April 2024

Airport Security Market (By Security Type: Cyber Security, Perimeter Security, Access Control, Screening, Surveillance, Others; By Location: Terminal side, Airside, Landside; By System: Metal Detectors, Backscatter X-Ray Systems, Cabin Baggage Screening Systems, Fiber optic Perimeter Intrusion, Others; By Airport Model: Airport 3.0, Airport 4.0, Airport 2.0; By Airport Class: Class B, Class C, Class A) - Global Industry Analysis, Size, Share, Analysis, Trends and Forecast 2026 - 2035

The global airport security market size was valued at USD 16.34 billion in 2025 and is projected to reach USD 37.84 billion by 2035, expanding at a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2026 to 2035.

The growth of the airport security market is primarily driven by the increasing passenger traffic on airlines is leading to ongoing developments in airports all over the world. While at the same time, governments and airport officials are reacting to an increase in security issues, such as terrorism, smuggling, and cyber risks, by requiring airports to take drastic steps to improve security after numerous terrorist incidents in recent years. The imposition of international aviation security standards, therefore, is accelerating the use of advanced screening, surveillance, and access control technology throughout many airports worldwide.

Furthermore, the another growth factors such as the introduction of artificial intelligence-based screening, biometric authentication systems, automated surveillance systems, and cyber security technologies, continued advancements to technology will continue to drive growth in the airport security equipment and technology market as an increasing number of airports adopt these technologies as part of their efforts to create smart airports, invest in modernizing existing security systems, and invest in digital security and perimeter security over time.

The airport security market comprises technologies, systems, and services that provide security to airports, passengers, aircraft, and Infrastructure from various types of security threats, including terrorism, cyberattacks, and unauthorized entry.

Technological Advancements in Airport Security Systems

Increasing Government Regulations and Aviation Security Initiatives

High Capital Investment and Infrastructure Modernization Costs

Data Privacy Concerns and Regulatory Compliance Challenges

Growth of Smart Airports and Digital Security Ecosystems

Expansion of Airport Infrastructure in Emerging Economies

| Attributes | Details |

| Airport Security Market Size 2025 | USD 16.34 Billion |

| Airport Security Market Forecast 2035 | USD 37.84 Billion |

| Airport Security Market CAGR During 2026 - 2035 | 8.8% |

| Analysis Period | 2023 - 2035 |

| Base Year | 2025 |

| Forecast Data | 2026 - 2035 |

| Segments Covered | By Security Type, By Location, By System, By Airport Model, By Airport Class, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Honeywell International Inc., Siemens AG, Robert Bosch GmbH, Axis Communication AB, Thales Group, American Science and Engineering Inc., Amadeus, Genetec Inc., Elbit Systems Ltd., SITA, Raytheon Technologies, and Hitachi Limited. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

