March 2024

Water Electrolysis Market (By Product: Proton Exchange Membrane, Alkaline Water Electrolysis, Solid Oxide Electrolyte (SOE); By End-Use: Chemicals, Electronics & Semiconductor, Power Plants, Petroleum, Pharmaceuticals, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

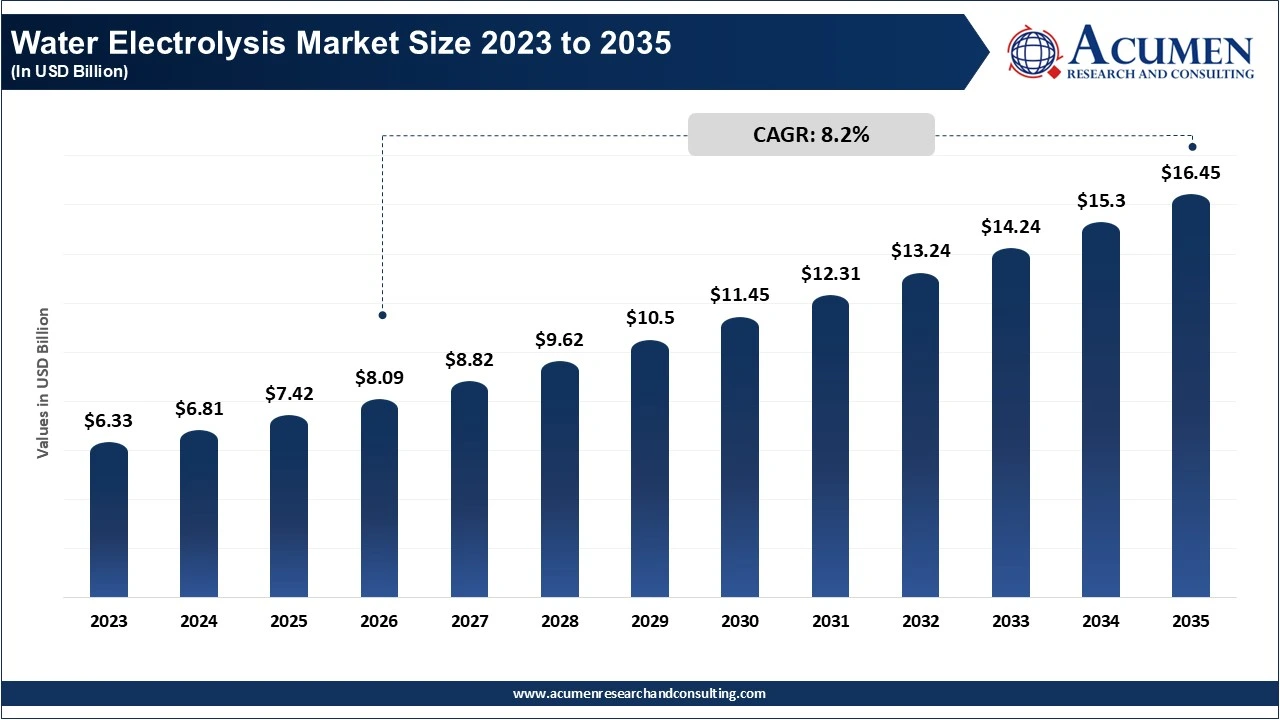

The global water electrolysis market size was accounted for USD 7.42 billion in 2025 and is estimated to surpass around USD 16.45 billion by 2035 growing at a CAGR of 8.2% from 2026 to 2035.

The significant growth of water electrolysis market is primarily driven by evolving landscapes of government and industrial investment in green hydrogen solutions for trading fossil fuels across power generation, mobility, & industrial applications. The rapid rise in the use of renewable energy (primarily solar & wind) has enabled large-scale deployments of electrolyzers supported by National Hydrogen Strategies across Europe, USA, China, India, & The Middle East. In addition, the demand for electrolyzers at utility scale is supported and stimulated by items like tax credits, subsidies, mechanisms related to carbon pricing, and public-private partnerships around Hydrogen.

