February 2024

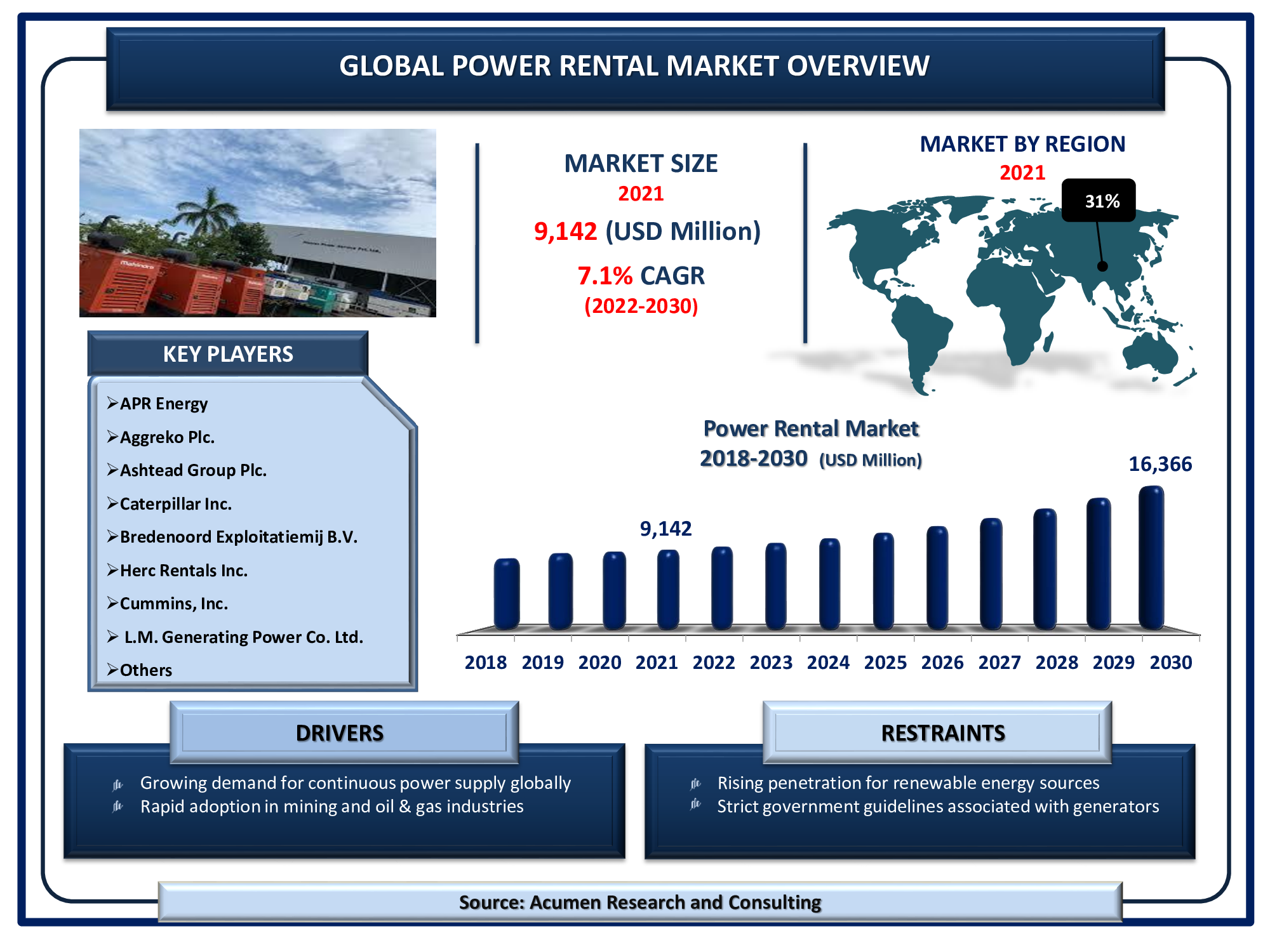

Power Rental Market Size is valued at USD 9,142 million in 2021 and is estimated to achieve a market size of USD 16,366 million by 2030; growing at a CAGR of 7.1%

The Global Power Rental Market Size is valued at USD 9,142 million in 2021 and is estimated to achieve a market size of USD 16,366 million by 2030; growing at a CAGR of 7.1%.

