April 2024

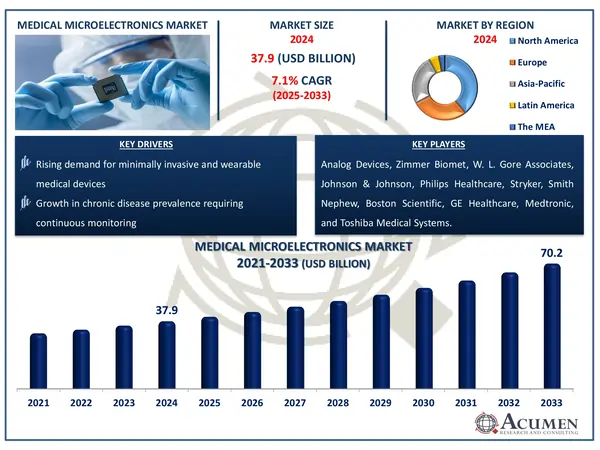

The Global Medical Microelectronics Market Size accounted for USD 37.9 Billion in 2024 and is estimated to achieve a market size of USD 70.2 Billion by 2033 growing at a CAGR of 7.1% from 2025 to 2033.

The Global Medical Microelectronics Market Size accounted for USD 37.9 Billion in 2024 and is estimated to achieve a market size of USD 70.2 Billion by 2033 growing at a CAGR of 7.1% from 2025 to 2033.

Medical microelectronics refers to the use of miniature electronic components and systems in medical devices and equipment. These technologies enable functions like sensing, data processing, communication, and control within compact, often implantable or wearable, medical tools. They are vital in diagnostics, monitoring, therapeutics, and drug delivery applications. By enhancing precision, portability, and automation, medical microelectronics are driving innovations in modern healthcare.

The National Institutes of Health (NIH) emphasizes microelectronics' considerable potential for boosting modern medicine, citing personalized treatment as a prime example. While molecular biology has long dominated the life sciences, scientists are gradually acknowledging that advances in microelectronics, particularly its increasing downsizing to the scale of human cells, bring up new avenues for therapeutic applications.

|

Market |

Medical Microelectronics Market |

|

Medical Microelectronics Market Size 2024 |

USD 37.9 Billion |

|

Medical Microelectronics Market Forecast 2033 |

USD 70.2 Billion |

|

Medical Microelectronics Market CAGR During 2025 - 2033 |

7.1% |

|

Medical Microelectronics Market Analysis Period |

2021 - 2033 |

|

Medical Microelectronics Market Base Year |

2024 |

|

Medical Microelectronics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product Type, By Technology, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Analog Devices, Zimmer Biomet, W. L. Gore Associates, Johnson & Johnson, Philips Healthcare, Stryker, Smith Nephew, Boston Scientific, GE Healthcare, Medtronic, Toshiba Medical Systems, Edwards Lifesciences, Terumo Corporation, Abbott Laboratories, and Siemens Healthineers. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increased desire for minimally invasive and wearable medical equipment is a major driver in the medical microelectronics market. According to our analysis, the global wearable medical devices market was valued at USD 23,581 million in 2021 and is expected to reach USD 188,398 million by 2030, expanding at a CAGR of 27.1% between 2022 and 2030. This rapid increase in wearable healthcare technologies considerably drives market growth.

Furthermore, technical advances in microfabrication and sensor integration are driving the industry forward. According to the Office of Scientific and Technical Information (OSTI), microfabrication techniques like photolithography and etching have altered the manufacture of miniature medical equipment. These technologies allow for the accurate production of micro-scale components, as well as the seamless integration of sensors and actuators into small systems. This has resulted in the development of sophisticated inventions such as implanted sensors and lab-on-a-chip technologies, which greatly improve diagnostic and therapeutic capacities. The ongoing evolution of microfabrication remains important to fostering innovation and advancement in the medical microelectronics sector.

While the high research and manufacturing costs of microelectronic components continue to impede market growth, the expansion of telehealth and remote patient monitoring represents a significant opportunity. For example, the United States Federal Government has developed a number of initiatives to boost telehealth adoption. Medicare patients can now receive non-behavioral/mental health telehealth services from home until September 30, 2025, from any eligible Medicare provider, including Federally Qualified Health Centers (FQHCs) and Rural Health Clinics. This expansion of telehealth coverage is predicted to greatly increase demand for linked diagnostic and monitoring equipment, supporting growth in the medical microelectronics industry.