Another major growth is technological advancements such as increased efficiency of PEM, Alkaline & Solid Oxide Electrolyzes. The combination of continued decreasing costs, and improving manufacturing capabilities associated with renewable energy, are making electrolysis cost-competitive, as these same sectors transform to utilize green hydrogen to accomplish net-zero objectives and adhere to environmental standards and regulations. Moreover, increasing corporations' commitments toward sustainability and efficiency, the increasing need for energy storage, and new uses for hydrogen-fuel-cell vehicles represent additional commercial opportunities for water electrolysis systems globally.

The market for electrolysis of electrowater includes devices utilizing technology to break down the hydrogen and oxygen molecules in water, through the application of electric current to separate both gases (H2 and O2) from each other. As such, this is one of the most significant sources for producing 'green hydrogen, as such processes powered by solar energy or wind turbines are considered to be the cleanest methods.

| Area of Focus | Details |

| Water Electrolysis Market Size 2025 | USD 7.42 Billion |

| Water Electrolysis Market Forecast 2035 | USD 16.45 Billion |

| Water Electrolysis Market CAGR During 2026 - 2035 | 8.2% |

| Segments Covered | By Product, By End-Use, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Teledyne Energy Systems Inc. Ltd, Hitachi Zosen Corporation, ITM Power PLC, ThyssenKrupp AG, Asahi Kasei Corporation, Cummins Inc., Nel ASA, Plug Power Inc., Toshiba Energy Systems & Solutions Corporation, Siemens Energy AG, ShaanXi HuaQin, and Suzhou Jingli. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for water electrolysis is split based on product, end-use, and geography.

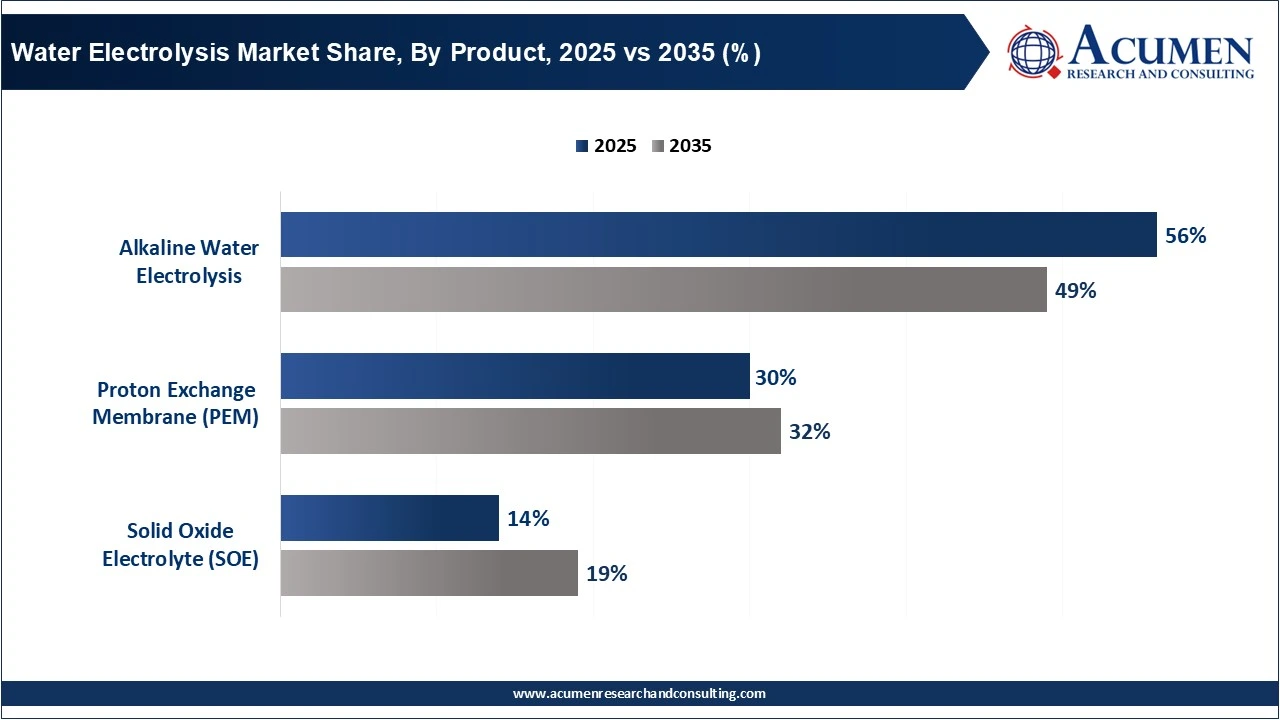

Alkaline water electrolysis dominates the market due to its established technology, low cost of installation, and long operational life. The use of inexpensive catalysts in the process allows for stable hydrogen production which is well suited for large capacity applications, such as ammonia production, and chemical processing (including fuel cells). The reliability of alkaline water electrolysis, and cost effectiveness have made this method the preferred choice of developers of utility scale green hydrogen projects worldwide throughout regions that continue to expand in renewable energy capacity.

