January 2020

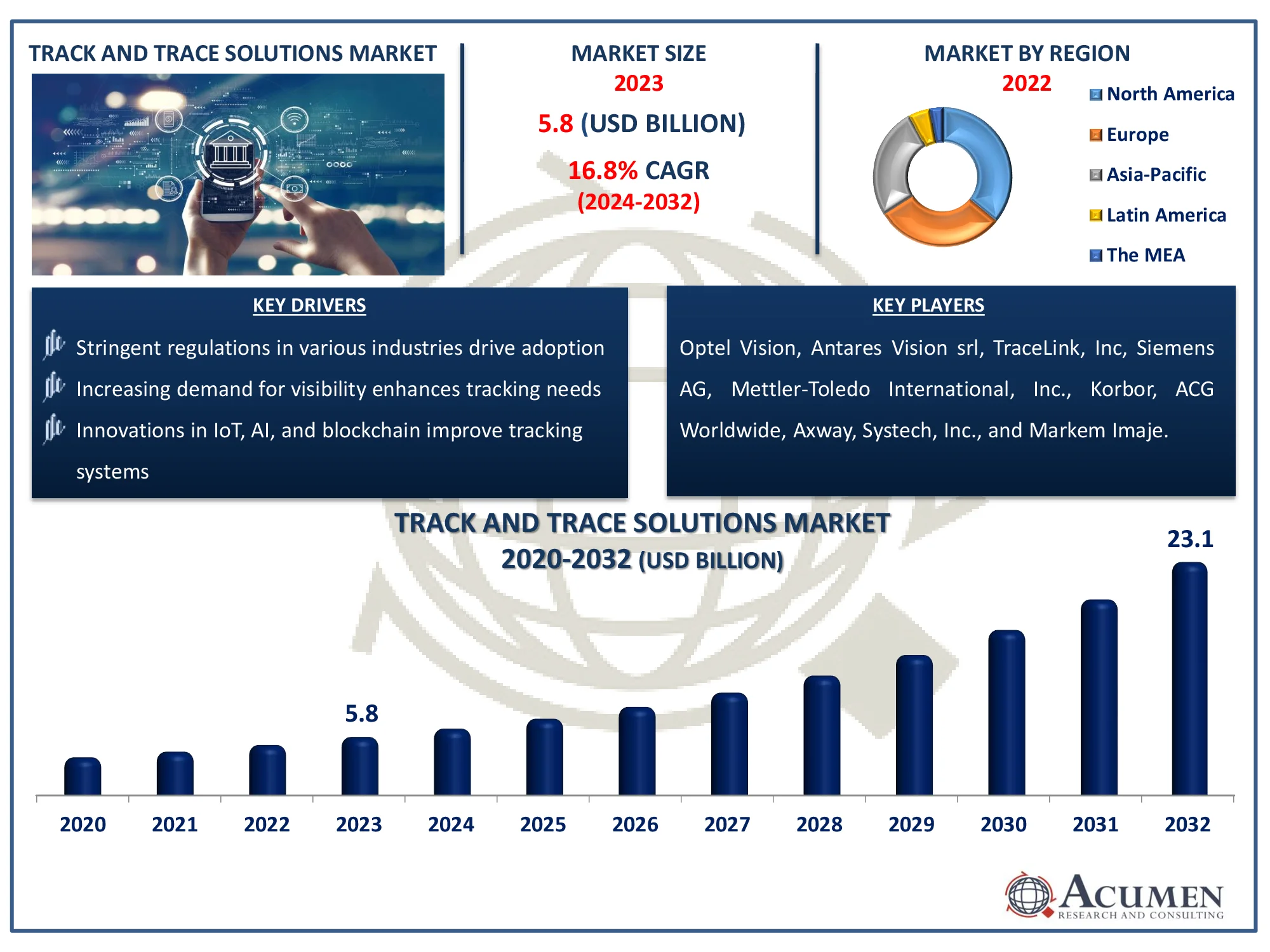

The Global Track and Trace Solutions Market is expected to expand from USD 5.8 billion in 2023 to USD 23.1 billion by 2032, growing at a CAGR of 16.8%.