The worldwide market for medical microelectronics is split based on treatment, type, application, end-user, and geography.

According to medical microelectronics industry analysis, integrated circuits (ICs) are expected to dominate because of their small size, high efficiency, and ability to execute multiple functions on a single chip. ICs play a vital role in allowing medical device downsizing, which is required for wearable health monitoring, portable diagnostic instruments, and implanted devices. They provide power efficiency and dependability, which are critical in life-saving applications.

As per the technology segment, analog technology is predominant in medical microelectronics because biological signals such as heartbeats, brainwaves, and muscle activity are intrinsically analog. These signals must be reliably collected and processed without distortion, hence analog circuits are required for devices such as ECGs, EEGs, and pacemakers. Analog front-end systems provide high-resolution sensing with low power consumption, which is crucial in medical applications.

Based on application, diagnostics is the most common use in medical microelectronics because it allows for the real-time, accurate identification of diseases using compact, efficient devices. Microelectronics plays an important role in data collecting and processing in technologies such as lab-on-a-chip, biosensors, and wearable monitors. These methods facilitate early diagnosis, which is critical for prompt treatment and better patient outcomes. The growing demand for point-of-care testing and home diagnostics fuels the segment's rapid expansion.

According to medical microelectronics market forecast, hospitals are the fastest expanding end-user owing to their constant need for new diagnostic, monitoring, and therapeutic equipment. These facilities necessitate high-performance technologies including imaging systems, patient monitoring, and surgical tools driven by microelectronics. The need for digital healthcare transformation and real-time patient data collecting strengthens microelectronics integration.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

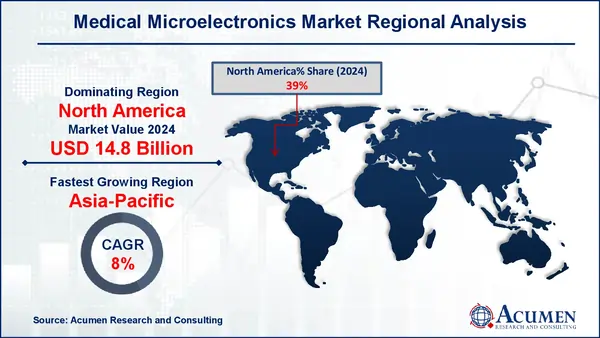

In terms of regional segments, North America now dominates the medical microelectronics industry, with a share of 39%. This is mostly due to the increasing frequency of chronic diseases in the United States and Canada, which necessitates the use of modern medical technology. According to the Centers for Disease Control and Prevention (CDC), around 129 million Americans have at least one serious chronic ailment, such as heart disease, cancer, diabetes, obesity, or hypertension, as defined by the US Department of Health and Human Services. Notably, six in ten Americans have at least one chronic disease, with four in ten suffering from two or more. Technological advancements by important participants in the field, notably for patient monitoring systems, bolster North America's dominant position in the medical microelectronics sector.

Meanwhile, the Asia-Pacific area is emerging as the fastest-growing market for medical microelectronics, owing to developing telehealth infrastructure and increased use of remote patient monitoring. For example, India's Ministry of Health and Family Welfare recognizes eSanjeevani, the National Telemedicine Service as a significant step toward digital health equity and Universal Health Coverage (UHC). This technology provides easy access to doctors and specialists using cellphones. According to Invest India, India's telehealth sector is expected to develop at a CAGR of 20.75% between 2016 and 2030, reaching $1.54 billion in 2024. The widespread usage of such digital health platforms drives demand for compact, linked medical equipment, therefore stimulating innovation and growth in the medical microelectronics sector across the area.

Some of the top medical microelectronics companies offered in our report include Analog Devices, Zimmer Biomet, W. L. Gore Associates, Johnson & Johnson, Philips Healthcare, Stryker, Smith Nephew, Boston Scientific, GE Healthcare, Medtronic, Toshiba Medical Systems, Edwards Lifesciences, Terumo Corporation, Abbott Laboratories, and Siemens Healthineers.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2024

June 2020

February 2023

June 2024