September 2020

The Global Thermoplastic Tape Market Size accounted for USD 2.6 Billion in 2023 and is estimated to achieve a market size of USD 5.7 Billion by 2032 growing at a CAGR of 9.4% from 2024 to 2032.

The Global Thermoplastic Tape Market Size accounted for USD 2.6 Billion in 2023 and is estimated to achieve a market size of USD 5.7 Billion by 2032 growing at a CAGR of 9.4% from 2024 to 2032.

Thermoplastic tape is a composite that combines the qualities of fibers and polymers. This is extremely flexible at normal temperatures, but hardens when heated and chilled again. This change is caused by the plastic impregnation of the thermoplastic tape, which produces homogeneous liquid during heating and polymer linkages while cooling, culminating in the hardened composite element. The tape's qualities include flexible placement before curing, considerable strength and rigidity after curing, ease of storage and application, and high recyclability.

|

Market |

Thermoplastic Tape Market |

|

Thermoplastic Tape Market Size 2023 |

USD 2.6 Billion |

|

Thermoplastic Tape Market Forecast 2032 |

USD 5.7 Billion |

|

Thermoplastic Tape Market CAGR During 2024 - 2032 |

9.4% |

|

Thermoplastic Tape Market Analysis Period |

2020 - 2032 |

|

Thermoplastic Tape Market Base Year |

2023 |

|

Thermoplastic Tape Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Thickness, By Fiber Type, By Material, By End-Use Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Mitsui Chemicals, Ensinger, Suprem SA, Fibrtec, Evonik Industries, Shindo Co. Ltd., Barrday Inc., Teijin, Suzhou Noen, Mitsubishi Chemical, LANXESS, SGL Carbon, Covestro, Toray, and Victrex.. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The characteristics of thermoplastic tape include ease of molding and reshaping, recyclability and sustainability, incredible strength, damage and temperature resistance, and rigidity while remaining flexible, all of which add to its commercial value. The expanding use in a variety of industry applications, particularly in automotive, is driving market growth. The growing need in the aerospace industry for reusable and long-lasting spacecraft is likely to create new opportunities in the coming year.

The aerospace, automotive, and construction industries are increasingly adopting thermoplastic films to save weight while maintaining structural integrity. These tapes beat standard materials in terms of mechanical properties, corrosion resistance, and production ease. As fuel efficiency and performance become increasingly essential, the demand for lightweight composites grows.

The creation of thermoplastic tapes necessitates complex processing procedures and high-quality raw ingredients, resulting in higher costs. Specialized equipment and skilled labor are required, which increases production costs. These high costs may be a barrier to adoption, especially for small and medium-sized organizations.

The growing renewable energy sector, particularly wind and solar, presents great opportunities for thermoplastic tapes. For example, as of August 31, 2024, India had installed 198.96 GW of renewable energy capacity. This includes 89.43 GW of solar power, 46.92 GW of large hydro, 47.19 GW of wind power, 10.35 GW of bio-energy, and 5.07 GW of small hydropower. These materials improve the durability and performance of turbine blades, solar panels, and structural components. With increased global investment in sustainable energy, the demand for sophisticated, lightweight composites is expected to surge.

The worldwide market for Thermoplastic Tape is split based on Thickness, Material, End-Use Industry.

According to the thermoplastic tape industry analysis, the <0.20 mm thickness is quickly developing because of its broad use in applications requiring lightweight materials with good flexibility and ease of handling, such as aerospace, automotive, and electronics. Thin tapes have excellent conformability, which is required for precise bonding and insulating jobs. The 0.21 mm-0.40 mm and >0.40 mm segments are utilized in more specialized applications that require more thickness for added strength, durability, or insulation. Thicker tapes provide better performance in heavy-duty applications, but they are less frequent than thinner tapes.

According to the thermoplastic tape industry analysis, resins, PAEK and PC, in particular, are expected to grow in popularity due to their excellent mechanical properties, heat resistance, and versatility in a variety of applications, including aerospace and automotive. These resins have excellent bonding and durability properties, making them appropriate for high-performance applications. Other materials, like as PA and PP, serve to fill particular applications that require certain chemical or physical properties. Fibers provide structural strength, while resins ensure durability and heat resistance in specialized applications.

According to the thermoplastic tape market forecast, aerospace sector is primarily expanding due to rising demand for lightweight, high-strength materials that enable improved performance in aircraft construction and maintenance. The aerospace sector's demand for improved bonding and insulating materials pushes the use of thermoplastic tapes. The automotive sector follows closely, with thermoplastic tapes being utilized for lightweighting, bonding, and improving fuel efficiency in car components. Building and construction, as well as industrial goods, provide significant contributions through insulation, bonding, and sealing applications. The oil and gas industry employs thermoplastic tapes to seal and safeguard pipelines and other essential equipment.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

