November 2023

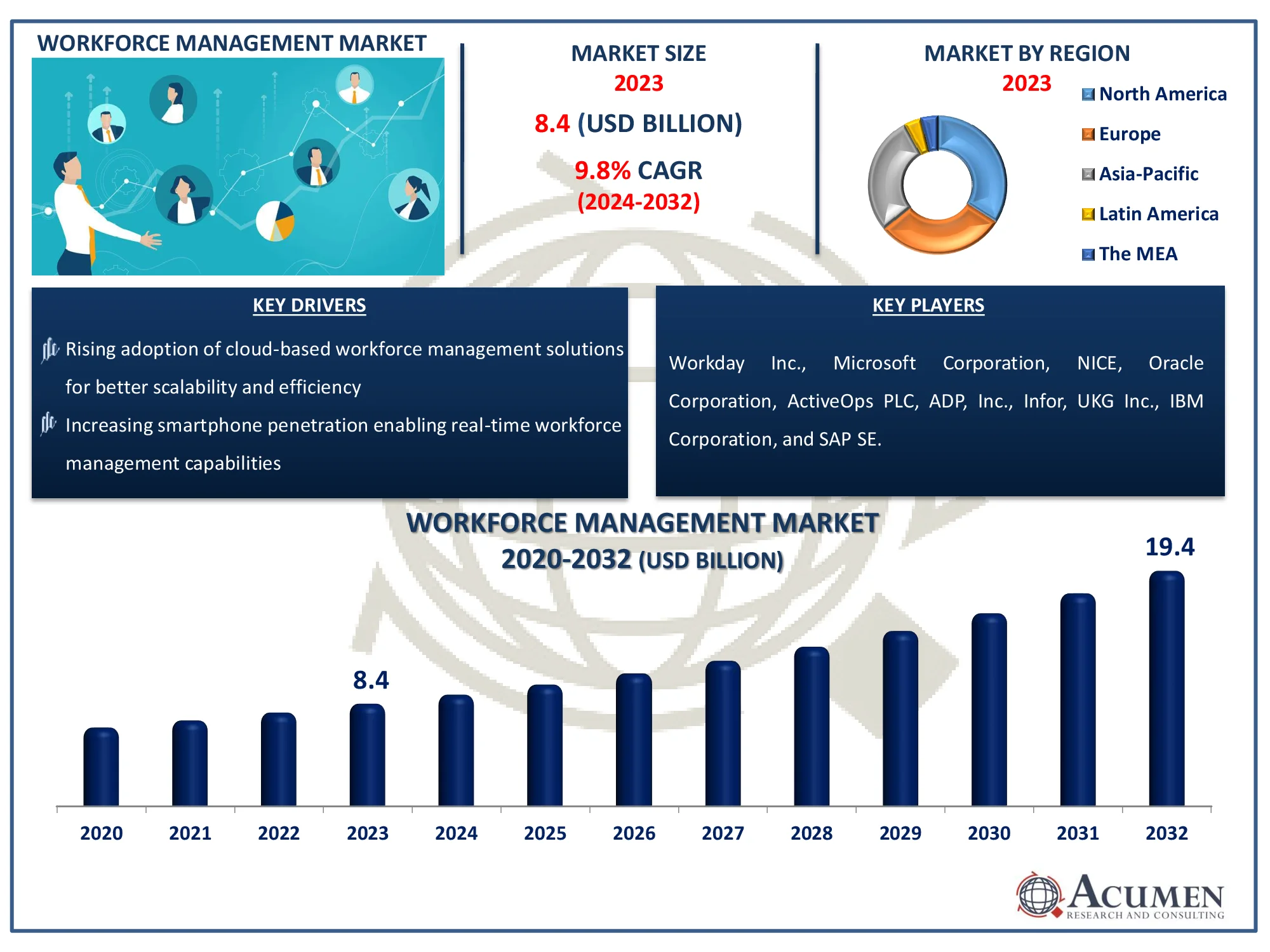

The Global Workforce Management Market Size accounted for USD 8.4 Billion in 2023 and is estimated to achieve a market size of USD 19.4 Billion by 2032 growing at a CAGR of 9.8% from 2024 to 2032.

The Global Workforce Management Market Size accounted for USD 8.4 Billion in 2023 and is estimated to achieve a market size of USD 19.4 Billion by 2032 growing at a CAGR of 9.8% from 2024 to 2032.