Power rental is also known as power on hire it includes the rental generators which are useful over the purchased one. These power rentals provide flexibility in the requirement of power rating, less maintenance, and installation costs, have lower initial costs, and readily available on short notice. The increasing demand for uninterrupted and reliable power supply is the primary factor leading the power rental market revenue. Integration of digital technology solutions for operation enhancement is one of the recent trends in power rental market.

Global Power Rental Market DRO’s:

Market Drivers:

Market Restraints:

Market Opportunities:

Power Rental Market Report Coverage:

| Market | Power Rental Market |

| Power Rental Market Size 2021 | USD 9,142 Million |

| Power Rental Market Forecast 2030 | USD 16,366 Million |

| Power Rental Market CAGR During 2022 - 2030 | 7.1% |

| Power Rental Market Analysis Period | 2018 - 2030 |

| Power Rental Market Base Year | 2021 |

| Power Rental Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Fuel, By Power Rating, By End-User Industries, And By Region |

| Power Rental Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | APR Energy, Aggreko Plc., Ashtead Group Plc., Caterpillar Inc., Bredenoord Exploitatiemij B.V., Herc Rentals Inc., Cummins, Inc., L.M. Generating Power Co. Ltd., United Rentals, Inc., and Speedy Hire Plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The limited access to electricity in rural areas, as well as an increase in power loss due to aging infrastructure, is the factor driving the market growth. The development of a new customized compressed air rental solution is supporting the growing market value. The manufacturers mostly prefer hiring generators instead of maintaining the existing power supply system. The lesser availability of grid infrastructure and the requirement of power for a temporary time period are other factors favoring the market value. Power rentals are also gaining pace on account of increasing usage in many industries to provide essential support during the event of a power outage. Additionally, the advantage of the equipment as it can be used as a baseload or as a standby Power Rating. Furthermore, obsolete permanent power plants, decarbonization & decentralization of energy mix, and development of next-generation air compressors are some of the factors anticipated to provide potential opportunities over the forecast timeframe from 2022 to 2030.

On the other side, the slowdown in global economies, and uncertainty in raw material prices are factors projected to limit the growth to an extent over the forecast period.

Power Rental Market Segmentation

The market can be bifurcated on the basis of fuel, power rating, end-user industries, and region.

