August 2024

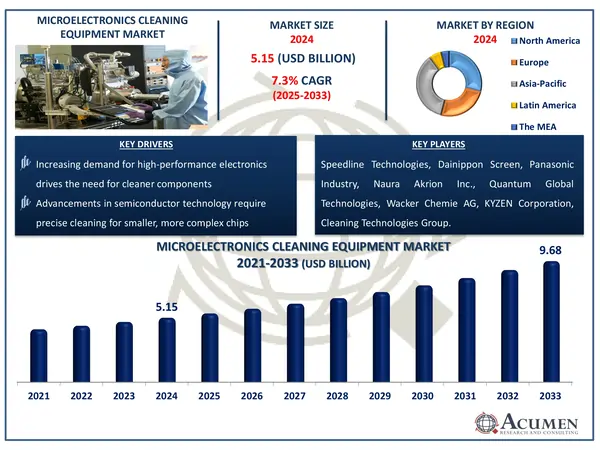

The Global Microelectronics Cleaning Equipment Market Size accounted for USD 5.15 Billion in 2024 and is estimated to achieve a market size of USD 9.68 Billion by 2033 growing at a CAGR of 7.3% from 2025 to 2033.

The Global Microelectronics Cleaning Equipment Market Size accounted for USD 5.15 Billion in 2024 and is estimated to achieve a market size of USD 9.68 Billion by 2033 growing at a CAGR of 7.3% from 2025 to 2033.

Microelectronics cleaning equipment is specialized tools and machinery used in the semiconductor industry to remove impurities, particles, or residues from microelectronic components such as chips and circuit boards during the manufacturing or assembly process. This equipment often uses procedures like chemical cleaning, ultrasonic waves, or high-pressure water jets to ensure that the components are free of dirt, oils, or other undesired elements.

The Institute of Electrical and Electronics Engineers (IEEE) Xplore emphasizes the growing relevance of cleaning in microelectronics as a result of improved downsizing, quicker processing rates, and smaller circuit board layouts. This need is exacerbated by the demand for greater dependability in key applications such as automotive and medical devices. Furthermore, the application of ISO 14000 standards has made cleaning necessary at all stages of the technological process, including the use of lead-free solders. Vapor cleaning technologies, which need complicated and expensive equipment to comply with environmental standards, are often kept for specialized applications, increasing demand for advanced microelectronics cleaning solutions and contributing to market expansion.

|

Market |

Microelectronics Cleaning Equipment Market |

|

Microelectronics Cleaning Equipment Market Size 2024 |

USD 5.15 Billion |

|

Microelectronics Cleaning Equipment Market Forecast 2033 |

USD 9.68 Billion |

|

Microelectronics Cleaning Equipment Market CAGR During 2025 - 2033 |

7.3% |

|

Microelectronics Cleaning Equipment Market Analysis Period |

2021 - 2033 |

|

Microelectronics Cleaning Equipment Market Base Year |

2024 |

|

Microelectronics Cleaning Equipment Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Operational Mode, By Technology, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Speedline Technologies, Dainippon Screen, Panasonic Industry, Naura Akrion Inc., Quantum Global Technologies, Wacker Chemie AG, KYZEN Corporation, Cleaning Technologies Group, Ultrasonic Power Corporation, Rena Technologies, Semitorr Group Inc., Axus Technologies, Axcelis Technologies, and Ultra T Equipment Company. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The semiconductor industry's rapid expansion, fuelled by advances in consumer electronics, automotive technologies, and the internet of things (IoT), is creating a great demand for efficient microelectronics cleaning equipment to assure high-quality manufacturing. For example, on May 5, 2025, the Semiconductor Industry Association (SIA) announced global semiconductor sales of $167.7 billion in Q1 2025, up 18.8% over the same period in 2024.

Plasma and ultrasonic cleaning are two innovative technologies that improve the precision and effectiveness of microelectronics cleaning procedures. These solutions contribute to market growth by providing more efficient and ecologically friendly options. According to the American Institute of Physics (AIP), plasma cleaning is essential for eliminating organic impurities and enhancing surface characteristics, making it a suitable non-destructive approach for fragile semiconductor components.