Workforce management is classified as human resource management and includes all operations necessary to track and maintain the workforce in diverse businesses in order to achieve a productive conclusion. The vast majority of small and medium-sized businesses in developing countries rely on traditional techniques of worker monitoring and retention. Worker management is used to reduce labor costs, increase worker utilization, and improve corporate performance. The automation of operations like as time calculations and employee compensation minimizes or eliminates errors, allowing diverse organizational regulations to be easily and reliably updated and applied into systems. Organizations may efficiently conduct complex analytics on worker operations to identify and correct problems, allowing them to make better use of available resources.

|

Market |

Workforce Management Market |

|

Workforce Management Market Size 2023 |

USD 8.4 Billion |

|

Workforce Management Market Forecast 2032 |

USD 19.4 Billion |

|

Workforce Management Market CAGR During 2024 - 2032 |

9.8% |

|

Workforce Management Market Analysis Period |

2020 - 2032 |

|

Workforce Management Market Base Year |

2023 |

|

Workforce Management Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Solution, By Deployment, By Company Size , By Industry Vertical, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Workday Inc., Microsoft Corporation, NICE, Oracle Corporation, ActiveOps PLC, ADP, Inc., Infor, UKG Inc., IBM Corporation, and SAP SE. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Workforce management solutions are rapidly being used in areas such as retail, healthcare, BFSI, and government. The development of cloud and mobile technologies has led to new ways of working in a variety of industries. Because of the increasing complexity of corporate activities and the quick modification of people's situations and plans, real-time workforce management is becoming more popular. Technological improvements and innovations have had a significant impact on the growth of the labor management industry. Workforce analytics and talent management are among the fastest expanding market solutions. Rising population, the increase of small and medium-sized firms in developing markets such as China and India, and changing work dynamics are expected to drive growth in the workforce management solutions market.

Moreover, the rising rate of adoption of cloud-based solutions and increasing smartphone penetration across various emerging markets is further expected to drive growth. Additionally, the benefits associated with workforce management solutions enable a well-organized flow of tracking and maintaining the workforce in an organization. However, the lack of awareness in some developing nations is presently hampering the growth of the workforce management market.

Workforce Management Market Segmentation

Workforce Management Market SegmentationThe worldwide market for workforce management is split based on solution, deployment, company size, industry vertical, and geography.

According to workforce management industry analysis, time & attendance management is the industry leader in terms of revenue creation due to its critical role in simplifying employee operations. This technology enables firms to automate attendance tracking, removing the errors and administrative difficulties associated with manual systems. The growing usage of time-tracking software in businesses, notably in retail, healthcare, and BFSI, underscores its importance in ensuring labor law compliance and payroll accuracy. Furthermore, merging biometric systems with mobile applications increases real-time tracking, increasing efficiency and productivity. With the increasing need for cloud-based solutions, time & attendance management provides scalability and flexibility, making it an essential tool for businesses looking to optimize workforce management while lowering labor costs and operational inefficiencies.

The on-premise deployment strategy dominates the workforce management market, owing to its popularity among large enterprises that require more control over data and systems. Businesses in areas such as government, healthcare, and BFSI frequently choose on-premise solutions to meet tight security and compliance requirements. This deployment strategy enables for modification based on individual organizational requirements, making it a dependable option for managing complicated workforce operations. Furthermore, firms with established IT infrastructure prefer to use on-premise platforms to optimize their existing resources. Despite the growing popularity of cloud solutions, on-premise deployments are the preferred choice for organizations that value control and stability because to their strong data protection, low reliance on external networks, and long-term cost savings.

Large enterprises lead the workforce management market due to their complex operational systems and massive workforces. These firms confront distinct issues in coordinating and maximizing labor across many departments and locations, necessitating the use of workforce management systems. They want sophisticated systems because they need advanced tools to handle scheduling, compliance, and analytics. Large organizations have the financial resources to invest in comprehensive solutions that work smoothly with existing infrastructure. Furthermore, these organizations prioritize labor productivity and cost efficiency, leveraging workforce management technologies to optimize operations and gain a competitive advantage. Their emphasis on scalability and long-term value strengthens their position as the market segment's primary contributors.

The BFSI sector emerges as the largest segment in the workforce management market forecast period, propelled by the demand for precision and compliance in human resource management. BFSI firms must deal with massive client engagements, complicated workflows, and stringent regulatory requirements, all of which necessitate intelligent workforce solutions. These technologies simplify staff scheduling, enforce labor rules, and optimize resource allocation to meet changing company demands. Furthermore, the industry's reliance on real-time analytics for productivity tracking and decision-making raises the importance of workforce management solutions. With increasing digitalization and the implementation of new technologies, BFSI institutions emphasize solutions that improve operational efficiency, customer service, and staff happiness, establishing them as the leading vertical in this market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Workforce Management Market Regional Analysis

Workforce Management Market Regional AnalysisGeographically, the workforce management market can be divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa (MEA).

The North American market is expected to command the largest share, followed by Europe. However, the emerging nations in the Asia-Pacific region are believed to possess huge growth potential. During the future years, the workforce management market is estimated to witness healthy growth due to the rising number of small-medium businesses and the growing population among various end users across emerging economies. Presently, North America commands the largest share of the global workforce management market. However, during the future years, Asia-Pacific is expected to witness robust growth for workforce management solutions.

Some of the top workforce management companies offered in our report includes Workday Inc., Microsoft Corporation, NICE, Oracle Corporation, ActiveOps PLC, ADP, Inc., Infor, UKG Inc., IBM Corporation, and SAP SE.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2023

November 2022

February 2023

November 2023