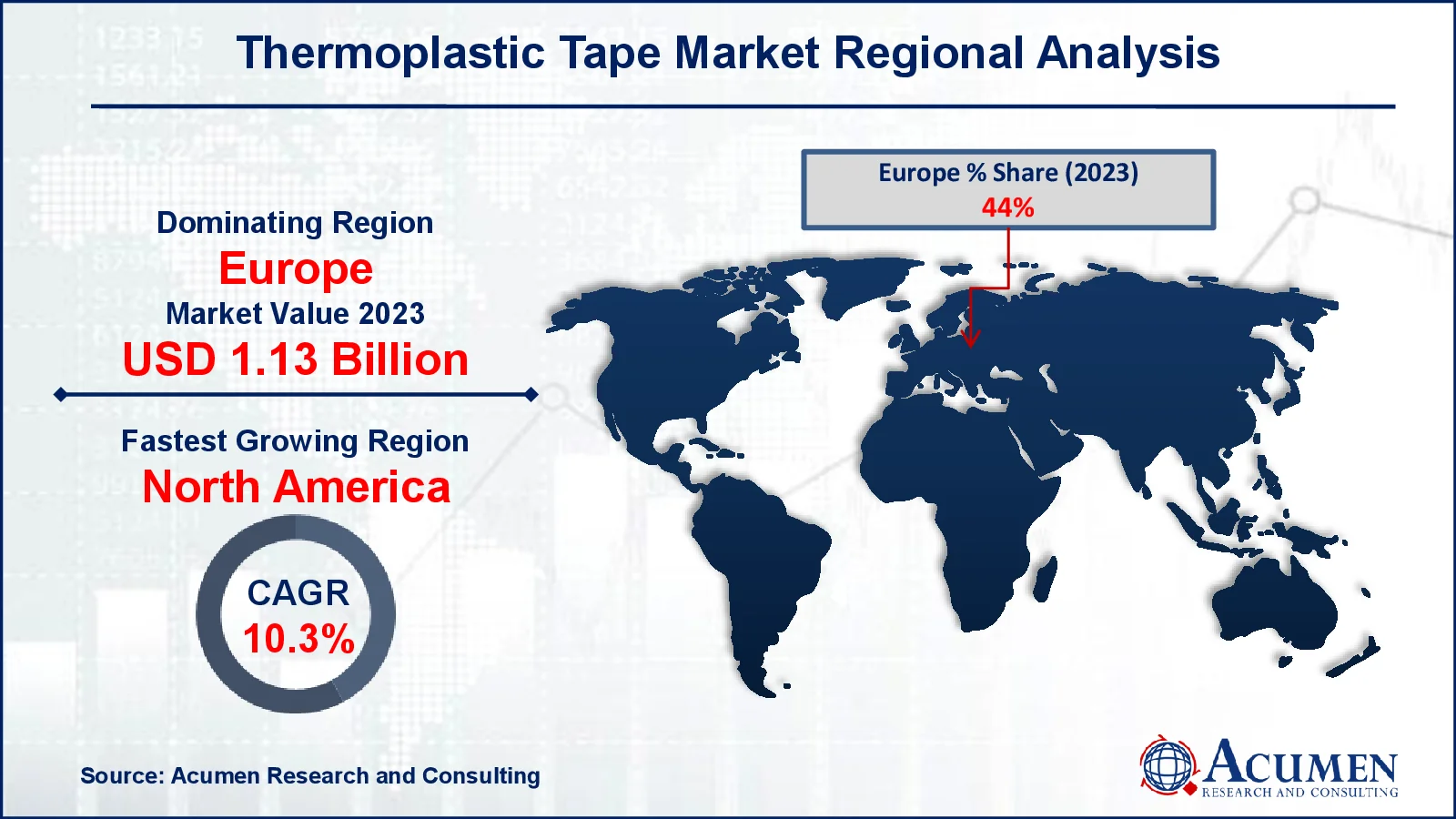

For several reasons, Europe dominates thermoplastic tape market due to better manufacturing techniques and rising demand for high-performance materials in industries like aerospace and automotive.

North America is expected to grow in industry. The region's well-established infrastructure, paired with strict requirements for lightweight and durable materials, contributes to its success. For example, the US Environmental Protection Agency states that the Biden-Harris Administration's 2024 Infrastructure Week coincides with $11.5 billion in water infrastructure investments reaching state funding programs around the country under the Investing in America program. This investment has the potential to stimulate the North American thermoplastic tape market by raising demand for long-lasting, corrosion-resistant materials like thermoplastic tapes used in water systems and other infrastructure projects.

The Asia-Pacific area is predicted to expand most rapidly during the projection period. Rapid development and rising purchasing power in emerging markets like China and India are propelling market growth. For example, the output of the equipment manufacturing sector increased by 6.8 percent year on year in 2023, outpacing the total industrial production growth rate. Furthermore, the region's robust automotive industry contributes significantly to market growth.

Some of the top thermoplastic tape companies offered in our report include Mitsui Chemicals, Ensinger, Suprem SA, Fibrtec, Evonik Industries, Shindo Co. Ltd., Barrday Inc., Teijin, Suzhou Noen, Mitsubishi Chemical, LANXESS, SGL Carbon, Covestro, Toray, and Victrex.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2020

April 2020

September 2022

June 2017