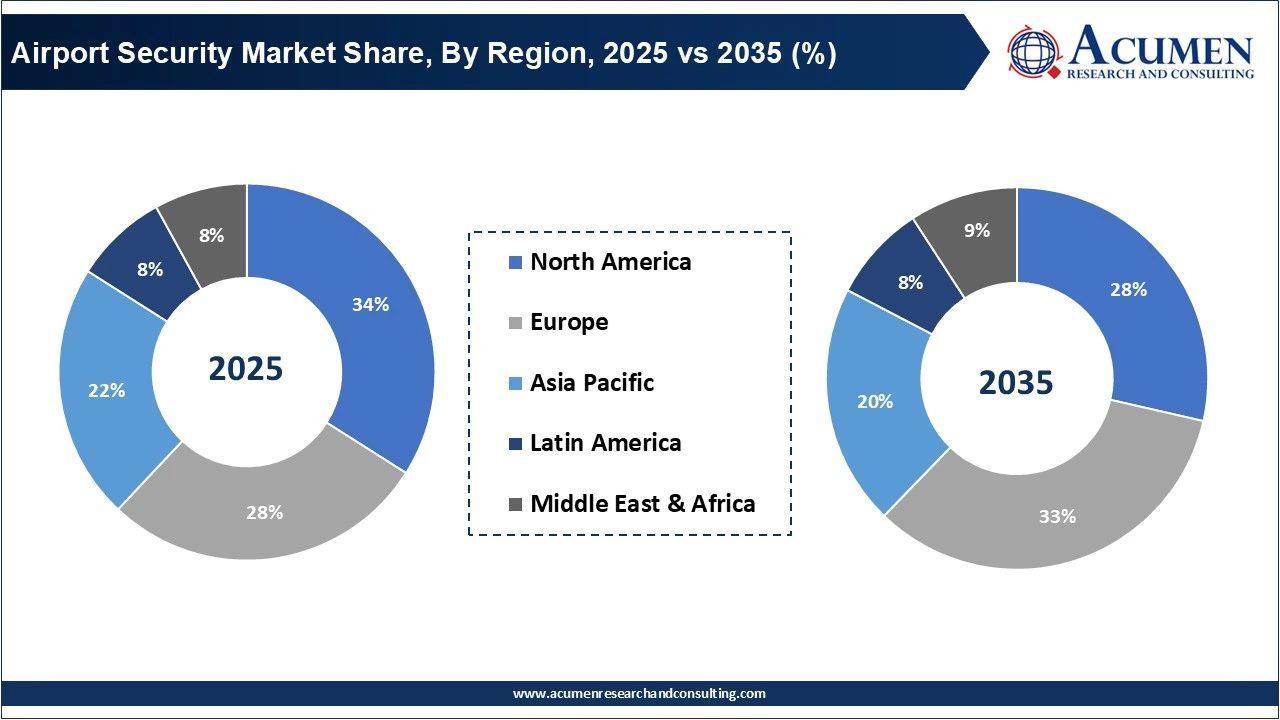

North America dominates the global airport security market because of the highly developed aviation infrastructure, the heavy volume of air passengers utilizing the regional air travel system, and the strict aviation security. As an early adopter of innovative types of security technology, such as biometric scanning, artificial intelligence-based surveillance systems, cyber security-related products, and integrated access control systems, the North American region has an advantage over many other regions in terms of the airport security market. Coupled with continued investment in airport modernization programs and support from the U.S. federal government, the North American region and its dominant market position will continue to expand.

Asia Pacific is the fastest-growing region in the airport security market, due to a growing number of airports being constructed and expanded, as well as strong demand for increased air travel in Asia's developing economies. Additionally, airport authorities are providing significant funding for enhanced airport safety and smart airport initiatives, as well as building modern aviation security infrastructure to accommodate these increasing demands. The increase in the use of advanced screening technology, innovative perimeter security solutions, and digital surveillance is driving the growth rate of this industry in the Asia-Pacific region.

The worldwide market for airport security is split based on security type, location, system, airport model, airport class, and geography.

Cyber security holds the largest share of the airport security market mainly because of the increasing digitization of airport commerce and the widespread use of IT networks, communication systems, and passenger management systems that are interoperable and accessible to the public. All airports keep confidential information regarding both operational processes and passengers, which makes cyber protection necessary. Ongoing investments in network security, threat monitoring, and data protection services and products have maintained the strong dominance of this industry sector.

| Security Type | Market Share, 2025 (%) | Key Highlights |

| Cyber Security | 32% | Dominant due to rising cyber threats, digital airport operations, and protection of passenger and operational data. |

| Perimeter Security | 24% | Fastest-growing driven by airport expansion, intrusion risks, and deployment of advanced boundary protection systems. |

| Access Control | 15% | Adoption supported by biometric authentication and secure workforce movement management. |

| Screening | 12% | Sustained demand from regulatory mandates for passenger, baggage, and cargo inspection. |

| Surveillance | 10% | Growth supported by AI-enabled video analytics and real-time monitoring needs. |

| Others | 7% | Includes command-and-control, communication, and emergency response systems. |

Perimeter security segment is largely growth of the market due to an increased focus on runway security, restricted-access zones, and outer-perimeter protection at airports. Increased risks of intrusion, unauthorized access, and other external threats are driving the use of better fenced designs, electronic sensor systems, and advanced radar and intrusion detection systems in both new and expanding airport environments.

