June 2021

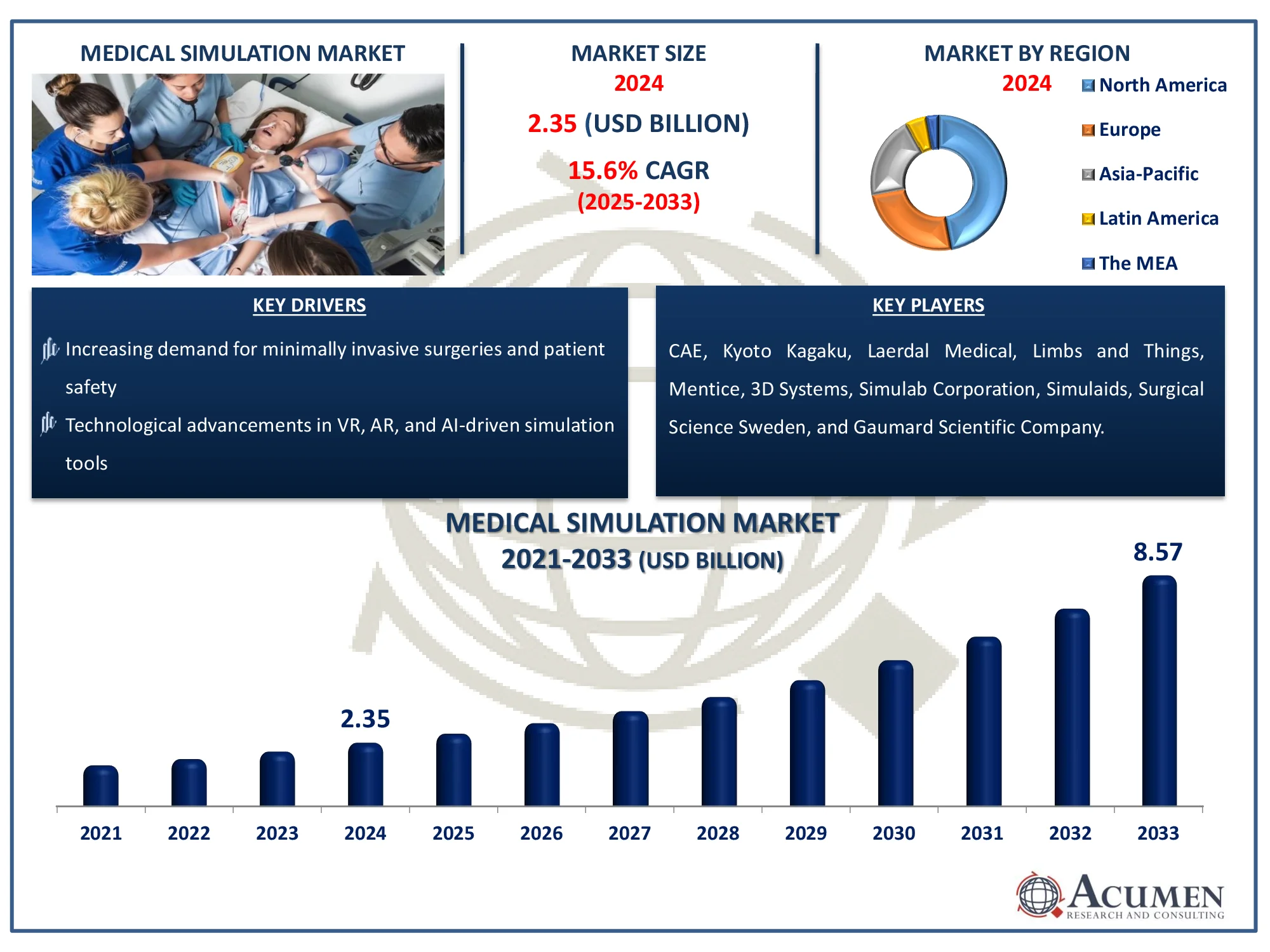

The Global Medical Simulation Market Size accounted for USD 2.35 Billion in 2024 and is estimated to achieve a market size of USD 8.57 Billion by 2033 growing at a CAGR of 15.6% from 2025 to 2033.

The Global Medical Simulation Market Size accounted for USD 2.35 Billion in 2024 and is estimated to achieve a market size of USD 8.57 Billion by 2033 growing at a CAGR of 15.6% from 2025 to 2033.

Simulation is a word, used for an artificial representation of a real process to educate professionals or students through experiential learning. Medical simulation education is defined as educational activities that utilize simulation models to reproduce the clinical scenario. The medical simulation process is used in medical universities and hospitals to train and demonstrate healthcare professionals. The process helps to increase the safety of patients by decreasing errors during practice.