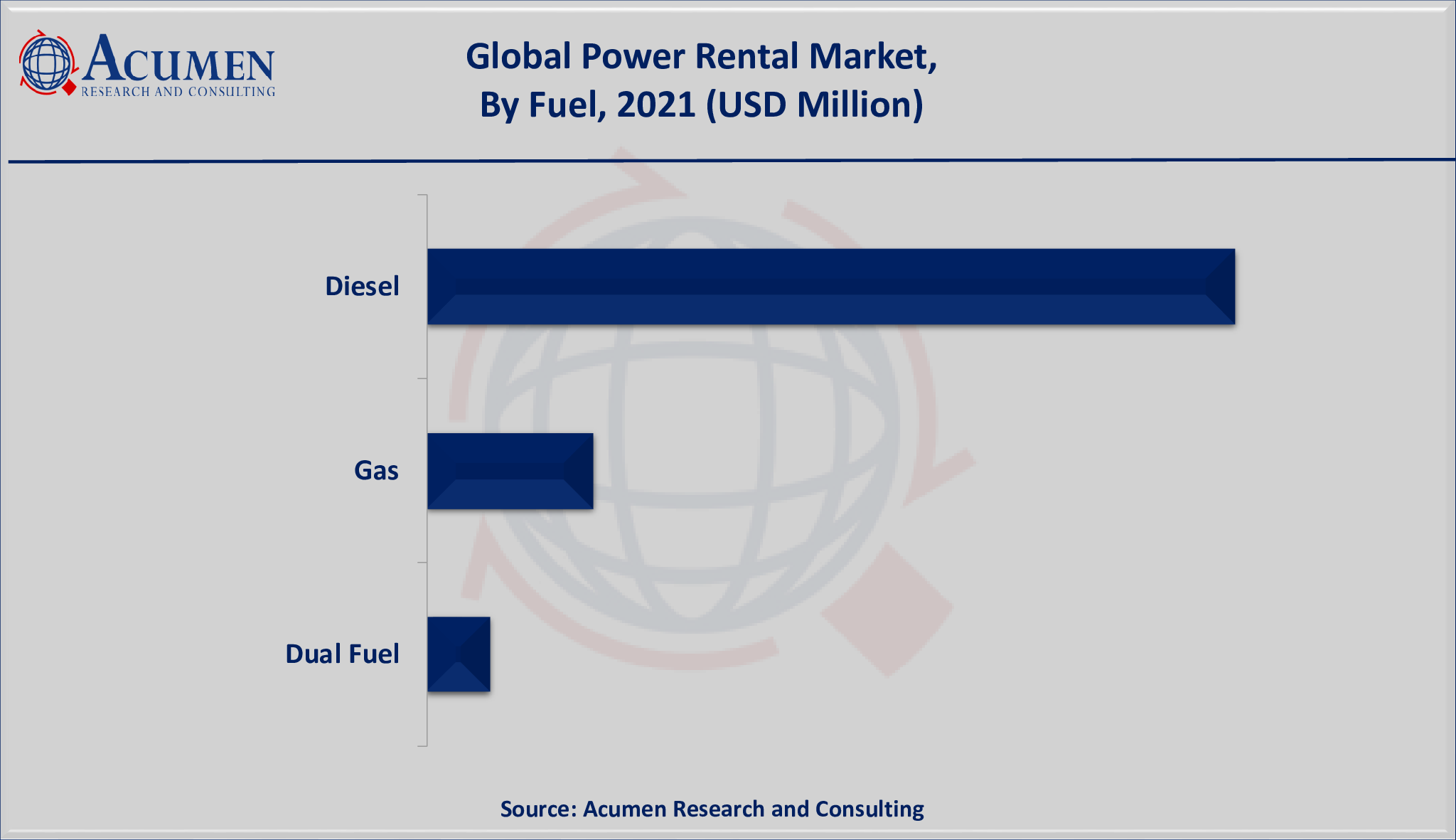

Power Rental Market by Fuel

According to our power rental industry analysis, diesel is the leading the fuel segment in the global power rental market. The segment is gaining pace because diesel generators incur low purchase and maintenance cost against to gas-fueled generators as well as diesel-fueled power rental equipment is more popular in the market. Moreover, the segment is projected to experience the adverse effects of increasing government regulations on diesel engines due to rising environmental concerns.