The Global Track and Trace Solutions Market Size accounted for USD 5.8 Billion in 2023 and is estimated to achieve a market size of USD 23.1 Billion by 2032 growing at a CAGR of 16.8% from 2024 to 2032.

Track and Trace Solutions Market (By Product Type: Hardware Systems, Software Solutions; By Technology: RFID, Barcode; By Application: Serialization solutions, Aggregation Solutions; By End-User: Pharmaceutical Companies, Consumer Packaged Goods, Medical device Companies, Luxury Goods, Food and Beverage, Other Healthcare End-Users; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Track and Trace Solutions Market Highlights

Track and trace solutions provide detailed cross-border shipping data and are widely used globally to track specific products or shipments. The track and trace solutions include a label with each business unit's name, a code with a serial number, and an obvious product seal. Tracking and tracing technologies are gaining traction in the medical device sector because they provide accurate data on device location when needed. With the increasing usage of these alternatives by medical device and pharmaceutical businesses, the tracking and tracing solutions market has a promising future. The track market is expected to grow in the near future as these alternatives are quickly adopted globally.

Global Track and Trace Solutions Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Track and Trace Solutions Market Report Coverage

| Market | Track and Trace Solutions Market |

| Track and Trace Solutions Market Size 2022 |

USD 5.8 Billion |

| Track and Trace Solutions Market Forecast 2032 | USD 23.1 Billion |

| Track and Trace Solutions Market CAGR During 2023 - 2032 | 16.8% |

| Track and Trace Solutions Market Analysis Period | 2020 - 2032 |

| Track and Trace Solutions Market Base Year |

2022 |

| Track and Trace Solutions Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Optel Vision, Antares Vision srl, TraceLink, Inc, Siemens AG, Axway, Mettler-Toledo International, Inc., Korbor, ACG Worldwide, Systech, Inc., and Markem Imaje. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Track and Trace Solutions Market Insights

The primary factors driving the market's growth include high serialization requirements and laws, an increased emphasis on brand protection by manufacturers, an increase in the number of packaging-related recalls, and development in the medical device sector. The bar code method has a wide range of uses in the healthcare industry, including hospitals, diagnostic laboratories, medical equipment, and pharmaceutical producers. A barcode allows medical organizations to keep patient information, precisely manage inventory and the provenance of medicines, and affix barcode labels to blood supplies to assist distinguish between various specimens. This barcode technology has been utilized for many years and continues to be used for monitoring.

In the healthcare industry, barcode technologies are gaining traction by assisting in the tracking of patient data and prescription information, improving stock management of medical supplies, and adding barcode labels to blood supplies to differentiate between specimens. Many public restrictions, as well as an increase in the frequency of counterfeit pharmaceuticals, have led to the implementation of bar code technology in the health sector. Additional benefits include increased stock visibility and less waste, smaller cost disparities and higher quality care, improved safety and conformance, and automated supply chain activities. Drug counterfeiting is one of the most significant difficulties that large pharmaceutical and biopharmaceutical firms face. As a result, healthcare organizations use follow-up and trace tactics to ensure that brands obtain their fair amount of brand recognition throughout supply chains.

Counterfeiting has taken many forms, including mislabeling medicines and products, forging a legitimate authorized product, and inappropriate sales of medicines containing active chemicals. These counterfeit pharmaceutical items frequently include harmful or alien substances. Tracking and tracking solutions are becoming more popular in the health care industry as they have the potential to significantly reduce this rising issue. This growing acceptance by pharmaceutical companies accelerates the growth of the trace and trace alternatives industry.

