June 2024

The Global Sand Battery Market Size accounted for USD 1,218.3 Million in 2024 and is estimated to achieve a market size of USD 4,320.7 Million by 2033 growing at a CAGR of 15.3% from 2025 to 2033.

The Global Sand Battery Market Size accounted for USD 1,218.3 Million in 2024 and is estimated to achieve a market size of USD 4,320.7 Million by 2033 growing at a CAGR of 15.3% from 2025 to 2033.

A sand battery is a novel energy storage technology that uses sand or sand-like materials to store thermal energy. Unlike traditional batteries, which store electricity chemically, sand batteries store excess renewable energy, typically from solar or wind, as heat. This heat is transmitted to a silo filled with sand, which can maintain high temperatures (up to 500-600°C) for extended periods of time due to sand's strong insulation qualities. When needed, the stored heat can be converted into electricity or used for district heating. Sand batteries are cost-effective, scalable, and environmentally friendly, making them a promising alternative for balancing energy supply and demand, especially in locations with high renewable energy penetration and a need for sustainable heating solutions.

|

Market |

Sand Battery Market |

|

Sand Battery Market Size 2024 |

USD 1,218.3 Million |

|

Sand Battery Market Forecast 2033 |

USD 4,320.7 Million |

|

Sand Battery Market CAGR During 2025 - 2033 |

15.3% |

|

Sand Battery Market Analysis Period |

2021 - 2033 |

|

Sand Battery Market Base Year |

2024 |

|

Sand Battery Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Storage Capacity, By Sand Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

ESS Inc., Azelio, Sila Nanotechnologies, Caloric GmbH, Energy Vault, Polar Night Energy, Stornetic, Highview Power, Heliogen, and EnergyX. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The sand battery market, which is a subset of thermal energy storage (TES), is growing due to its ability to store excess renewable energy as heat. According to the International Renewable Energy Agency (IRENA), the global TES market is expected to treble by 2030, with over 800 GWh of installed capacity and investments ranging from USD 13 billion to USD 28 billion. Sand batteries, which take advantage of sand's excellent heat retention, are a low-cost, scalable solution for long-term energy storage.

In Europe, TES plays a crucial role in decarbonizing the heating and cooling sector, which accounts for approximately 50% of the EU's energy consumption. The European Commission's programs seek to boost the contribution of renewables in this sector by 1.1 percentage points per year. Sand batteries can help achieve this goal by combining with district heating systems, which reduces dependency on fossil fuels.

In India, the Solar Energy Corporation of India (SECI) has invited proposals for a 50 MW solar PV facility supported by a 50 MWh battery energy storage system in Leh, indicating growing interest in thermal storage solutions. Sand batteries, with their low environmental effect and ability to store energy over long periods of time, are ideal for such applications, particularly in rural or off-grid places. Overall, the sand battery market is expected to expand, driven by the demand for long-term energy storage options that may supplement renewable energy sources and aid global decarbonization efforts.

The worldwide market for sand battery is split based on storage capacity, sand type, application, and geography.

According to sand battery industry analysis, the high-capacity segment (above 50 MWh) in India's market is experiencing significant growth. As of March 2024, India's installed battery energy storage capacity reached 219.1 MWh, marking a more than fourfold increase from 47.6 MWh in March 2023. This rise is mostly being driven by large-scale projects. For example, Andhra Pradesh is slated to host India's largest integrated renewable energy project, which includes a 2,000 MW (2 GWh) battery storage plant. The Indian government announced the Viability Gap Funding (VGF) program with a budget of ₹37.6 billion (~$452 million) to install 4 GWh of battery energy storage systems by FY2026. These efforts demonstrate the country's commitment to expanding high-capacity energy storage to achieve its renewable energy goals.

The silica sand segment is predicted to lead the sand battery market due to its widespread availability, low cost, and superior thermal qualities. Silica sand is known for its high heat retention capability, making it an excellent choice for thermal energy storage. Its abundance in nature offers a consistent and cost-effective supply, which is critical for large-scale energy storage. Furthermore, silica sand is non-toxic and eco-friendly, which aligns with the growing demand for sustainable energy solutions. Its proven efficiency in pilot projects, particularly in high-temperature applications, reinforces its market leadership. As governments spend more in renewable energy infrastructure, the dependability and performance of silica sand in sand battery systems will maintain its supremacy.

The district heating systems segment is expected to witness significant growth during the forecast period in the sand battery market. This rise is driven by increasing efforts to decarbonize urban heating infrastructure and improve energy efficiency in residential and commercial buildings. Sand batteries, with their ability to store thermal energy at high temperatures for lengthy periods of time, are perfect for powering district heating networks, particularly in colder climates. Governments in Europe and Asia are investing extensively in sustainable district heating solutions to minimize reliance on fossil fuels. Furthermore, sand's low cost and non-toxic properties make it a viable option for long-term heat storage. As cities migrate to renewable and centralized heating systems, this category is expected to grow rapidly.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

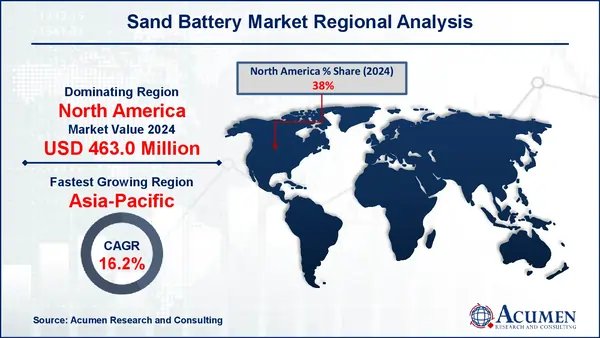

North America is emerging as a viable location, due to increased expenditures in sustainable energy and a growing demand for reliable grid-connected energy storage. The United States and Canada are investigating sand battery technology as a low-cost, long-term alternative to lithium-ion systems for industrial applications and seasonal heat storage. Government incentives and a greater emphasis on grid stability are driving adoption in this region.

Asia-Pacific, particularly Japan, South Korea, and China, is predicted to expand fast during the sand battery market forecast period as a result of increased urbanization, energy consumption, and government initiatives to encourage renewable energy technologies. The region's emphasis on low-emission industrial operations and efficient heating systems opens up new potential for sand battery integration.

Some of the top sand battery companies offered in our report include ESS Inc., Azelio, Sila Nanotechnologies, Caloric GmbH, Energy Vault, Polar Night Energy, Stornetic, Highview Power, Heliogen, and EnergyX.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2024

September 2023

June 2022

August 2023