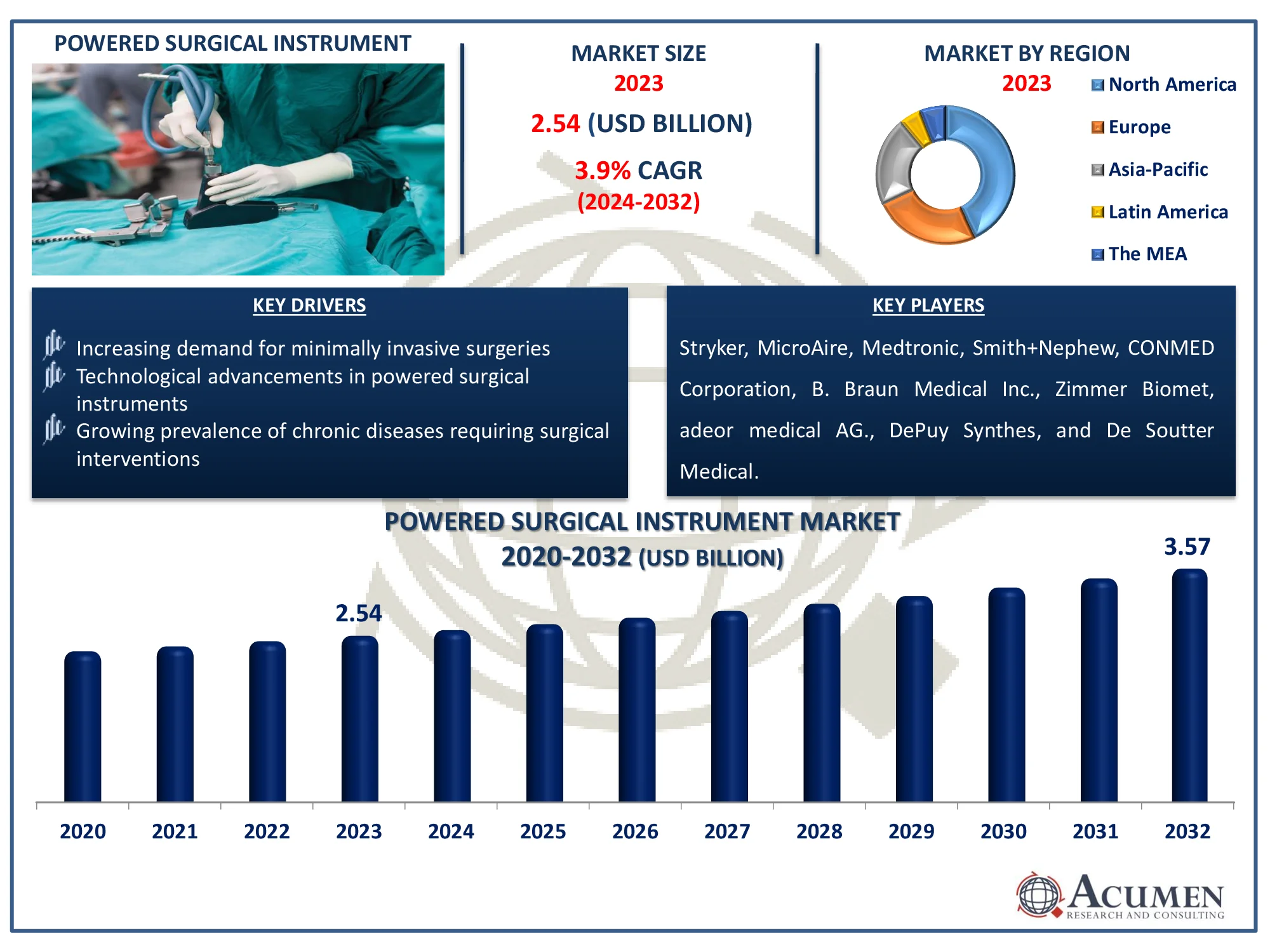

The Global Powered Surgical Instrument Market Size accounted for USD 2.54 Billion in 2023 and is estimated to achieve a market size of USD 3.57 Billion by 2032 growing at a CAGR of 3.9% from 2024 to 2032.

