March 2023

The Global Alkaline Water Electrolysis Market Size accounted for USD 162.6 Million in 2024 and is estimated to achieve a market size of USD 628.5 Million by 2033 growing at a CAGR of 16.4% from 2025 to 2033.

The Global Alkaline Water Electrolysis Market Size accounted for USD 162.6 Million in 2024 and is estimated to achieve a market size of USD 628.5 Million by 2033 growing at a CAGR of 16.4% from 2025 to 2033.

Alkaline water electrolysis (AWE) is a well-known method of creating hydrogen by splitting water with an electric current in an alkaline solution, usually potassium hydroxide. It works by conducting electricity between two electrodes in the alkaline electrolyte, an anode and a cathode separated by a diaphragm.

This process produces hydrogen gas at the cathode and oxygen at the anode, making it a clean and sustainable hydrogen generation method when fueled by renewable energy. Alkaline water electrolysis is praised for its comparatively low cost, durability, and capacity to operate at large scales, although it confronts issues with dynamic power inputs and efficiency when compared to newer technologies.

|

Market |

Alkaline Water Electrolysis Market |

|

Alkaline Water Electrolysis Market Size 2024 |

USD 162.6 Million |

|

Alkaline Water Electrolysis Market Forecast 2033 |

USD 628.5 Million |

|

Alkaline Water Electrolysis Market CAGR During 2025 - 2033 |

16.4% |

|

Alkaline Water Electrolysis Market Analysis Period |

2021 - 2033 |

|

Alkaline Water Electrolysis Market Base Year |

2024 |

|

Alkaline Water Electrolysis Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Green Hydrogen Systems, Cummins, Enaex, SunHydrogen, Asahi Kasei, McPhy Energy, Teledyne CARES, ITM Power, Thyssenkrupp Uhde Chlorine Engineers, and NEL Hydrogen. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Green hydrogen is gaining popularity as a cleaner alternative to fossil fuels in important industries like steel, chemicals, and power generation. For example, to help speed this transition, the Green Hydrogen Organisation has made seven strategic suggestions targeted at raising demand for green hydrogen-based products. These include setting emissions standards aligned with net-zero goals, implementing strict product mandates and quotas, scaling up support schemes for hydrogen production and use, building high-quality hydrogen infrastructure, accelerating the development of hydrogen hubs and corridors, leveraging public procurement, removing regulatory barriers to project approval, and promoting book and claim systems in emerging applications. These activities are likely to greatly increase demand for green hydrogen, hence stimulating growth in the alkaline water electrolysis market through regulatory backing and infrastructure investment in efficient electrolysis technology.

However, a significant obstacle remains: the high electricity consumption of electrolyzers makes green hydrogen production expensive, particularly in areas where renewable energy is scarce or not economically viable. This cost barrier continues to prevent widespread commercial deployment.

On a worldwide scale, major projects are opening the way for new prospects. In 2023, the US Department of Energy announced $7 billion in funding for the establishment of seven Regional Clean Hydrogen Hubs, which will improve hydrogen production, distribution, and use across industries as part of a larger drive to achieve net-zero emissions and expand the clean energy economy.

Similarly, Ulsan Green Hydrogen Town in South Korea is establishing itself as a hydrogen city model, with plans to construct hydrogen pipelines, vehicle and ship filling facilities, and residential hydrogen fuel cell systems. Ulsan wants to be at the forefront of sustainable hydrogen use in the transportation, industrial, and residential sectors by 2025. This global expansion of hydrogen hubs and pilot projects creates a tremendous potential for the alkaline water electrolysis industry, as demand for scalable and cost-effective hydrogen generation technology grows.

The worldwide market for alkaline water electrolysis is split based on type, application, and geography.

According to alkaline water electrolysis industry analysis, the < 50 m³/h segment leads the industry due to its appropriateness for small- to medium-scale hydrogen generation. These systems are appropriate for pilot projects, research applications, and locally sourced energy solutions. Their small size and modest capital commitment make them appealing to early adopters and emerging markets. They also make it easier to integrate decentralized renewable energy sources such as solar and wind.

According to alkaline water electrolysis market forecast, the power plants category dominates the market, accounting for around 30% of worldwide revenue by 2024. This dominance stems from the increased need to decarbonize energy generation through green hydrogen integration. Alkaline electrolyzers are increasingly being used in power plants to generate hydrogen for energy storage, grid balancing, and as a clean fuel for turbines, which improves both sustainability and operational flexibility.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

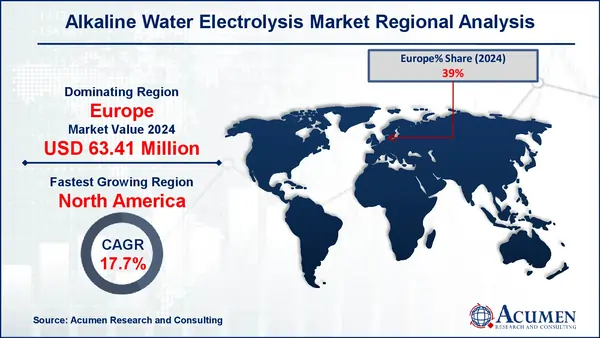

In terms of regional segments, Europe leads the alkaline water electrolysis market, owing to rising industrial demand and strong government-led hydrogen plans. For example, the UK government intends to achieve up to 10 GW of low-carbon hydrogen production capacity by 2030, with at least 5 GW coming from electrolytic hydrogen. This effort addresses expanding hydrogen demand in important industries such as industrial, power, heat, and transportation, which could require up to 40 TWh of hydrogen by 2030. The Hydrogen Allocation Rounds (HAR2, HAR3, and HAR4), which collectively aim more than 2.3 GW, establish a stable policy framework that promotes industrial investment and the advancement of electrolysis technologies. Such measures considerably increase demand for alkaline water electrolysis devices.

North America is also expected to see considerable growth in the alkaline water electrolysis market, thanks to significant government support, well-developed energy infrastructure, and huge clean hydrogen expenditures. For example, the Infrastructure Investment and Jobs Act (IIJA) of 2021 earmarked $8 billion to build Regional Clean Hydrogen Hubs, which aim to improve hydrogen production, storage, and distribution. Furthermore, collaborations between energy corporations and research institutes are driving innovation and increasing market adoption.

Some of the top alkaline water electrolysis companies offered in our report include Green Hydrogen Systems, Cummins, Enaex, SunHydrogen, Asahi Kasei, McPhy Energy, Teledyne CARES, ITM Power, Thyssenkrupp Uhde Chlorine Engineers, and NEL Hydrogen.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

December 2025

March 2024

December 2024