The National Institute of Health (NIH) highlights simulation-based training (SBT) as a transformative approach in medical education, utilizing advanced technologies and innovative methods to enhance healthcare professionals' competence and confidence. By integrating high-fidelity simulators, VR, AR, standardized patients, and hybrid simulations, this approach provides a comprehensive framework for developing both technical and non-technical skills crucial for patient care. These modalities offer significant benefits, including improved clinical outcomes, enhanced patient safety, and strengthened communication and teamwork. This advancement fuels the growth of the medical simulation market by increasing demand for cutting-edge SBT technologies.

|

Market |

Medical Simulation Market |

|

Medical Simulation Market Size 2024 |

USD 2.35 Billion |

|

Medical Simulation Market Forecast 2033 |

USD 8.57 Billion |

|

Medical Simulation Market CAGR During 2025 - 2033 |

15.6% |

|

Medical Simulation Market Analysis Period |

2021 - 2033 |

|

Medical Simulation Market Base Year |

2024 |

|

Medical Simulation Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product & Service, By Technology, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

CAE, Kyoto Kagaku, Laerdal Medical, Limbs and Things, Mentice, 3D Systems, Simulab Corporation, Simulaids, Surgical Science Sweden, and Gaumard Scientific Company. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The simulation model plays a crucial role in professional training programs, complementing traditional learning methods by allowing professionals and students to refine their clinical skills, especially for high-risk scenarios. A study by the US National Council of State Boards of Nursing (NCSBN) found that nursing students who trained using simulation models required only half the time to achieve competency compared to those following traditional methods, proving the effectiveness of simulation-based training in pre-licensure nursing programs.

The medical simulation market is set for growth due to its benefits, including keeping the medical community updated on technological advancements, demonstrating complex and routine medical cases, and the increasing focus on patient safety and outcomes. For example, the WHO’s Patient Safety Flagship initiative supports the Global Patient Safety Action Plan 2021–2030, emphasizing the need for improved training and risk reduction in healthcare. However, the high setup and operational costs of simulation models remain a significant challenge to market expansion.

Additionally, in November 2023, the FDA released final guidance titled "Assessing the Credibility of Computational Modeling and Simulation in Medical Device Submissions." This framework helps manufacturers establish the credibility of physics-based CM&S models in regulatory submissions, excluding standalone AI or machine learning models. This guidance presents a growth opportunity for the medical simulation market by promoting regulatory acceptance, leading to increased investment and adoption of simulation technologies in medical device development.

Medical Simulation Market Segmentation

Medical Simulation Market SegmentationThe worldwide market for medical simulation is split based on product and services, technology, end-user, and geography.

According to medical simulation industry analysis, the anatomical model accounted for the largest share of the market in 2024. This can be attributed to benefits associated with the anatomical model such as understanding key concepts through practical information. Furthermore, an increase in focus on patient safety helps to enhance the demand for anatomical models for academic purposes. However, the web-based simulation segment is anticipated to observe the fastest growth during the forecast period. Web-based simulation combines electronic multimedia options with a central video or virtual world to create interactive learning activities. An increase in the usage of internet services is anticipated to observe significant growth during the forecast period.

According to medical simulation industry analysis, 3D printing technology plays a crucial role in the market by enabling the creation of highly realistic anatomical models for training and education. It facilitates patient-specific simulations, improving surgical planning and procedural accuracy. Additionally, in June 2022, Israel-based Stratasys announced its plans to expand its 3D printing business into India, catering to major clients like Ashok Leyland, Hero MotoCorp, AIIMS, Symbiosis, and IITs. With extensive expertise in design prototyping, manufacturing tools, and production parts, the company strengthens its presence in the market. As the demand for advanced medical training increases, 3D printing continues to transform simulation with its precision and adaptability.

According to medical simulation market forecast, academic institutes are the leading end-users as they integrate simulation-based training (SBT) into medical and healthcare education. These institutions use high-fidelity simulators, VR, AR, and standardized patient programs to enhance students' clinical skills and decision-making. By prioritizing patient safety and reducing medical errors, academic centers drive the demand for advanced simulation technologies. As medical education evolves, their continuous investment fuels the growth and innovation of the medical simulation market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Medical Simulation Market Regional Analysis