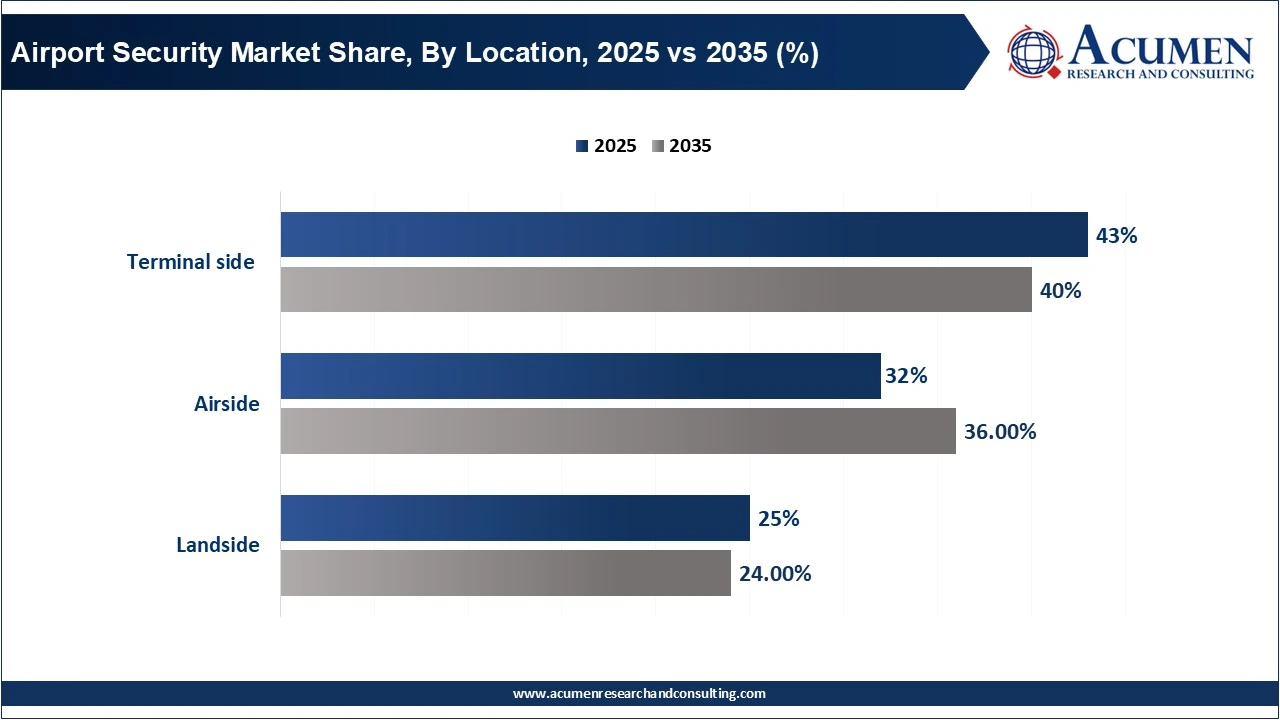

Terminal security segment led the market to focus on high concentrations of station visitors, baggage handling, and access points to an airport terminal. Most of the security activities within an airport terminal take place through passenger screening, baggage inspection, video surveillance, and restricted access control. Aviation security regulations and the efficient management of large aircraft, as well as a lot of passengers through your terminal, have resulted in significant investment in the development of terminal-side security infrastructure at airports around the world.

| Location | Market Share, 2025 (%) | Key Highlights |

| Terminal Side | 43% | Dominant due to high passenger concentration, screening, baggage handling, and access control deployment. |

| Airside | 32% | Fastest-growing driven by aircraft safety, runway protection, and restricted area monitoring. |

| Landside | 25% | Growth supported by crowd management and public-area surveillance requirements. |

Security of the airside of an airport is one of the fastest-growing segments of the airport security market. The increasing focus on the protection of aircraft, runways, taxiways, and Restricted Operational Areas (ROAs) has resulted in an increase in demand for integrated advanced surveillance, access control, and perimeter monitoring systems deployed within airport airside areas. Due to the increase in aircraft movements, expansions at airports, and heightened concerns for safety, these investments are being made to continue developing the required technologies to enhance aircraft safety and prevent anyone from accessing these types of areas without proper clearance.