Pharmaceutical businesses are considering current and prospective anti-counterfeiting legislation, as well as medication traceability legislation. Many governments choose to apply the serialization standards. Regulatory compliance for serialization is increasingly becoming a priority for pharmaceutical manufacturers and supply chain partners around the world. Most advanced and developing countries have either adopted or are in the process of building a regulatory framework for serialization. Increased drug-related operations and supply chain inefficiencies prompt legislative action to protect the pharmaceutical supply chain.

Track and Trace Solutions Market Segmentation

The worldwide market for track and trace solutions is split based on product type, technology, application, end-user, and geography.

Track and Trace Solutions Product Type

According to the track and trace solutions industry analysis, software solutions dominate market because they offer real-time monitoring, data analytics, and easy interaction with current systems. These technologies provide supply chain visibility, ensure regulatory compliance, and improve operational efficiency. With the growing use of cloud-based platforms, software solutions become more scalable and flexible, making them perfect for industries such as pharmaceuticals and logistics. Furthermore, enhanced capabilities including as serialization, aggregation, and reporting drive their wider adoption in global supply chains.

Track and Trace Solutions Technology

According to the track and trace solutions industry analysis, barcode dominates in market. A barcode allows medical organizations to keep patient information, precisely manage inventory and the provenance of medicines, and affix barcode labels to blood supplies to assist distinguish between various specimens. This barcode technology has been utilized for many years and continues to be used for monitoring. In the healthcare industry, barcode technologies are gaining traction by assisting in the tracking of patient data and prescription information, improving stock management of medical supplies, and adding barcode labels to blood supplies to differentiate between specimens. Many public restrictions, as well as an increase in the frequency of counterfeit pharmaceuticals, have led to the implementation of bar code technology in the health sector.

Track and Trace Solutions Application

According to the track and trace solutions market forecast, serialization solutions dominate market, owing to regulatory requirements for product authenticity and supply chain transparency, particularly in the pharmaceutical and food sectors. These technologies provide unique product identification, improve traceability, and reduce the danger of counterfeiting. The rising emphasis on consumer safety and compliance with government laws is driving the deployment of serialization technologies.

Track and Trace Solutions End-User

According to the track and trace solutions market forecast, pharmaceutical businesses are the dominant end users in market due to severe regulatory requirements aimed at maintaining medicine safety, combating counterfeiting, and enhancing supply chain visibility. These technologies contribute to compliance with worldwide standards such as the Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive (FMD). Pharmaceutical companies use track and trace systems to improve product authenticity, streamline recalls, and maintain compliance, making them significant players in this sector.

Track and Trace Solutions Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Track and Trace Solutions Market Regional Analysis

For several reasons, because of the increasing prevalence of counterfeit medications in the region, developed economies such as North America will maintain their dominance in the tracking and tracking solutions market. The strong presence of advanced healthcare systems in the United States and Canada, emerging pharmaceutical and biotechnology businesses, and a burgeoning medical device sector are all major elements driving growth in North America. For instance, February 2023, DispatchTrack, a provider of last-mile delivery solutions, has added a new track and trace capability to its platform. This feature has been developed to take vast volumes of data, arrange it, and present it so that end users can obtain the information they need.

Furthermore, the Asia-Pacific region is experiencing strong expansion in the track and trace solutions market, owing to increased regulatory requirements for product serialization and rising demand for supply chain transparency in industries such as pharmaceuticals and healthcare.

In terms of income share, Europe is expected to see notable growth in market due to the existence of developed countries like Germany, Turkey, the United Kingdom, France, and Italy. To combat drug counterfeiting and theft, the European Union plans to gradually implement track and trace solutions for its health supply chain. Manufacturers who do not comply with drug serialization requirements will be barred from selling their products in Europe under the Falsified Medicines Directive.

Track and Trace Solutions Market Players

Some of the top track and trace solutions companies offered in our report include Optel Vision, Antares Vision srl, TraceLink, Inc, Siemens AG, Axway, Mettler-Toledo International, Inc., Korbor, ACG Worldwide, Systech, Inc., and Markem Imaje.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2020

April 2025

August 2024

January 2023