Powered Surgical Instrument Market Highlights

Powered surgical devices are technical instruments used to assist with neurological and orthopedic surgery. This surgical powered instrument is divided into five product categories: high speed equipment, large bone battery/electric equipment, small bone pneumatic equipment, large bone pneumatic equipment, and small bone electrical equipment. Surgeons frequently employ saws, clip appliers, surgical drills, and surgical staplers to cauterize and cut tissue in practically all sorts of surgical procedures.

|

Market |

Powered Surgical Instrument Market |

|

Powered Surgical Instrument Market Size 2023 |

USD 2.54 Billion |

|

Powered Surgical Instrument Market Forecast 2032 |

USD 3.57 Billion |

|

Powered Surgical Instrument Market CAGR During 2024 - 2032 |

3.9% |

|

Powered Surgical Instrument Market Analysis Period |

2020 - 2032 |

|

Powered Surgical Instrument Market Base Year |

2023 |

|

Powered Surgical Instrument Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Power Source, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Stryker, MicroAire, Medtronic, Smith+Nephew, CONMED Corporation, B. Braun Medical Inc., Zimmer Biomet, adeor medical AG, DePuy Synthes, and De Soutter Medical. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The domination of chronic disease and the growing geriatric population as a result of increased public awareness of healthcare are two important drivers driving the powered surgical instrument market. For instance, according to National Institute of Health (NIH), the old population in India is anticipated to grow to 158.7 million by 2025, representing 11.1% of the total population. Another factor contributing to the growth of the powered surgical tool market is the increased demand for surgical treatments, including minimally invasive and non-invasive surgeries. For instance, as per NIH, according to the most recent survey, plastic surgeons will conduct 34.9 million surgical and nonsurgical cosmetic procedures in 2023, representing a 3.4% rise globally. Over 15.8 million surgical treatments and over 19.1 million nonsurgical procedures were carried out worldwide. Continuous pressure on healthcare suppliers to reduce costs, insufficient quality assurance, and inadequate sterilizing processes for machines are some of the reasons limiting market growth.

The high cost of powered surgical instruments poses a substantial barrier to wider adoption, particularly in price-sensitive regions and small healthcare facilities. This financial strain may limit the availability of improved surgical equipment, stifling growth prospects in specific locations and industries. However, the growing use of robotic-assisted operations represents a significant potential for the surgical tool industry, as it drives demand for more precise, efficient, and advanced powered devices. For instance, in June 2024, Zimmer Biomet announced collaboration with THINK Surgical to provide the TMINI, a small handheld robotic device for total knee arthroplasty. The TMINI expands Zimmer Biomet's existing ROSA Robotics line by offering surgeons a wireless, ergonomic solution for knee replacements. This collaboration aims to increase the use of robotic assistance in orthopedic procedures, particularly in walk-in centers. As robotic technologies advance, the demand for specialized instruments that integrate with these systems is projected to rise significantly.

The worldwide market for powered surgical instrument is split based on product, power source, application, and geography.

According to the powered surgical instrument industry analysis, the hand parts sector had the most revenue in 2023 and is expected to continue expanding through the forecast period, with the fastest growing CAGR from 2024 to 2032. The hand piece accounts for 88% of the global market due to increased acceptance for innovative technologically powered surgical instruments as well as rising demand for minimally invasive surgery. For instance, according to American Society of Plastic Surgeons, in 2023, minimally invasive procedures climbed by 7%, outpacing surgical treatments by 2%, respectively. Furthermore, the demand for handpieces is increasing rapidly due to its exact qualities such as high efficiency, power, and lightweight design.

Electric instruments dominate sector because of their ability to deliver consistent and precise power for a wide range of surgical operations. Electric-powered tools provide superior control, speed, and accuracy, making them indispensable in complex procedures. Furthermore, improvements by manufacturers, such as Dentsply Sirona's introduction of the Midwest Energo range of electric handpieces in North America in February 2024, are pushing up market demand for electric instruments. Their versatility in performing numerous tasks, such as cutting, drilling, and cauterizing, adds to their domination.

According to the powered surgical instrument market forecast, orthopedic surgery dominates market, owing to the increased demand for precise and efficient equipment in treatments such as joint replacements, bone repairs, and spinal surgeries. Powered devices improve precision, speed, and tissue injury, making them indispensable in orthopedic procedures. As the prevalence of musculoskeletal problems increases, the demand for better orthopedic surgical tools drives market expansion.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