However, the high expense of modern cleaning equipment, particularly in semiconductor applications, creates a barrier to adoption, especially for smaller businesses with restricted budgets.

Emerging areas such as Asia-Pacific and Latin America provide considerable prospects for industry expansion as electronics demand rises. According to Invest India, the Indian government increased allocations for the electronics sector from ₹5,747 crore in 2024-25 to ₹8,885 crore in 2025-26. Furthermore, the Ministry of Electronics and Information Technology (MeitY) expects India's electronics market to reach $300 billion by 2025-26, driving up need for microelectronics cleaning equipment.

The worldwide market for microelectronics cleaning equipment is split based on type, operational mode, technology, application, and geography.

According to microelectronics cleaning equipment industry analysis, microelectronics cleaning equipment market includes various types of systems, each serving a unique role in semiconductor manufacturing. Batch cleaning equipment enables high-throughput processing, while single-wafer cleaning offers precision for advanced nodes. Scrubber systems and spray cleaners remove particles and residues efficiently, while plasma and ultrasonic cleaners provide deep, non-contact cleaning for delicate surfaces. Together, these technologies ensure optimal wafer cleanliness; essential for high-yield and defect-free chip production.

According to operation mode, in the microelectronics cleaning equipment market, operational modes play a key role in efficiency and precision. Single system mode provides individualized cleaning for each wafer, ensuring high accuracy and reduced cross-contamination—ideal for advanced, high-performance chips. Batch system mode, on the other hand, processes multiple wafers simultaneously, offering greater throughput and cost-effectiveness for large-scale production. Both modes cater to different manufacturing needs, balancing quality with efficiency.

By technology, wet cleaning method is good at eliminating a variety of impurities and is compatible with current semiconductor manufacture procedures. Dry cleaning, which includes plasma and vapor phase technologies, is suitable for sensitive components that need to be cleaned without contact. Aqueous cleaning, which uses water-based treatments, is gaining popularity due to its environmental benefits. New cleaning methods, such as supercritical COâ‚‚ and cryogenic cleaning, offer eco-friendly and precise cleaning for specific applications.

According to microelectronics cleaning equipment market forecast, the integrated circuit (IC) market is predicted to develop significantly due to increased demand for smaller, more powerful electronic gadgets. As integrated circuits become more complicated and tightly packed, precision cleaning is required to remove minute impurities that can affect performance. This expansion is being propelled by new applications in cellphones, automotive electronics, and industrial automation.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

In terms of regional segments, Asia-Pacific leads the microelectronics cleaning equipment industry, driven by the strong presence of semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan. These countries consistently invest in electronics production and research, boosting demand for advanced cleaning technologies. For example, China's State Council Information Office reported a 9.3% increase in investment in electronic information manufacturing in 2023. Continued government support and the rise of local tech giants further reinforce the region’s dominant market position.

North America is experiencing rapid expansion in the microelectronics cleaning equipment market, owing largely to rising semiconductor expenditures in the United States, which have been fueled by initiatives such as the CHIPS and Science Act. The region's concentration on innovation, combined with the presence of large semiconductor businesses, is boosting the adoption of next-generation cleaning solutions. In December 2023, the US Department of Commerce awarded BAE Systems $35 million to upgrade its Microelectronics Center in Nashua, NH, marking the first funding under the CHIPS Act. This upgrading aligns with national aims of strengthening supply chains and boosting high-tech production, particularly in the automotive, defense, and healthcare industries.

Some of the top microelectronics cleaning equipment companies offered in our report include Speedline Technologies, Dainippon Screen, Panasonic Industry, Naura Akrion Inc., Quantum Global Technologies, Wacker Chemie AG, KYZEN Corporation, Cleaning Technologies Group, Ultrasonic Power Corporation, Rena Technologies, Semitorr Group Inc., Axus Technologies, Axcelis Technologies, and Ultra T Equipment Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2024

November 2023

February 2023

August 2021