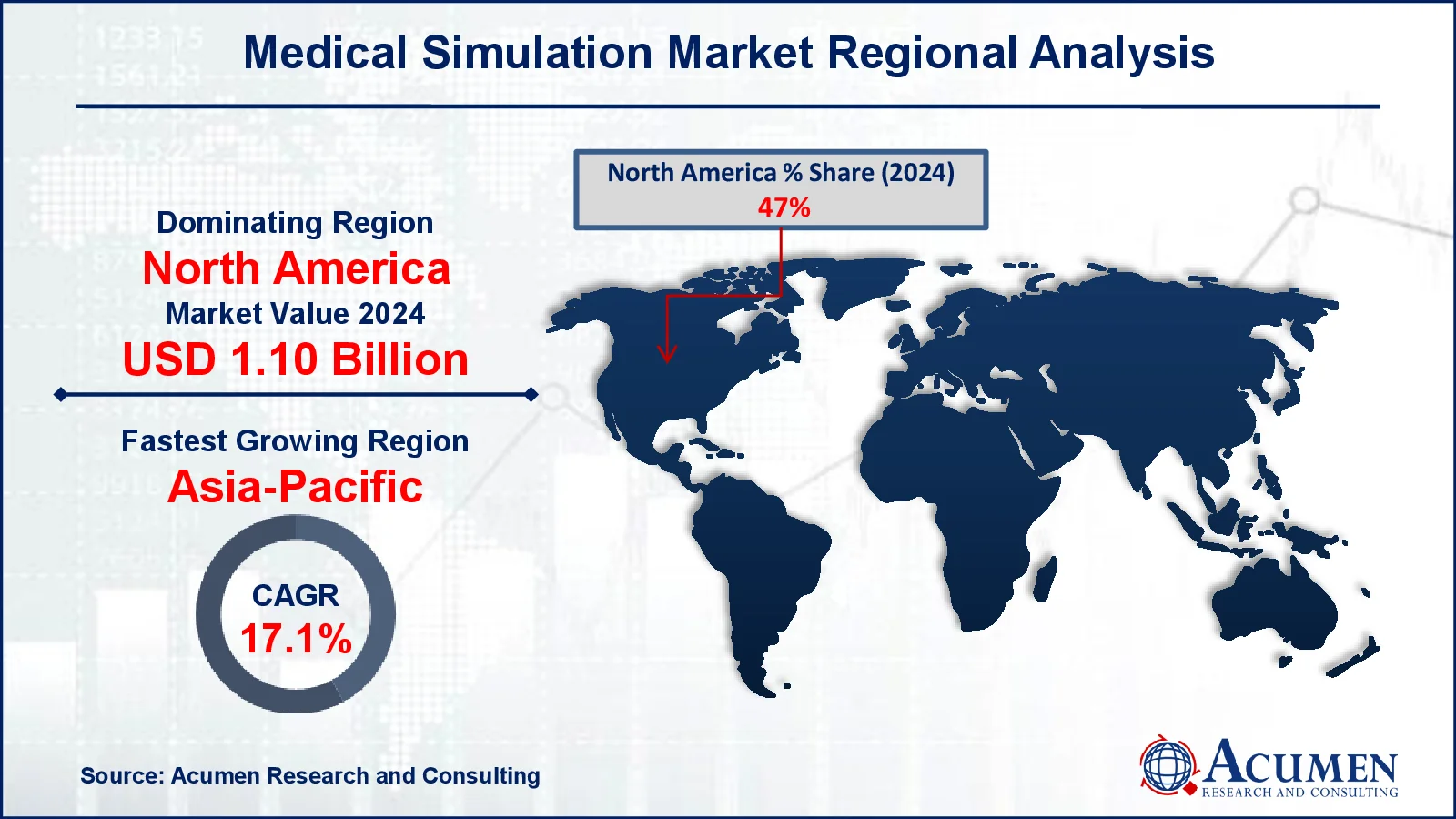

Medical Simulation Market Regional AnalysisIn terms of regional segments, in 2024, North America held the largest share of the global medical simulation market and is expected to maintain its dominance throughout the forecast period. This is driven by the widespread adoption of simulation technology in medical institutes and universities, easy access to advanced technology due to the presence of key market players, and strong distribution networks across the region. For instance, in November 2022, Gaumard Scientific Inc. announced the first installation of the HAL S5301 conversational robotic patient simulator at the Emory Nursing Learning Center. Additionally, the rising number of trainee healthcare professionals and well-established healthcare infrastructure further contribute to the region's leadership.

Europe holds the second-largest share in the market. France’s Haute Autorité de Santé (HAS), a National Authority for Health, has focused on patient safety innovation, developing an indicator to assess patient perception of hand hygiene and exploring routine data collection methods between 2022 and 2023. This initiative supports the growth of the medical simulation market by increasing demand for simulation-based training programs aimed at improving hand hygiene compliance and infection control among healthcare professionals.

Meanwhile, the Asia-Pacific region is projected to witness the fastest growth during the forecast period. This can be attributed to the large number of medical institutes and universities, growing awareness of simulation-based learning, increased government funding, and a heightened focus on patient safety. For example, in July 2024, MediSim VR, a healthcare simulation training technology provider, established Gujarat’s first VR Skill Training Lab at KD Hospital, marking a significant step in the region’s medical simulation advancements.

Some of the top medical simulation companies offered in our report include CAE, Kyoto Kagaku, Laerdal Medical, Limbs and Things, Mentice, 3D Systems, Simulab Corporation, Simulaids, Surgical Science Sweden, and Gaumard Scientific Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2021

March 2025

December 2023

June 2021