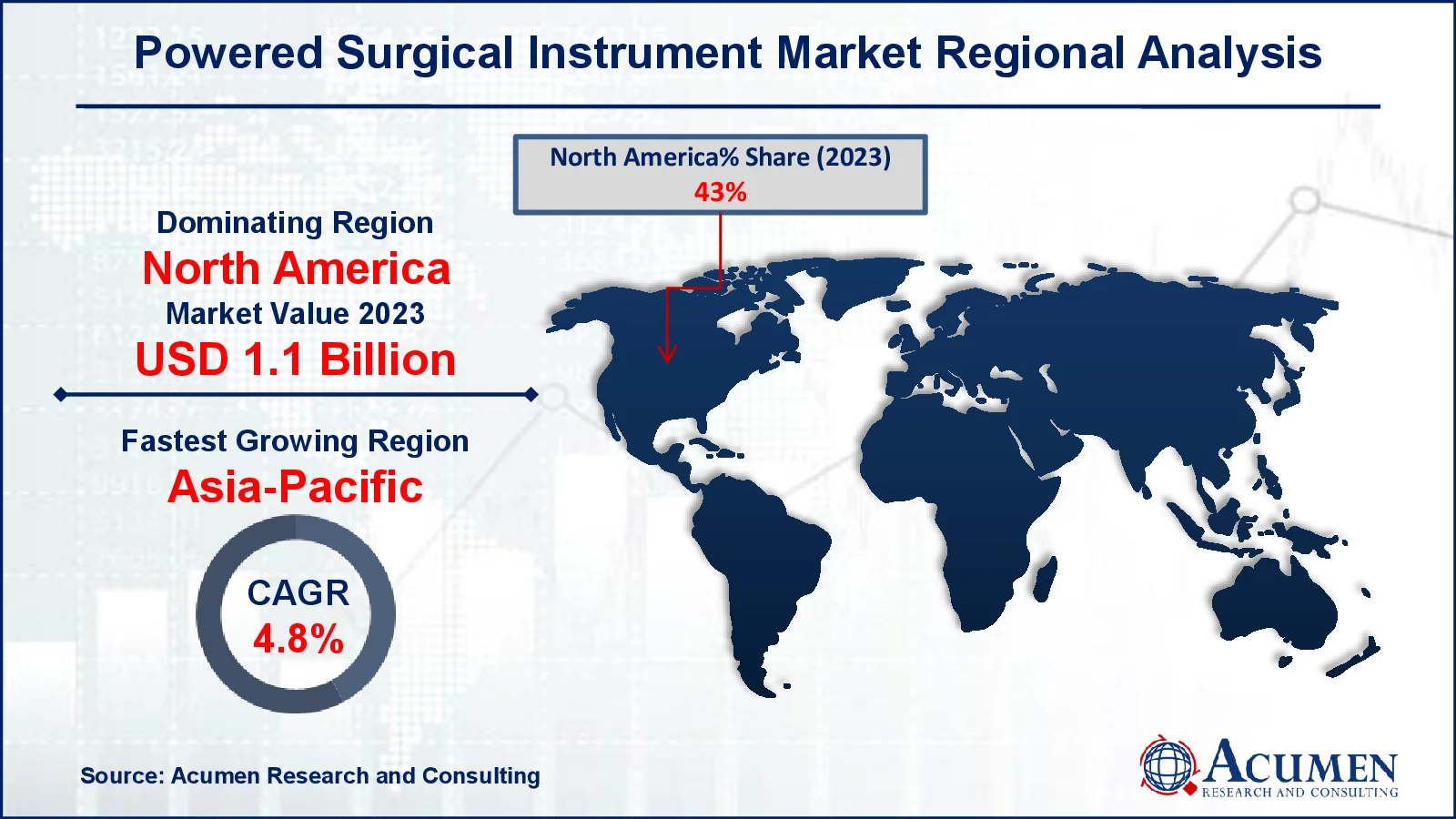

For several reasons, North America is expected to dominate the powered surgical instrument market in terms of revenue, followed by Europe, owing to a growing geriatric population, favorable government rules and regulations, and the adoption of innovative technology. According to U.S. Census Bureau forecasts, the number of Americans aged 100 and more will more than quadruple over the next three decades, from an expected 101,000 in 2024 to around 422,000 by 2054.

The Asia-Pacific region has the fastest growing market for powered surgical instrument hardware and accessories, owing primarily to increased medical tourism, improved access to health care facilities, and an increase in the incidence of chronic diseases requiring surgical procedures. Rising aging population further leads market’s growth. For instance, according to the World Health Organization, about 28% of Chinese inhabitants would be over 60 years old by 2040, owing to increased life expectancy and decreased fertility rates.

Latin America is experiencing significant expansion in the powered surgical instrument market as a result of the adoption of new technologies such as surgical robots, as well as the rising prevalence of diseases such as cancer, neurological diseases, cardiovascular disease, and orthopedic ailments. Other elements propelling this region include expanding population prevalence and awareness, as well as increased healthcare investment.

The market in the Middle East and Africa is expected to rise significantly due to an increase in therapeutic tourism, rising surgical procedures for ongoing infections, rising needs with low prevalence, and favorable repayment scenarios.

Some of the top powered surgical instrument companies offered in our report include Stryker, MicroAire, Medtronic, Smith+Nephew, CONMED Corporation, B. Braun Medical Inc., Zimmer Biomet, adeor medical AG, DePuy Synthes, and De Soutter Medical

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2024

June 2022

May 2025

August 2023