| Product | Market Share (%) | Key Highlights |

| Alkaline Water Electrolysis | 56% | Most widely used due to low cost, mature technology, and long operational life, ideal for large-scale hydrogen production in industrial sectors. |

| Proton Exchange Membrane (PEM) | 30% | Highly efficient, compact, and responsive to renewable fluctuations, preferred for green hydrogen refueling, mobility, and decentralized energy systems. |

| Solid Oxide Electrolyte (SOE) | 14% | Offers very high efficiency and uses waste heat from industries, gaining interest in heavy industrial applications despite early commercialization stage. |

Solid Oxide Electrolyte electrolyzers are the fastest-growing segment, driven by rapidly in solid oxide electrolyte electrolysis systems is the high efficiency and capability to produce hydrogen at very high temperature levels. Due to their dual energy input capability (electricity and waste heat), SOE electrolysis technologies can produce low carbon hydrogen at significantly lower costs than traditional methods and at higher efficiencies. SOE electrolysers are being quickly adopted by large industries including heavy industrial processes where high-volume demand for low carbon hydrogen exists, particularly the steel, cement and chemicals industries. As an emerging technology, substantial investment in research and development (R&D) and pilot projects is helping to speed up its progress towards commercialisation.

The chemicals sector dominates the water electrolysis market due to hydrogen is primarily consumed for the production of ammonia, methanol and other chemical raw materials. Historically reliant on hydrogen derived from fossil fuels, chemical manufacturers are quickly aligning themselves with renewable hydrogen options to minimize their carbon footprint and meet global regulations for cleaner manufacturing practices. Chemical manufacturers in this segment have a large-scale operation, a steady demand for hydrogen and growing interest in investing in projects for green ammonia and green methanol products, which will contribute to their continued dominance in terms of total market share in the future.

| End User | Market Share (%) | Key Highlights |

| Chemicals | 42% | Major consumer of hydrogen for ammonia, methanol, and chemical feedstocks; strong shift from grey to green hydrogen maintains high market share. |

| Power Plants | 18% | Growing rapidly for renewable energy storage, hydrogen-fired turbines, and grid balancing, driven by large-scale utility hydrogen projects. |

| Petroleum / Refining | 15% | Hydrogen used for desulfurization and hydrocracking; adoption of green hydrogen increases with global emission regulations. |

| Electronics & Semiconductor | 10% | Requires ultra-pure hydrogen for wafer cleaning, annealing, and fabrication processes; demand rises with global semiconductor manufacturing growth. |

| Pharmaceuticals | 8% | Used in hydrogenation reactions, drug synthesis, and clean-room applications; adoption increases due to high-purity onsite hydrogen needs. |

| Others | 7% | Includes metals, food processing, research labs, and emerging mobility applications; smaller share but gradually expanding across varied industries. |

Power plants are the fastest-growing end-use segment due to the increasing demand for grid balancing and large-scale energy storage in renewable energy-rich generation systems. Electrolyzers allow for the conversion of solar and wind energy into hydrogen. These hydrogen fuels can be stored and then utilized in either turbine generators or fuel cells as a means of stabilizing electric delivery. Countries that support hydrogen production through electrolyzers for instance are now aggressively implementing strategies of co-firing with natural gas and developing long-duration energy storage. Thus the large volume of hydrogen being created allows for the fastest growing sector of all consumer electric generation facilities to include electrolyzers.