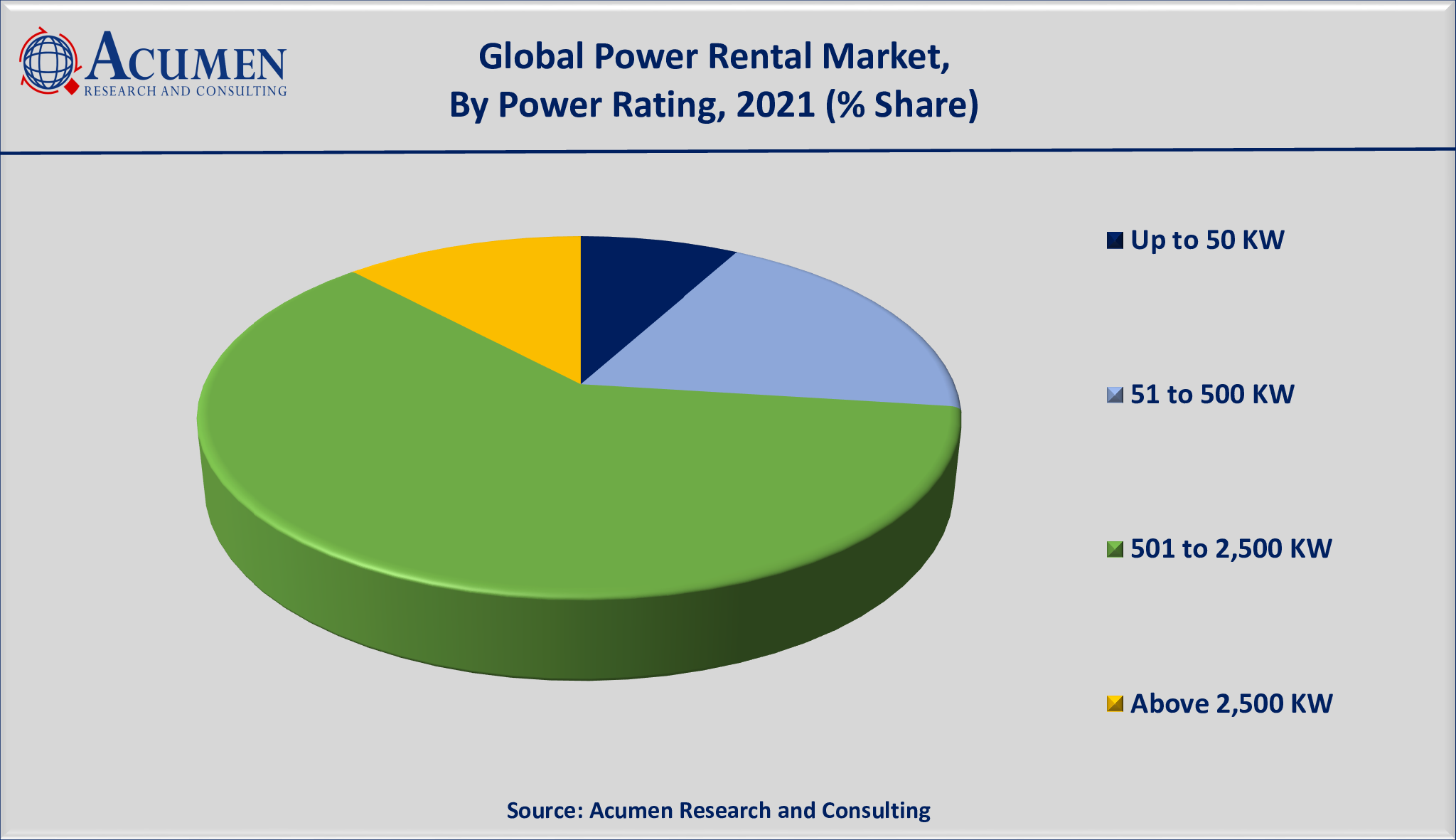

Power Rental Market by Power Rating

Among power rating, the 501 to 2,500 KW sub-segment achieved a considerable market share in 2021 and is likely to do so in the coming years. The 501 to 2,500 KW power rental equipment are well equipped to provide continuous power supply and standby power during outages peak shaving. The growing number of power outages in emerging nations due to the lack of proper power infrastructure fuels the segmental growth.

Power Rental Market by End-User Industries

According to our power rental market forecast, the utilities sub-segment captured a sizable market share in 2021 and is expected to do so in the future. The power leasing services are intended to assist utilities in stabilizing their power systems while also providing extra energy to businesses and communities. With the world's thermal power plant network ageing, the utility sector's demand for rented power is expected to rise.

Power Rental Market Regional Outlook

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

Growing need for power in Asian countries fuels the Asia-Pacific power rental market value

In 2021, Asia Pacific accounted for the maximum share in terms of value (USD Million), and the region is also projected to maintain its dominance over the forecast timeframe from 2022 to 2030. The emerging economies of the region along with the increasing discretionary income of people are supporting the regional market value. The rapid industrialization in emerging economies of the region including China and India is propelling the regional market value. Moreover, the region is also projected to exhibit the fastest growth over the estimated period due to the increasing demand for industrial production in the region.

Power Rental Market Players

Some of the global power rental companies profiled in the report include APR Energy, Aggreko Plc., Ashtead Group Plc., Caterpillar Inc., Bredenoord Exploitatiemij B.V., Herc Rentals Inc., Cummins, Inc., L.M. Generating Power Co. Ltd., United Rentals, Inc., and Speedy Hire Plc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2024

May 2023

May 2024

October 2020