Metal detectors continue to be the dominant segment in the airport security industry due to their broad acceptance by governments, low cost, and requirement for passenger screening. Airports use these devices to identify prohibited metal items prior to boarding an aircraft, and most security procedures for air travel include the use of metal detectors. Metal detectors are the leading technology worldwide in aviation security because of their reliability, ease of use, and the requirement for their inclusion in airport security protocols.

| System | Market Share, 2025 (%) | Key Highlights |

| Metal Detectors | 35% | Dominant due to regulatory acceptance, cost efficiency, and widespread deployment. |

| Backscatter X-Ray Systems | 25% | Fastest-growing driven by improved threat detection and faster passenger throughput. |

| Cabin Baggage Screening Systems | 20% | Demand supported by explosives detection and carry-on baggage screening mandates. |

| Fiber Optic Perimeter Intrusion | 12% | Growing use for real-time perimeter breach detection across large airports. |

| Others | 8% | Includes emerging and auxiliary screening and detection systems. |

Backscatter X-ray systems are the fastest-growing segment among all scanning devices in the market because airports are upgrading their technology to detect threats better and handle more passengers efficiently. Backscatter X-ray systems offer high-tech imaging capabilities that allow for greater efficiency in identifying threats more effectively. With large investments being made to improve and modernize the security screening processes and increased demand for quicker, more accurate security checks at busy airports, backscatter X-ray system adoption continues to grow rapidly.

Airport 3.0 industry dominates the current airport market. Today, airports are built on semi-digitalized, passenger-focused infrastructures, using a combination of conventional airport security with some level of digital automation to enable increased safety and operational efficiencies. Airport 3.0 continues to be a strong provider in the airport security solutions market due to the ongoing enhancements to the airport security systems as well as ongoing retrofits to provide current technology.

| Airport Model | Market Share, 2025 (%) | Key Highlights |

| Airport 3.0 | 50% | Dominant due to widespread semi-digital, passenger-centric airport infrastructure. |

| Airport 4.0 | 35% | Fastest-growing driven by smart airport initiatives, AI, automation, and digital security platforms. |

| Airport 2.0 | 15% | Gradually declining but still present in developing and regional airports. |

The Airport 4.0 model is one of the rapidly evolving segments in the market to be enhanced by the use of smart technologies, automated systems, and a digital-based approach to airport security. Many airports are seeing better results by investing more in future airport design and development, as well as meeting the growing need for smart-connected airports, by using AI-powered CCTV for surveillance, biometrics for identifying passengers, and digital platforms with data analytics to make security management more efficient.

The airport security market is led by Class B airports segment, which experience the most passenger traffic and require security to support all terminal areas and operational zones. Class B airports provide a combination of high volume of operations & regulatory compliance, resulting in continuing demand for statewide security equipment, such as advanced screening, surveillance, & access control, due to continual operations & a 1:1 ratio of equipment & use. Class B airports' volume supports ongoing investment in airport security infrastructure, so they will continue to be a dominant force in the airport security market.

| Airport Class | Market Share, 2025 (%) | Key Highlights |

| Class B | 45% | Dominant due to high passenger volume and comprehensive security requirements. |

| Class C | 35% | Fastest-growing supported by regional airport expansion and domestic air travel growth. |

| Class A | 20% | Stable demand driven by international traffic and advanced security standards. |

Class C airports are experiencing the fastest-growing segment of the airport security market. Driven by increasing demand for domestic air travel, advancements in regional connectivity initiatives, and investments from local and national governments in developing airports across the country, Class C airports are upgrading their security infrastructure to comply with international safety regulations. Continuous upgrades of regional aviation network systems and increasing security awareness of smaller airports are major contributors to the rapid growth of Class C airports.

By Security Type

By Location

By System

By Airport Model

By Airport Class

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2024

July 2024

May 2023

May 2025