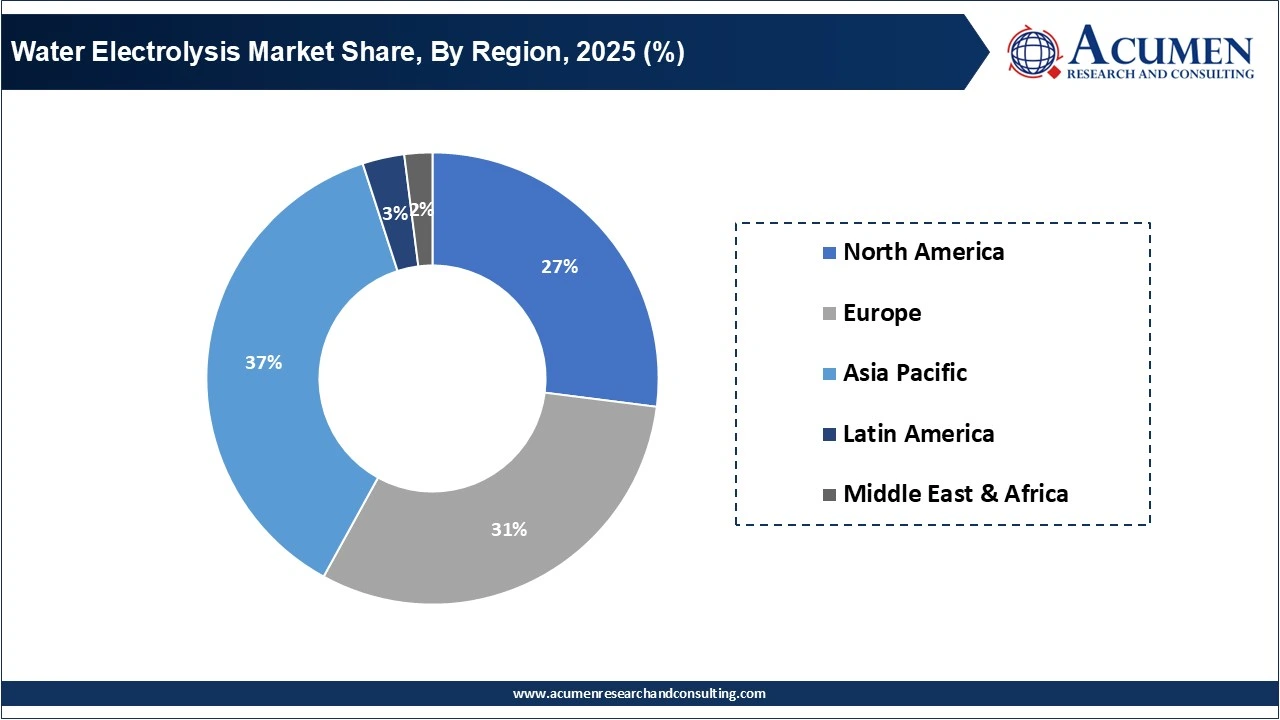

Asia Pacific is leading the water electrolysis market, driven by government policy support for renewable energy development, a growing demand for green hydrogen among industry users, and the rapid expansion of renewable energy throughout these countries. Countries such as China, Japan, South Korea, India and Australia have invested heavily in the development of electrolyzers, hydrogen infrastructure, and very large green hydrogen production facilities. China has developed into a global leader in the manufacturing of low-cost electrolyzers. Japan and South Korea have made strides towards increasing the use of hydrogen in the transportation and energy generation sectors, and India and Australia are developing multiple projects at the gigawatt level (GW) using their abundant solar and wind energy resources.

The North America region has significant growth in water electrolysis market, primarily driven by a combination of governmental backing for Clean Hydrogen initiatives, increased deployment of Renewable Energy on a large scale, and high levels of investment from both private and public sectors in this industry. Currently, the United States has the largest share of the North American market with several large Hydrogen Hubs, benefits available to producers of Green Hydrogen through the Inflation Reduction Act (IRA), and large amounts of funding going to manufacture electrolyzers and to develop Green Hydrogen Infrastructure. The North American leadership position is also assisted by the presence of advanced developers of technology within this sector. Both a strong demand for Industrial Use, and the rapid pace of the adoption of Green Hydrogen by refineries, chemical companies, and companies involved in Generation of Power also play a role. Additionally, Canada is focused on Low-Carbon Hydrogen and has an abundance of Renewable Energy Sources available for production of Green Hydrogen, which helps to solidify North America's position in market.

By Product

By End-Use

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2024

September 2023

February 2024

May 2024